Financial infidelity, involving secretive behaviors around money, can be as damaging to relationships as traditional cheating, eroding trust and causing emotional distress. Discover how to identify and address financial infidelity to strengthen your partnership in this article.

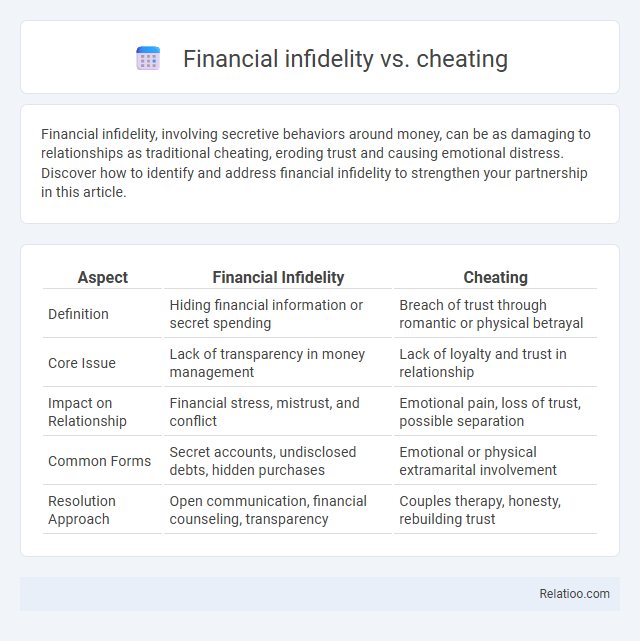

Table of Comparison

| Aspect | Financial Infidelity | Cheating |

|---|---|---|

| Definition | Hiding financial information or secret spending | Breach of trust through romantic or physical betrayal |

| Core Issue | Lack of transparency in money management | Lack of loyalty and trust in relationship |

| Impact on Relationship | Financial stress, mistrust, and conflict | Emotional pain, loss of trust, possible separation |

| Common Forms | Secret accounts, undisclosed debts, hidden purchases | Emotional or physical extramarital involvement |

| Resolution Approach | Open communication, financial counseling, transparency | Couples therapy, honesty, rebuilding trust |

Understanding Financial Infidelity: Definition and Examples

Financial infidelity involves secretive behavior regarding money, such as hiding debts, secret accounts, or undisclosed expenses, undermining trust in relationships. Unlike general cheating, which typically refers to emotional or physical betrayal, financial infidelity specifically targets financial transparency and honesty. Understanding financial infidelity means recognizing its impact on your relationship's stability and addressing hidden financial actions that can cause significant emotional and monetary harm.

What Constitutes Cheating in Relationships?

Cheating in relationships typically involves emotional or physical betrayal, such as secret affairs or deceit about intimate interactions, while financial infidelity specifically relates to hiding money matters, debts, or significant expenditures from your partner. Financial infidelity breaches trust through secrecy around finances, impacting the relationship's stability but differs from broader cheating by centering on monetary dishonesty. Understanding these distinctions helps you recognize the unique challenges each form of betrayal poses to relational trust and communication.

Financial Infidelity vs Cheating: Key Differences

Financial infidelity involves secretive behaviors related to money, such as hiding expenses, debts, or income from a partner, whereas cheating commonly refers to emotional or physical betrayal in a relationship. The key differences lie in the domain of trust violations: financial infidelity breaches monetary transparency and joint financial goals, while cheating compromises emotional or sexual fidelity. Understanding these distinctions is crucial for addressing the underlying issues in relationship counseling and rebuilding trust.

Common Signs of Financial Infidelity

Common signs of financial infidelity include hidden bank accounts, secret credit card use, and unexplained cash withdrawals, which often lead to trust issues in relationships. Unlike general cheating, which involves emotional or physical betrayal, financial infidelity specifically targets money matters and can deeply affect your financial stability and emotional well-being. Recognizing these warning signs early can help protect your assets and foster honest communication about finances.

Emotional Impact: Money Secrets vs Romantic Betrayals

Financial infidelity, characterized by hidden debts or secret spending, often generates deep emotional distress, eroding trust similarly to romantic betrayals but with unique anxieties related to security and future planning. Unlike traditional cheating, financial secrets introduce ongoing stress over financial stability, compounding feelings of betrayal with fears about shared goals and responsibilities. The emotional impact of money secrets can produce lasting resentment and anxiety, paralleling the heartbreak caused by romantic infidelity but rooted in practical, everyday realities.

Why Partners Commit Financial Infidelity

Partners commit financial infidelity due to a mix of fear, shame, and lack of communication about money, often hiding debt or secret accounts to avoid conflict or judgment. Unlike traditional cheating, which breaches emotional or physical trust, financial infidelity disrupts financial transparency and can severely impact the couple's future security and joint goals. Understanding your partner's financial mindset and fostering open dialogue can prevent secrecy and build mutual trust in your relationship.

Consequences of Financial Infidelity and Cheating

Financial infidelity, involving hidden spending or secret debts, often erodes trust and causes significant emotional distress, potentially leading to long-term relationship instability. Cheating extends beyond financial deceit to include emotional or physical betrayal, which can cause deeper psychological trauma, loss of intimacy, and relationship breakdown. Both financial infidelity and cheating result in diminished trust, increased conflict, and may necessitate professional counseling to rebuild communication and restore partnership balance.

How Financial Infidelity Undermines Trust

Financial infidelity undermines trust by secretly hiding financial information, such as undisclosed debts or secret bank accounts, which creates a breach in transparency essential for healthy relationships. Unlike general cheating, which typically involves emotional or physical betrayal, financial infidelity directly impacts your partners' sense of security and shared goals, leading to feelings of deception and instability. This erosion of trust complicates future financial decision-making and emotional intimacy, making recovery more difficult.

Steps to Heal After Financial or Romantic Betrayal

Healing after financial infidelity or romantic betrayal requires clear communication, rebuilding trust, and setting transparent financial boundaries to protect Your relationship. Prioritize open discussions about money management and emotional needs to restore mutual respect and security. Professional counseling or financial therapy can also provide structured support for overcoming the trauma of betrayal and fostering long-term healing.

Preventing Financial Infidelity and Cheating in Relationships

Preventing financial infidelity and cheating in relationships requires transparent communication and mutual trust regarding money management and personal boundaries. Establishing joint financial goals, regularly sharing account details, and scheduling periodic money discussions can reduce the risk of hidden expenditures and deceptive behaviors. Couples who prioritize financial honesty and emotional openness build stronger foundations that deter both financial infidelity and relationship cheating.

Infographic: Financial Infidelity vs Cheating

relatioo.com

relatioo.com