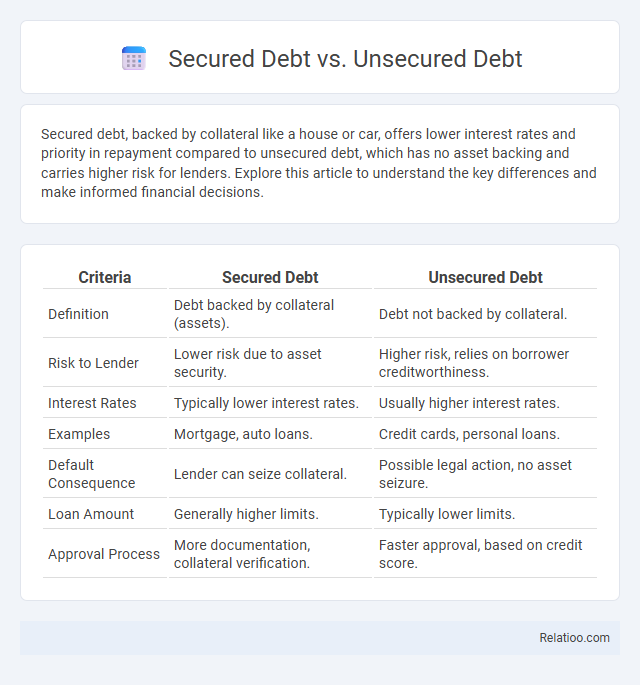

Secured debt, backed by collateral like a house or car, offers lower interest rates and priority in repayment compared to unsecured debt, which has no asset backing and carries higher risk for lenders. Explore this article to understand the key differences and make informed financial decisions.

Table of Comparison

| Criteria | Secured Debt | Unsecured Debt |

|---|---|---|

| Definition | Debt backed by collateral (assets). | Debt not backed by collateral. |

| Risk to Lender | Lower risk due to asset security. | Higher risk, relies on borrower creditworthiness. |

| Interest Rates | Typically lower interest rates. | Usually higher interest rates. |

| Examples | Mortgage, auto loans. | Credit cards, personal loans. |

| Default Consequence | Lender can seize collateral. | Possible legal action, no asset seizure. |

| Loan Amount | Generally higher limits. | Typically lower limits. |

| Approval Process | More documentation, collateral verification. | Faster approval, based on credit score. |

Introduction to Secured and Unsecured Debt

Secured debt is backed by collateral, such as a home or car, which reduces the lender's risk and often results in lower interest rates. Unsecured debt lacks collateral, relying solely on the borrower's creditworthiness, leading to higher interest rates and greater risk for lenders. Understanding the distinctions between secured and unsecured debt is crucial for effective financial management and borrowing decisions.

Key Differences Between Secured and Unsecured Debt

Secured debt requires collateral, such as property or assets, to back the loan, reducing the lender's risk and often resulting in lower interest rates. Unsecured debt has no collateral backing, leading to higher interest rates and increased risk for lenders since repayment depends solely on the borrower's creditworthiness. Key differences between secured and unsecured debt impact repayment terms, interest rates, and consequences of default, with secured debt allowing lenders to claim the collateral if the borrower fails to repay.

Common Types of Secured Debt

Common types of secured debt include mortgages, auto loans, and secured personal loans, where the borrower pledges an asset as collateral to reduce lender risk. These loans typically offer lower interest rates compared to unsecured debt, which lacks collateral and includes credit cards and medical bills. Understanding the distinction can help you choose the best financing option for your financial needs and protect your credit.

Common Types of Unsecured Debt

Common types of unsecured debt include credit card balances, medical bills, personal loans, and student loans, which do not require collateral for approval. Unlike secured debt, such as mortgages or auto loans, unsecured debt relies solely on your creditworthiness and income for repayment terms. Understanding these distinctions helps you manage your financial obligations more effectively and avoid costly penalties.

Collateral: Definition and Importance

Secured debt requires collateral, such as property or assets, which protects the lender by reducing the risk of default and often results in lower interest rates for the borrower. Unsecured debt does not involve collateral, leading to higher interest rates since lenders rely solely on the borrower's creditworthiness and ability to repay. Understanding the role of collateral in debt agreements is crucial for assessing risk, loan terms, and potential financial consequences if repayment obligations are not met.

Interest Rates: How Security Affects Borrowing Costs

Secured debt typically carries lower interest rates because it is backed by collateral, reducing the lender's risk and making borrowing more affordable for you. Unsecured debt, lacking asset backing, demands higher interest rates to offset the increased risk to lenders. Overall, the presence or absence of security directly influences your borrowing costs and repayment terms.

Risk Factors for Lenders and Borrowers

Secured debt involves collateral, reducing risk for lenders by providing assets to claim in case of default, while borrowers face the potential loss of pledged property. Unsecured debt lacks collateral, increasing lender risk due to reliance on the borrower's creditworthiness, which often results in higher interest rates to compensate. General debt risk factors include the borrower's credit score, repayment history, economic conditions, and loan terms that impact both parties' financial exposure and recovery options.

Impact on Credit Scores

Secured debt, such as mortgages and auto loans backed by collateral, generally has a more positive impact on your credit scores because timely payments reduce risk for lenders. Unsecured debt, including credit cards and personal loans, can negatively affect credit scores more quickly due to higher interest rates and the absence of collateral, increasing default risk. Understanding how different debts influence your credit profile helps you manage your financial health and improve your creditworthiness effectively.

Debt Repayment and Collection Processes

Secured debt involves collateral, which your lender can claim through a repossession process if repayment falls behind, making collection more straightforward and often faster. Unsecured debt lacks specific collateral, leading creditors to rely on credit reporting, collection agencies, or legal action to recover unpaid amounts, complicating and prolonging the collection process. Understanding the differences in debt repayment and collection strategies helps you manage obligations effectively and avoid escalating financial consequences.

Choosing Between Secured and Unsecured Debt

Choosing between secured and unsecured debt depends on factors such as collateral availability, interest rates, and risk tolerance. Secured debt typically offers lower interest rates because it is backed by assets like property or vehicles, reducing lender risk. Unsecured debt, lacking collateral, often carries higher interest rates but provides more flexibility and faster approval, making it suitable for borrowers without valuable assets.

Infographic: Secured Debt vs Unsecured Debt

relatioo.com

relatioo.com