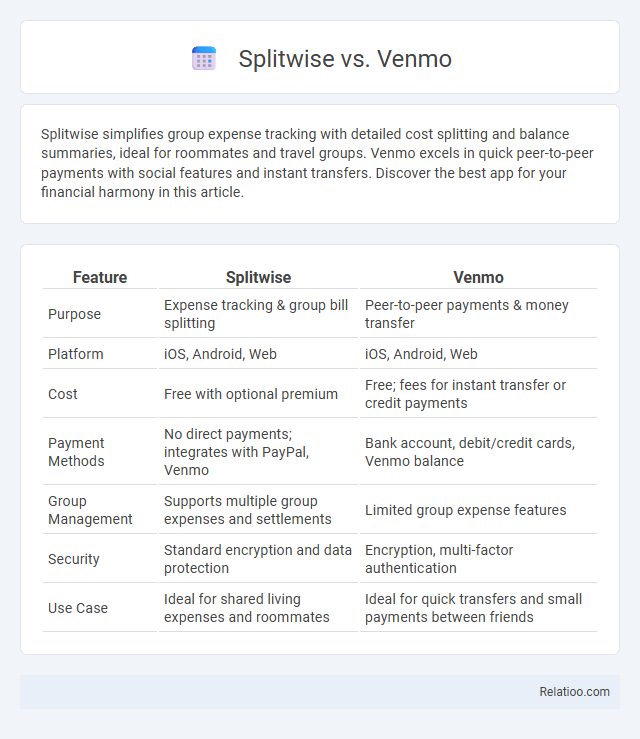

Splitwise simplifies group expense tracking with detailed cost splitting and balance summaries, ideal for roommates and travel groups. Venmo excels in quick peer-to-peer payments with social features and instant transfers. Discover the best app for your financial harmony in this article.

Table of Comparison

| Feature | Splitwise | Venmo |

|---|---|---|

| Purpose | Expense tracking & group bill splitting | Peer-to-peer payments & money transfer |

| Platform | iOS, Android, Web | iOS, Android, Web |

| Cost | Free with optional premium | Free; fees for instant transfer or credit payments |

| Payment Methods | No direct payments; integrates with PayPal, Venmo | Bank account, debit/credit cards, Venmo balance |

| Group Management | Supports multiple group expenses and settlements | Limited group expense features |

| Security | Standard encryption and data protection | Encryption, multi-factor authentication |

| Use Case | Ideal for shared living expenses and roommates | Ideal for quick transfers and small payments between friends |

Introduction: Splitwise vs Venmo Overview

Splitwise excels in simplifying group expense tracking and bill splitting, offering detailed balances and shared expense management. Venmo provides fast peer-to-peer payments with social media features and easy money transfers between users. Your choice depends on whether you prioritize expense organization with Splitwise or quick payment processing with Venmo for managing shared costs.

User Interface and Ease of Use

Splitwise offers a clean, intuitive user interface that simplifies managing group expenses and tracking balances, making it ideal for users who frequently share costs with multiple people. Venmo integrates social features with seamless payment options, providing a straightforward experience for peer-to-peer money transfers while maintaining clear transaction history. Splitting Bill focuses on quick, on-the-spot expense division with minimal input required, ensuring Your bill splits are handled efficiently without navigating complex menus.

Core Features Comparison

Splitwise excels in expense tracking and group bill management, offering features like detailed expense categorization, automated balance calculations, and multi-currency support. Venmo focuses on peer-to-peer payments with instant fund transfers, social activity feeds, and easy integration with bank accounts and cards. Splitting Bill provides straightforward bill division tools but lacks advanced tracking or social features, making it ideal for simple, one-time expense splits that suit Your casual or infrequent splitting needs.

Bill Splitting Capabilities

Splitwise offers comprehensive bill splitting capabilities by allowing users to create groups, track shared expenses, and manage balances accurately across multiple transactions. Venmo supports simple peer-to-peer payments but lacks detailed expense tracking or group bill management features. Your choice depends on whether you need robust shared expense management with Splitwise or quick individual payments through Venmo.

Payment Methods Supported

Splitwise supports multiple payment methods by integrating with PayPal and Venmo, allowing users to settle balances through these platforms after calculating expenses. Venmo offers direct peer-to-peer payments via linked bank accounts, debit, or credit cards, providing instant money transfers within the app. You can simplify shared expenses with Splitting Bill apps that often support bank transfers and digital wallets, but their payment options vary widely depending on the service used.

Security and Privacy Measures

Splitwise offers robust encryption and privacy controls, ensuring that users' bill-sharing data remains confidential and securely stored. Venmo implements secure payment processing with two-factor authentication and encrypted transactions, but its social feed may expose transaction details unless privacy settings are adjusted. Splitting Bill emphasizes secure data handling and straightforward privacy settings, allowing users to manage who views their shared expenses with minimal risk of data leaks.

Fees and Charges

Venmo charges a 3% fee for sending money using a credit card, while bank transfers and debit card payments are free, and instant transfers incur a 1.75% fee with a minimum of $0.25. Splitwise itself does not process payments but integrates with payment apps like PayPal and Venmo, offering free expense tracking without direct fees. Splitting Bill applications often vary widely in fees; some apps charge transaction fees or subscription costs for premium features, but many offer free basic splitting services without extra charges.

Integration with Other Apps

Splitwise excels in integration with apps like PayPal and Venmo for seamless debt tracking and payments, enhancing shared expense management. Venmo integrates widely with social media and online merchants, allowing quick transfers and purchase shares within its network. Splitting Bill offers basic app integrations but lacks the extensive payment and social features found in Splitwise and Venmo, making it less versatile for comprehensive expense sharing.

Pros and Cons of Splitwise

Splitwise excels in managing group expenses with clear expense tracking, detailed summaries, and support for multiple currencies, making it ideal for roommates or group trips. However, it lacks integrated payment options, requiring users to settle debts externally, which can be inconvenient compared to Venmo's direct payment feature. Its interface is focused on expense splitting rather than instant money transfers, so users seeking quick funds exchange might prefer Venmo, while those prioritizing detailed expense management benefit most from Splitwise.

Pros and Cons of Venmo

Venmo offers seamless peer-to-peer payments with a user-friendly interface and social feed, making bill splitting engaging and convenient, but it has limited support for splitting bills evenly among multiple users compared to Splitwise. Its instant transfer feature incurs fees, and privacy concerns arise from its public transaction feed unless adjusted in settings. Unlike Splitting Bill apps focused solely on expense division, Venmo combines payment processing with social networking, which may distract from purely financial management tasks.

Infographic: Splitwise vs Venmo

relatioo.com

relatioo.com