Withholding allowance reduces the amount of taxable income withheld from each paycheck, while an exemption directly decreases the taxpayer's overall tax liability. Learn more about how withholding allowances and exemptions impact your taxes in this article.

Table of Comparison

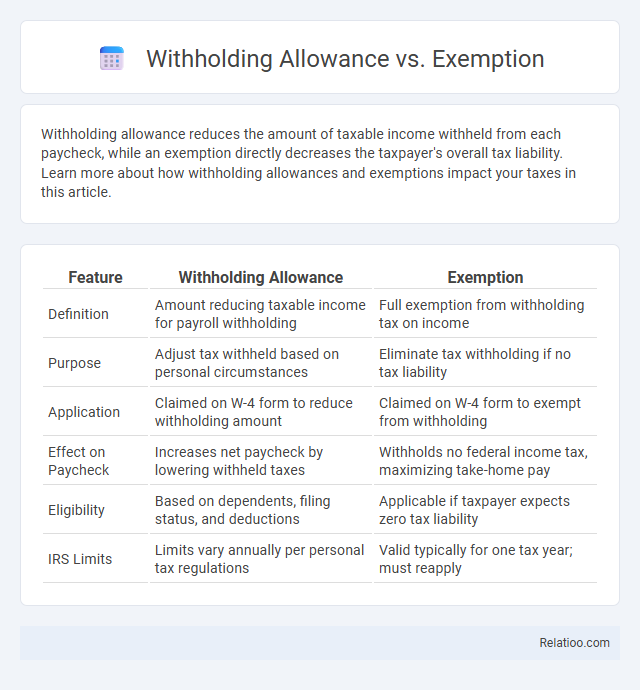

| Feature | Withholding Allowance | Exemption |

|---|---|---|

| Definition | Amount reducing taxable income for payroll withholding | Full exemption from withholding tax on income |

| Purpose | Adjust tax withheld based on personal circumstances | Eliminate tax withholding if no tax liability |

| Application | Claimed on W-4 form to reduce withholding amount | Claimed on W-4 form to exempt from withholding |

| Effect on Paycheck | Increases net paycheck by lowering withheld taxes | Withholds no federal income tax, maximizing take-home pay |

| Eligibility | Based on dependents, filing status, and deductions | Applicable if taxpayer expects zero tax liability |

| IRS Limits | Limits vary annually per personal tax regulations | Valid typically for one tax year; must reapply |

Introduction to Withholding Allowance and Exemption

Withholding allowance determines the amount of federal income tax an employer withholds from an employee's paycheck based on factors like marital status and number of dependents. Exemptions reduce taxable income by allowing deductions for each qualified individual, lowering overall tax liability. Understanding the distinction helps accurately calculate withholding to prevent owing taxes or receiving a large refund.

Defining Withholding Allowance

Withholding allowance determines the amount of federal income tax an employer deducts from an employee's paycheck, directly impacting take-home pay. Unlike exemptions, which reduce taxable income based on qualifying criteria, withholding allowances adjust the tax withheld by accounting for personal and dependent credits. Understanding withholding allowances helps employees optimize their tax withholdings and avoid underpaying or overpaying taxes throughout the year.

Understanding Tax Exemptions

Tax exemptions reduce the amount of income subject to federal withholding by excluding specific income types or dependents, directly impacting the withholding amount on paychecks. Withholding allowances, claimed on Form W-4, adjust the amount of tax withheld by accounting for factors like dependents and deductions but do not eliminate tax liability. Understanding these distinctions ensures accurate payroll withholding, preventing underpayment penalties or excessive tax refunds.

Key Differences Between Allowance and Exemption

Withholding allowance reduces the amount of income subject to tax by accounting for dependents and personal factors, directly affecting the paycheck withholding amount. Exemption, historically used to fully exclude a certain portion of income from taxation, has been largely phased out under recent tax reforms, making allowances the primary method for withholding adjustments. The key difference lies in allowances adjusting withholding amounts throughout the year, while exemptions once provided a fixed income exclusion but now hold limited relevance in federal tax calculations.

Historical Changes in Withholding Allowances

Withholding allowances have undergone significant changes due to tax reform acts, transitioning from a system that allowed multiple allowances per dependent to a simplified allowance framework aimed at enhancing withholding accuracy. Exemptions, distinct from allowances, previously reduced taxable income per exemption claimed but have been eliminated as of recent tax law changes, affecting payroll withholding calculations. Your understanding of withholding relies on recognizing these evolutions, which impact how employers calculate tax withheld from wages to comply with updated IRS guidelines.

Current Tax Regulations Impacting Both Terms

Withholding allowance, exemption, and withholding are critical components of tax regulation that determine the amount of federal income tax withheld from your paycheck. Current tax laws have reduced the use of withholding allowances with the introduction of the redesigned Form W-4, which eliminates allowances and focuses on accurate income and deductions reporting to better match your tax liability. Understanding these terms affects your paycheck accuracy and ensures compliance with IRS regulations to avoid underpayment penalties or large tax refunds.

How to Claim a Withholding Allowance

Claiming a withholding allowance involves completing the IRS Form W-4, where you indicate your personal allowances based on factors like filing status and dependents to reduce the amount of federal income tax withheld from your paycheck. Unlike exemptions, which were eliminated starting in 2018 under the Tax Cuts and Jobs Act, withholding allowances still affect the withholding calculation by adjusting your taxable income. Properly claiming the correct number of withholding allowances helps ensure accurate tax withholding, preventing large tax bills or refunds when you file your annual return.

Who Qualifies for Tax Exemptions?

Tax exemptions reduce your taxable income based on specific qualifications such as dependents, filing status, or special circumstances like blindness or age. You qualify for tax exemptions if you meet IRS criteria, including having eligible dependents or being claimed as an exemption by another taxpayer. Understanding the difference between withholding allowances, exemptions, and withholding helps you accurately adjust your tax payments and avoid under- or over-paying taxes.

Impact on Payroll and Paychecks

Withholding allowances reduce the amount of income tax withheld from an employee's paycheck, directly influencing take-home pay by lowering tax withholding based on personal and dependent claims. Withholding exemptions eliminate withholding entirely when an employee expects no tax liability, resulting in the highest possible paycheck but potential tax owed at filing. Payroll systems must accurately reflect allowances and exemptions to ensure compliance with IRS regulations and prevent under- or over-withholding, affecting both employer reporting and employee tax outcomes.

Withholding Allowance vs Exemption: Which Applies to You?

Withholding allowances determine the amount of federal income tax withheld from your paycheck based on factors like dependents and personal circumstances, directly impacting your take-home pay. Exemptions, which were eliminated under the Tax Cuts and Jobs Act of 2017, previously allowed individuals to reduce taxable income but no longer apply for current tax years. Understanding the distinction--allowances still influence withholding calculations, while exemptions do not--is essential for accurate tax planning and preventing under- or over-withholding.

Infographic: Withholding Allowance vs Exemption

relatioo.com

relatioo.com