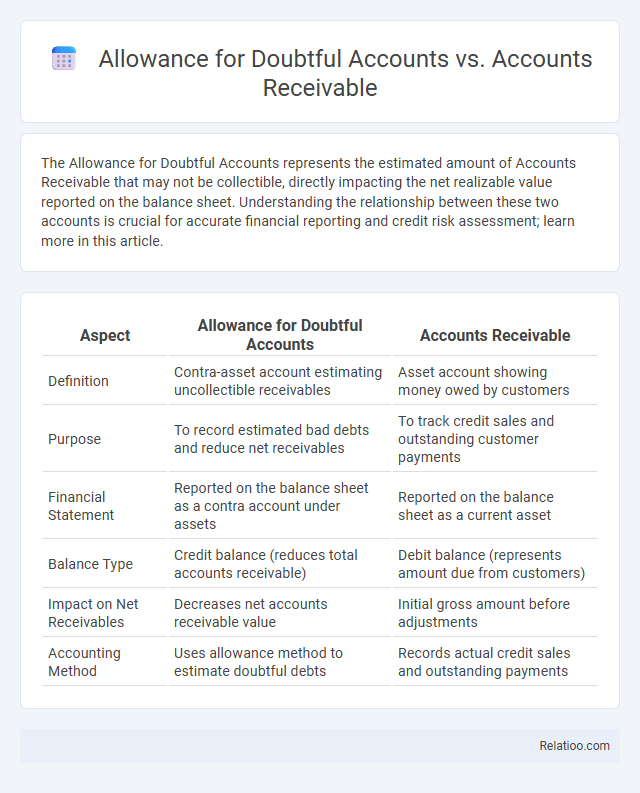

The Allowance for Doubtful Accounts represents the estimated amount of Accounts Receivable that may not be collectible, directly impacting the net realizable value reported on the balance sheet. Understanding the relationship between these two accounts is crucial for accurate financial reporting and credit risk assessment; learn more in this article.

Table of Comparison

| Aspect | Allowance for Doubtful Accounts | Accounts Receivable |

|---|---|---|

| Definition | Contra-asset account estimating uncollectible receivables | Asset account showing money owed by customers |

| Purpose | To record estimated bad debts and reduce net receivables | To track credit sales and outstanding customer payments |

| Financial Statement | Reported on the balance sheet as a contra account under assets | Reported on the balance sheet as a current asset |

| Balance Type | Credit balance (reduces total accounts receivable) | Debit balance (represents amount due from customers) |

| Impact on Net Receivables | Decreases net accounts receivable value | Initial gross amount before adjustments |

| Accounting Method | Uses allowance method to estimate doubtful debts | Records actual credit sales and outstanding payments |

Overview of Allowance for Doubtful Accounts

Allowance for Doubtful Accounts is a contra-asset account that reduces the total Accounts Receivable to reflect estimated uncollectible amounts, providing a more accurate representation of expected cash inflows. It is established based on historical data, customer credit risk, and economic conditions to anticipate potential credit losses. Unlike Accounts Receivable, which records total amounts owed by customers, the allowance adjusts the net realizable value on the balance sheet.

Understanding Accounts Receivable

Accounts Receivable represents the total amount owed to your business by customers for goods or services delivered on credit. Allowance for Doubtful Accounts is a contra asset account that reduces the Accounts Receivable balance to reflect the estimated uncollectible amounts. Understanding these accounts helps you accurately assess your net realizable value and manage credit risk effectively.

Key Differences Between Allowance for Doubtful Accounts and Accounts Receivable

Allowance for Doubtful Accounts is a contra asset account used to estimate and record potential uncollectible amounts within Accounts Receivable. Accounts Receivable represents the total amount owed by customers for goods or services provided on credit, reflecting your expected cash inflow before considering bad debts. The key difference lies in that Allowance for Doubtful Accounts reduces the net realizable value of Accounts Receivable by accounting for credit risk, providing a more accurate financial picture.

Purpose and Importance of Allowance for Doubtful Accounts

Allowance for Doubtful Accounts is a contra-asset account that estimates the portion of Accounts Receivable unlikely to be collected, ensuring more accurate financial reporting by reflecting potential credit losses. This allowance aligns with the matching principle in accounting, linking bad debt expenses to the same period when related sales occur. Maintaining an appropriate Allowance for Doubtful Accounts is crucial for businesses to present realistic asset values and avoid overstating receivables on the balance sheet.

How Accounts Receivable Impact Financial Statements

Accounts Receivable represent amounts owed by customers and are recorded as current assets on the balance sheet, directly impacting a company's liquidity and working capital ratios. The Allowance for Doubtful Accounts is a contra-asset account that reduces Accounts Receivable to reflect estimated uncollectible amounts, ensuring more accurate representation of net realizable value. Changes in these accounts affect the income statement through bad debt expense, influencing net income and providing a realistic view of expected cash inflows from credit sales.

Methods for Estimating Allowance for Doubtful Accounts

Allowance for Doubtful Accounts is estimated using methods such as the percentage of sales method, which calculates a fixed percentage of credit sales as bad debt expense, and the aging of accounts receivable method, which assesses the collectibility of individual receivables based on their age. Accounts Receivable represents the total amount owed by customers, while the Allowance for Doubtful Accounts serves as a contra-asset account, offsetting accounts receivable to reflect expected uncollectible amounts. Your choice of estimation method influences the accuracy of financial statements by providing a realistic view of collectible receivables and expected credit losses.

Recording and Reporting Bad Debts

Allowance for Doubtful Accounts is a contra-asset account used to estimate and record potential uncollectible amounts within Accounts Receivable, reflecting anticipated bad debts on the balance sheet. Accounts Receivable represents the total amount owed by customers before any adjustments for doubtful accounts, serving as a gross figure for outstanding credit sales. Your financial reporting benefits from accurately adjusting Accounts Receivable with the Allowance for Doubtful Accounts to present a net realizable value, ensuring bad debts are recorded in the same period as the related revenues for proper matching and compliance with GAAP.

Effects on Cash Flow and Working Capital

Allowance for Doubtful Accounts reduces the net Accounts Receivable on the balance sheet, impacting working capital by reflecting more accurate expected cash inflows without directly affecting cash flow until specific bad debts are written off. Accounts Receivable represents outstanding customer invoices, and an increase ties up working capital while indicating future cash inflows. The Allowance account adjusts the value of receivables, improving financial statement accuracy and aiding in better cash flow forecasting, but does not immediately impact cash flow or liquidity until adjustments are made.

Best Practices for Managing Doubtful Accounts and Receivables

Effective management of doubtful accounts and receivables involves maintaining a well-calibrated Allowance for Doubtful Accounts to accurately reflect potential credit losses, enhancing financial statement reliability. Regularly reviewing Accounts Receivable aging reports helps identify high-risk accounts early, allowing timely adjustments to the allowance and proactive collection efforts. Implementing consistent credit policies and leveraging automation for tracking payments optimize cash flow and minimize the impact of uncollectible accounts.

Common Mistakes to Avoid in Accounting for Bad Debts

Common mistakes in accounting for bad debts include failing to accurately estimate the Allowance for Doubtful Accounts, which can lead to overstated Accounts Receivable and misrepresented financial health. Confusing the Allowance account with Accounts Receivable often results in improper adjustments, skewing Your company's net receivables and impacting revenue recognition. Ensuring proper differentiation and regular review of these accounts is essential to maintain accurate financial statements and comply with accounting standards.

Infographic: Allowance for Doubtful Accounts vs Accounts Receivable

relatioo.com

relatioo.com