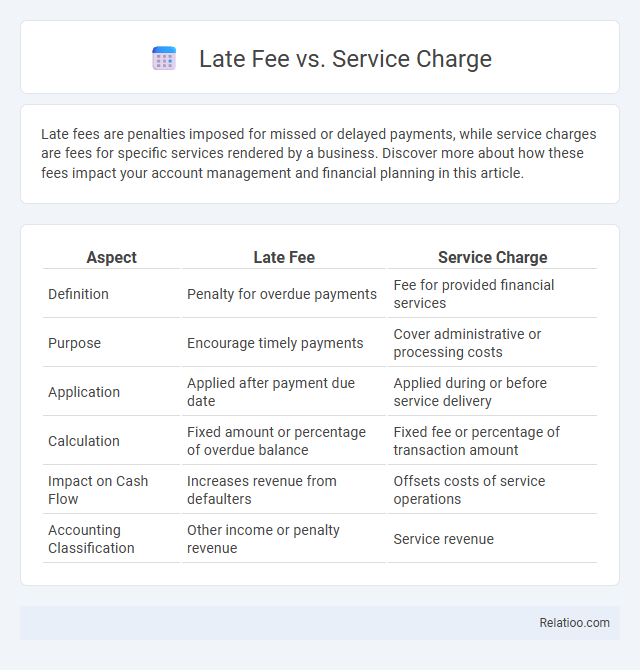

Late fees are penalties imposed for missed or delayed payments, while service charges are fees for specific services rendered by a business. Discover more about how these fees impact your account management and financial planning in this article.

Table of Comparison

| Aspect | Late Fee | Service Charge |

|---|---|---|

| Definition | Penalty for overdue payments | Fee for provided financial services |

| Purpose | Encourage timely payments | Cover administrative or processing costs |

| Application | Applied after payment due date | Applied during or before service delivery |

| Calculation | Fixed amount or percentage of overdue balance | Fixed fee or percentage of transaction amount |

| Impact on Cash Flow | Increases revenue from defaulters | Offsets costs of service operations |

| Accounting Classification | Other income or penalty revenue | Service revenue |

Understanding Late Fees: Definition and Purpose

Late fees are penalties imposed on your account when payments are not received by the due date, serving as a deterrent to encourage timely payments. Service charges refer to fees for specific services rendered, such as account maintenance or processing, and are not directly related to payment delays. Understanding these distinctions helps you manage your finances effectively and avoid unnecessary costs.

What Is a Service Charge? Explained

A service charge is a fixed fee imposed by businesses or service providers to cover operational costs, distinct from a late fee which penalizes overdue payments. Unlike late fees that apply after a payment deadline, a service charge is often included in the total bill for services rendered, reflecting administrative or processing expenses. Understanding your billing statement ensures you identify service charges separately from late fees to manage your finances effectively.

Key Differences Between Late Fees and Service Charges

Late fees are penalties imposed for overdue payments, typically calculated as a fixed amount or a percentage of the outstanding balance, designed to encourage timely payments. Service charges, however, cover the costs associated with specific services provided, such as processing fees or maintenance costs, and are not necessarily linked to payment timeliness. Understanding these differences helps you manage your finances by distinguishing between charges meant to deter late payment and fees that compensate for actual services rendered.

When Are Late Fees Applied?

Late fees are applied when a payment is not made by the specified due date, typically on bills or loan repayments, to encourage timely payments and compensate for administrative costs. Service charges, however, are fixed fees associated with specific services regardless of payment timing. You should review your billing agreement to understand when late fees are triggered, as they usually incur after a grace period ends or on the first day past due.

Typical Scenarios for Service Charges

Service charges commonly apply in scenarios where businesses cover costs for additional services like credit card processing or handling special requests, differing from late fees which penalize overdue payments. Your bill may include a service charge during events at restaurants or hotels where extra staffing or amenities are required. Unlike late fees, service charges are often mandatory and reflect operational expenses rather than payment delays.

Legal Regulations: Late Fees vs Service Charges

Legal regulations differentiate late fees and service charges based on their purpose and calculation methods, with late fees usually imposed for missed payments and service charges applied for specific services or administrative costs. Your understanding of state laws and consumer protection statutes is essential, as many jurisdictions cap late fees to prevent excessive penalties while allowing reasonable service charges. Ensuring compliance with these regulations protects your business from legal disputes and maintains transparent financial practices.

How Late Fees Impact Your Finances

Late fees, commonly imposed when payments are overdue, can significantly increase your overall debt by compounding interest and penalties, leading to higher financial burdens. Service charges differ as they represent fixed fees for specific services, usually not tied to payment delays, but they still add to your monthly expenses. Understanding the distinctions between late fees and service charges helps manage budgeting effectively and avoid unnecessary financial strain.

Service Charges and Their Effect on Customers

Service charges are mandatory fees added to a bill for specific services provided, directly impacting customer expenses by increasing the total payment amount. Unlike late fees, which are penalties for overdue payments, service charges reflect the cost of services rendered, influencing customer perceptions of value and fairness. Businesses must carefully balance the amount of service charges to maintain customer satisfaction while covering operational costs effectively.

Ways to Avoid Late Fees and Service Charges

To avoid late fees and service charges, always pay your bills on or before the due date, set up automatic payments, and monitor your account statements regularly for any discrepancies. Understanding the distinction between a late fee, which penalizes overdue payments, and a service charge, which may apply for specific services or account maintenance, helps you manage your finances better. Your proactive approach in tracking payment schedules and utilizing reminders can significantly reduce the risk of incurring these extra costs.

Choosing the Right Fee Structure for Your Business

Choosing the right fee structure for your business involves understanding the distinctions between late fees, service charges, and penalties. Late fees are imposed for overdue payments to encourage timely settlement, while service charges cover the cost of additional services or administrative efforts. Evaluating customer behavior, cash flow needs, and regulatory compliance helps determine whether implementing a late fee, a service charge, or both best aligns with your business objectives and maintains customer satisfaction.

Infographic: Late Fee vs Service Charge

relatioo.com

relatioo.com