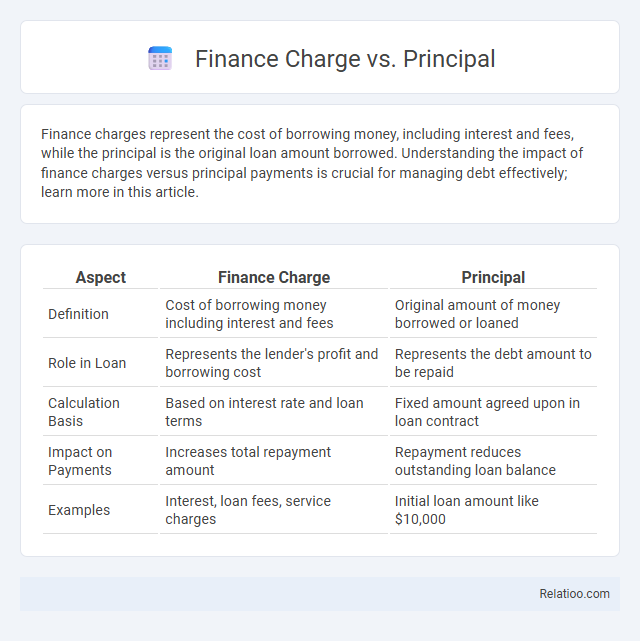

Finance charges represent the cost of borrowing money, including interest and fees, while the principal is the original loan amount borrowed. Understanding the impact of finance charges versus principal payments is crucial for managing debt effectively; learn more in this article.

Table of Comparison

| Aspect | Finance Charge | Principal |

|---|---|---|

| Definition | Cost of borrowing money including interest and fees | Original amount of money borrowed or loaned |

| Role in Loan | Represents the lender's profit and borrowing cost | Represents the debt amount to be repaid |

| Calculation Basis | Based on interest rate and loan terms | Fixed amount agreed upon in loan contract |

| Impact on Payments | Increases total repayment amount | Repayment reduces outstanding loan balance |

| Examples | Interest, loan fees, service charges | Initial loan amount like $10,000 |

Understanding Finance Charge and Principal

Finance charge represents the total cost of borrowing, including interest and fees, while the principal is the original amount of money borrowed or still owed. Understanding the distinction between the finance charge and principal is crucial for managing loan repayments effectively since payments often first cover finance charges before reducing the principal balance. Monitoring how much of each payment applies to the finance charge versus the principal helps borrowers assess the true cost of a loan and plan for faster debt reduction.

Key Differences Between Finance Charge and Principal

The principal represents the original amount borrowed or the remaining balance excluding interest, while the finance charge encompasses all costs of borrowing, including interest, fees, and other related expenses. The finance charge impacts the total cost of a loan, whereas the principal determines the actual debt amount to be repaid. Understanding these key differences is crucial for accurate loan management and effective financial planning.

The Role of Principal in Loans and Credit

The principal in loans and credit represents the original amount borrowed, which determines how much you owe before interest and fees are added. Finance charges, including interest and other fees, are calculated based on the remaining principal balance, making principal reduction essential for lowering overall debt costs. Understanding the role of principal helps you manage loan repayment effectively and minimize total finance charges over time.

How Finance Charges Are Calculated

Finance charges are calculated based on the outstanding loan balance, interest rate, and time period, incorporating fees and interest accrued over the billing cycle. The principal represents the original loan amount or remaining balance on which the finance charge is applied. Understanding the distinction between principal and finance charges helps borrowers assess how payments reduce debt versus cover borrowing costs.

Impact of Finance Charges on Total Repayment

Finance charges significantly increase the total repayment amount beyond the principal borrowed by including interest, fees, and other costs associated with the loan. The principal represents the original loan amount that must be repaid, while finance charges accumulate over time, directly impacting the overall cost and repayment schedule. Understanding the relationship between principal and finance charges helps borrowers evaluate the true expense of credit and plan their budgets effectively.

Common Types of Finance Charges

Common types of finance charges include interest fees, loan origination fees, late payment charges, and service fees applied to principal balances. The principal represents the original loan amount or unpaid balance, which accrues finance charges based on the lending agreement. Understanding the breakdown between finance charges and principal helps borrowers evaluate total loan costs and manage repayment strategies effectively.

Reducing Your Finance Charges Effectively

Reducing your finance charges effectively requires understanding the distinction between finance charges and principal balance. Finance charges represent the cost of borrowing, including interest and fees, while principal is the original amount borrowed that must be repaid. Prioritize paying down the principal quickly to minimize accumulating finance charges and lower overall debt expenses.

Finance Charge vs. Principal: Real-World Examples

Finance charge represents the cost of borrowing money, including interest and fees, while principal is the original amount loaned or borrowed. For example, on a $10,000 loan with a 5% annual interest rate, your monthly payment primarily reduces the principal over time, but initial payments include higher finance charges. Understanding this distinction helps you accurately track loan balances and manage repayment strategy.

Mistakes to Avoid with Finance Charges and Principal

Confusing finance charges with principal often leads to costly errors such as underestimating total loan costs or mismanaging payment schedules. Avoid applying payments solely to the principal without addressing accrued finance charges, as this can prolong debt and increase interest expenses. Clear understanding of the distinction between principal and finance charges ensures more accurate budgeting and faster loan payoff.

Frequently Asked Questions: Finance Charge vs Principal

Finance charge represents the total cost of borrowing, including interest and fees, while the principal is the original amount of money you borrowed or invested. Understanding the difference between finance charge vs principal helps you manage loan payments effectively and avoid surprises on your statements. FAQ topics often address how each affects your monthly payment, the impact on loan amortization, and strategies to reduce finance charges over time.

Infographic: Finance Charge vs Principal

relatioo.com

relatioo.com