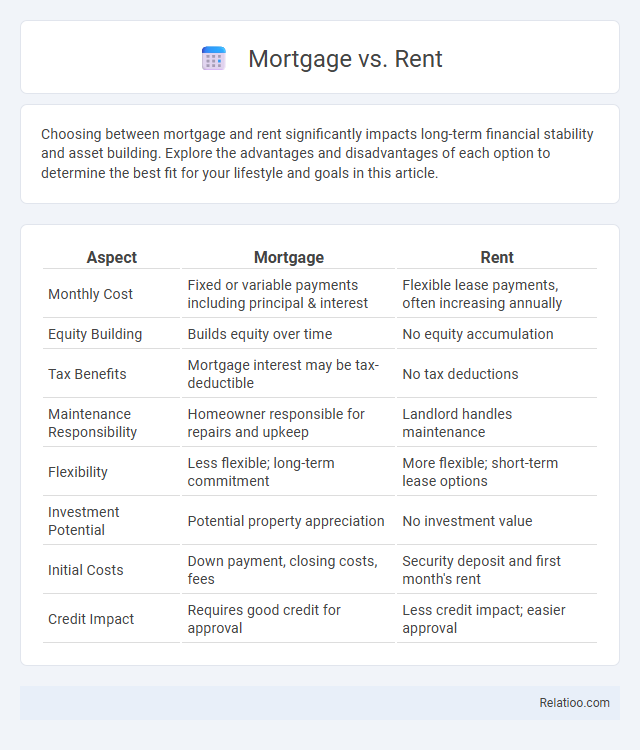

Choosing between mortgage and rent significantly impacts long-term financial stability and asset building. Explore the advantages and disadvantages of each option to determine the best fit for your lifestyle and goals in this article.

Table of Comparison

| Aspect | Mortgage | Rent |

|---|---|---|

| Monthly Cost | Fixed or variable payments including principal & interest | Flexible lease payments, often increasing annually |

| Equity Building | Builds equity over time | No equity accumulation |

| Tax Benefits | Mortgage interest may be tax-deductible | No tax deductions |

| Maintenance Responsibility | Homeowner responsible for repairs and upkeep | Landlord handles maintenance |

| Flexibility | Less flexible; long-term commitment | More flexible; short-term lease options |

| Investment Potential | Potential property appreciation | No investment value |

| Initial Costs | Down payment, closing costs, fees | Security deposit and first month's rent |

| Credit Impact | Requires good credit for approval | Less credit impact; easier approval |

Introduction to Mortgage vs Rent

Mortgage payments build home equity over time, serving as an investment in property ownership, while rent payments offer flexibility without equity accumulation. Mortgages typically require a down payment, fixed or adjustable interest rates, and long-term financial commitment, contrasting with the short-term, often monthly rent agreements. Understanding these differences helps individuals balance financial stability with mobility and homeownership goals.

Key Differences Between Mortgaging and Renting

Mortgaging involves acquiring property ownership through loan repayment, building equity over time, while renting requires regular payments with no ownership benefits. Mortgage payments typically include principal, interest, taxes, and insurance, whereas rent payments are fixed and cover only the right to occupy the property. Your choice affects long-term financial stability, tax benefits, and investment potential.

Financial Implications: Mortgage vs Rent

Choosing between a mortgage and rent significantly impacts your long-term financial health, as mortgage payments build home equity over time while rent is a recurring expense with no asset accumulation. With a mortgage, your monthly payments contribute to ownership, potentially offering tax benefits and property appreciation, whereas rent payments solely cover living expenses without investment returns. Understanding Your budget, credit score, and financial goals is essential to determine which option aligns best with your financial stability and future wealth creation.

Long-Term Wealth Building: Ownership vs Leasing

Mortgage payments contribute to building equity and long-term wealth by turning your monthly costs into property ownership, whereas rent payments primarily cover housing expenses without asset accumulation. A payment plan for purchasing property can offer structured financial discipline, helping you gradually secure ownership and increase net worth. Choosing ownership over leasing provides the advantage of property appreciation and tax benefits, positioning you for greater financial stability in the long run.

Flexibility and Stability Comparison

Mortgage offers long-term stability through fixed monthly payments and eventual homeownership, providing predictable financial planning and equity growth. Renting provides high flexibility with shorter commitments and easier relocation options but lacks equity building and may face rent increases. Payment plans for home purchase or renovation strike a balance by allowing manageable installments with more control than renting, yet often less stability than a full mortgage.

Upfront and Ongoing Costs Explained

Mortgage upfront costs typically include a down payment, closing fees, and property inspections, while ongoing expenses cover monthly principal, interest, property taxes, and insurance. Renting demands lower upfront fees, usually limited to a security deposit and first month's rent, with ongoing monthly rent payments that often increase over time. Your choice between mortgage, rent, or a payment plan hinges on balancing initial affordability against long-term financial commitments and cash flow management.

Tax Benefits of Mortgages and Renting

Mortgage interest payments often provide significant tax benefits by allowing you to deduct interest from your taxable income, which is not available when renting. Rent payments do not offer direct tax deductions, though some regions may provide renter's credits or subsidies that reduce your overall tax burden. Comparing these options, choosing a mortgage can enhance your financial strategy through tax savings while building equity over time.

Impact on Credit Score: Mortgage vs Rent

Mortgage payments have a significant positive impact on credit scores when paid consistently and on time, as they are reported to credit bureaus and demonstrate long-term financial responsibility. Rent payments typically do not affect credit scores unless reported through specialized rent reporting services, which are less common and have limited influence compared to mortgage history. Choosing a mortgage over renting can build a stronger credit profile due to the regular, documented repayment of a substantial debt.

Lifestyle Considerations and Personal Goals

Choosing between mortgage, rent, or a payment plan significantly impacts your lifestyle and aligns with personal goals such as stability, flexibility, or financial freedom. Mortgages build equity and provide long-term security, ideal for those seeking homeownership and investment growth, while renting offers mobility and lower upfront costs suiting transient or uncertain lifestyles. Payment plans can balance affordability and asset acquisition but require careful budgeting to match your financial capacity and future aspirations.

Choosing the Right Option for Your Situation

Evaluating mortgage, rent, and payment plans requires analyzing your financial stability, long-term goals, and market conditions to choose the best fit for your situation. Mortgages offer equity building and tax benefits but demand upfront costs and creditworthiness, while renting provides flexibility without homeownership responsibilities. Payment plans can help manage expenses over time but may include interest or fees, making it essential to compare total costs and personal cash flow before deciding.

Infographic: Mortgage vs Rent

relatioo.com

relatioo.com