Internal Rate of Return (IRR) measures the rate at which a project's net present value (NPV) equals zero, while NPV calculates the total value added by the project based on a specific discount rate. Discover the detailed relationship between IRR and NPV in this article.

Table of Comparison

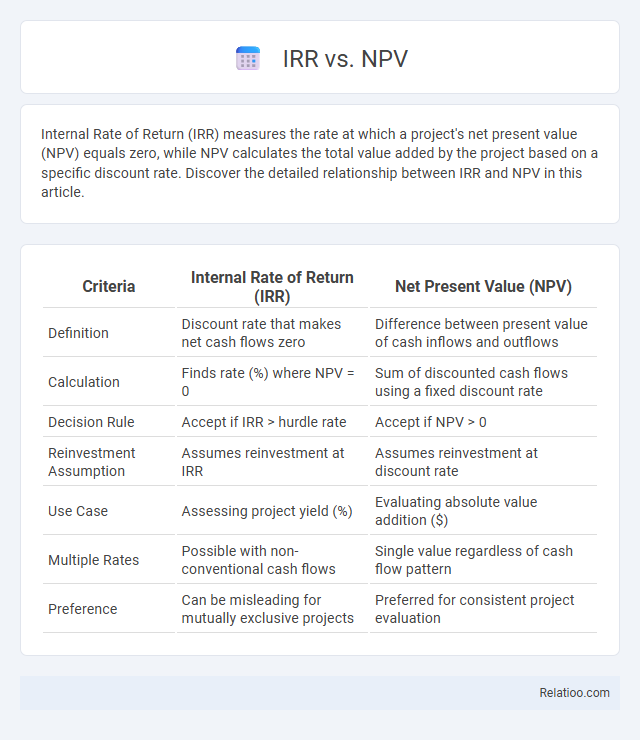

| Criteria | Internal Rate of Return (IRR) | Net Present Value (NPV) |

|---|---|---|

| Definition | Discount rate that makes net cash flows zero | Difference between present value of cash inflows and outflows |

| Calculation | Finds rate (%) where NPV = 0 | Sum of discounted cash flows using a fixed discount rate |

| Decision Rule | Accept if IRR > hurdle rate | Accept if NPV > 0 |

| Reinvestment Assumption | Assumes reinvestment at IRR | Assumes reinvestment at discount rate |

| Use Case | Assessing project yield (%) | Evaluating absolute value addition ($) |

| Multiple Rates | Possible with non-conventional cash flows | Single value regardless of cash flow pattern |

| Preference | Can be misleading for mutually exclusive projects | Preferred for consistent project evaluation |

Introduction to IRR and NPV

Internal Rate of Return (IRR) measures the profitability of potential investments by calculating the expected annual return rate, while Net Present Value (NPV) evaluates the monetary value gained or lost from a project by discounting future cash flows to their present value. IRR identifies the discount rate that makes the NPV of all cash flows equal to zero, helping you decide if an investment meets your required rate of return. Understanding both IRR and NPV allows you to assess the efficiency and value of projects for more informed financial decisions.

Defining Internal Rate of Return (IRR)

Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of all cash flows from a project or investment equal to zero, reflecting the project's expected annualized return. Unlike NPV, which provides the absolute value added by an investment, IRR expresses the efficiency or profitability as a percentage, enabling direct comparison between multiple projects regardless of scale. Understanding IRR helps you evaluate whether your investment meets or exceeds your required rate of return, guiding informed financial decisions.

Understanding Net Present Value (NPV)

Net Present Value (NPV) measures the profitability of your investment by calculating the present value of all cash flows, discounted at a specific rate, reflecting the time value of money. Unlike Internal Rate of Return (IRR), which identifies the discount rate that makes NPV zero, NPV provides an absolute value indicating whether your project adds financial value. Comparing NPV versus return enables you to assess both the magnitude and efficiency of your investments for better decision-making.

Key Differences Between IRR and NPV

IRR (Internal Rate of Return) represents the discount rate at which the net present value (NPV) of cash flows equals zero, while NPV calculates the absolute value of cash flows discounted at a specific rate, reflecting your project's profitability. Unlike IRR, which provides a percentage return, NPV offers a dollar value indicating how much wealth your investment generates beyond the hurdle rate. You should prioritize NPV when dealing with mutually exclusive projects or varying cash flow patterns, as IRR can sometimes give multiple or misleading rates.

How IRR Works in Capital Budgeting

Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of all cash flows from a capital budgeting project equal to zero, helping investors evaluate the profitability of potential investments. Unlike NPV, which provides a dollar value representing the project's net gain, IRR expresses the expected percentage return, allowing comparison across different projects or investments. IRR is particularly useful in capital budgeting for ranking projects, as it highlights the efficiency of invested capital by indicating the annualized effective compounded return rate.

Applications of NPV in Investment Decisions

Net Present Value (NPV) is a crucial metric in investment decisions for evaluating the profitability of projects by discounting future cash flows to their present value using a specific discount rate. Unlike Internal Rate of Return (IRR), which calculates the break-even interest rate, NPV provides a dollar amount that reflects the expected added value to the firm, making it more reliable for comparing mutually exclusive projects or investments with different scales and durations. Return, often expressed as a percentage, gives a simple measure of investment performance but lacks the comprehensive time value of money perspective that NPV integrates, thereby making NPV the preferred tool for strategic capital budgeting and long-term financial planning.

Advantages of Using IRR

The Internal Rate of Return (IRR) provides a clear percentage measure of investment profitability, making it easier for stakeholders to compare against required rates of return or cost of capital. IRR accounts for the time value of money by discounting future cash flows, offering a more accurate reflection of an investment's efficiency over its lifespan. Unlike Net Present Value (NPV), IRR allows for quick decision-making without the need to specify a discount rate, making it especially useful in projects with varying funding costs.

Benefits of the NPV Method

The NPV method provides a clear measure of value creation by calculating the present value of cash inflows minus outflows, ensuring investment decisions align with maximizing shareholder wealth. Unlike IRR, NPV accounts for varying discount rates and avoids multiple rate solutions, making it more reliable for projects with non-normal cash flows. NPV also directly reflects the expected increase in firm value, offering a straightforward criterion for accepting or rejecting projects based on positive net present value.

Limitations of IRR and NPV

IRR often provides multiple or misleading results for projects with non-conventional cash flows, making it unreliable for evaluating complex investments. NPV relies heavily on the accuracy of the discount rate, which can be subjective and affect the valuation outcome significantly. Both IRR and NPV ignore external factors like market volatility and assume reinvestment at constant rates, limiting their effectiveness in dynamic financial environments.

Choosing Between IRR and NPV: Best Practices

Choosing between IRR and NPV depends on project scale and cash flow patterns, with NPV preferred for its direct measure of value addition in dollar terms. IRR offers intuitive percentage returns but can be misleading with non-conventional cash flows or mutually exclusive projects. Best practices recommend using NPV for investment decisions to maximize shareholder wealth and applying IRR as a complementary metric for understanding rate of return.

Infographic: IRR vs NPV

relatioo.com

relatioo.com