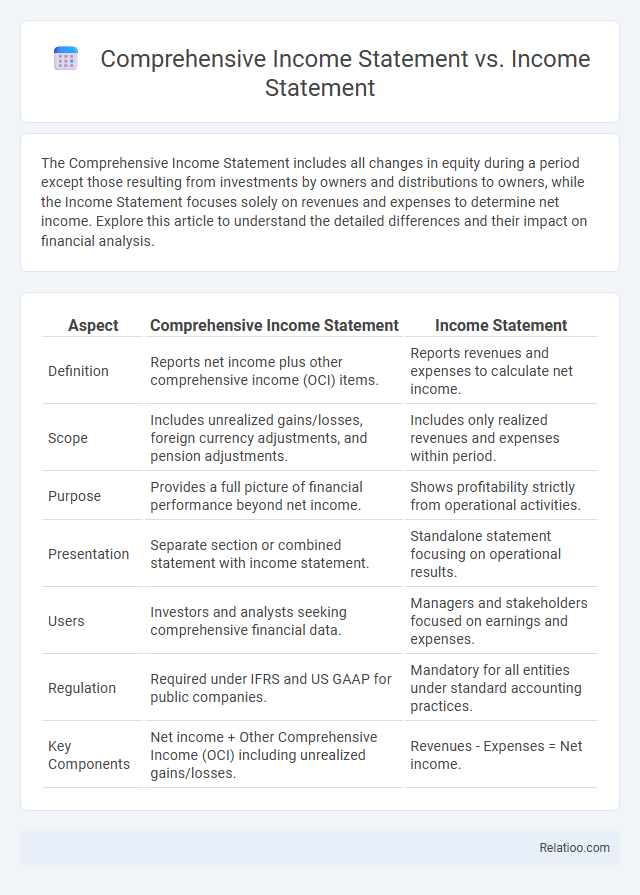

The Comprehensive Income Statement includes all changes in equity during a period except those resulting from investments by owners and distributions to owners, while the Income Statement focuses solely on revenues and expenses to determine net income. Explore this article to understand the detailed differences and their impact on financial analysis.

Table of Comparison

| Aspect | Comprehensive Income Statement | Income Statement |

|---|---|---|

| Definition | Reports net income plus other comprehensive income (OCI) items. | Reports revenues and expenses to calculate net income. |

| Scope | Includes unrealized gains/losses, foreign currency adjustments, and pension adjustments. | Includes only realized revenues and expenses within period. |

| Purpose | Provides a full picture of financial performance beyond net income. | Shows profitability strictly from operational activities. |

| Presentation | Separate section or combined statement with income statement. | Standalone statement focusing on operational results. |

| Users | Investors and analysts seeking comprehensive financial data. | Managers and stakeholders focused on earnings and expenses. |

| Regulation | Required under IFRS and US GAAP for public companies. | Mandatory for all entities under standard accounting practices. |

| Key Components | Net income + Other Comprehensive Income (OCI) including unrealized gains/losses. | Revenues - Expenses = Net income. |

Introduction to Income Statements

The Income Statement provides a summary of a company's revenues and expenses over a specific period, reflecting net profit or loss. Comprehensive Income Statement extends this by including other comprehensive income items like unrealized gains and losses, providing a broader view of financial performance. Understanding these statements is crucial for assessing overall profitability and financial health beyond net income.

Defining the Comprehensive Income Statement

The Comprehensive Income Statement extends beyond the traditional Income Statement by including all changes in equity during a period except those resulting from investments by and distributions to owners. This statement incorporates items such as unrealized gains or losses on available-for-sale securities and foreign currency translation adjustments, providing a more holistic view of a company's financial performance. Unlike the standard Income Statement, which reports net income from primary operations, the Comprehensive Income Statement captures total comprehensive income, reflecting both realized and unrealized economic effects.

Key Components of a Standard Income Statement

The Key Components of a Standard Income Statement include Revenues, Expenses, Gains, and Losses, which collectively determine Net Income. A Comprehensive Income Statement extends this by incorporating Other Comprehensive Income items such as unrealized gains or losses on investments and foreign currency translation adjustments. Understanding Your financial performance requires analyzing these components to assess both operational results and overall financial health.

Elements Included in a Comprehensive Income Statement

A Comprehensive Income Statement includes all elements found in a traditional Income Statement--revenues, expenses, gains, and losses--plus other comprehensive income items such as unrealized gains or losses on available-for-sale securities, foreign currency translation adjustments, and pension plan gains or losses. The traditional Income Statement focuses strictly on net income from operating activities and non-operating items, while the Comprehensive Income Statement provides a broader view of total income affecting equity but excluded from net income. This expanded scope captures changes in equity from non-owner sources, offering a more complete financial performance measure.

Main Differences Between Comprehensive and Standard Income Statements

The main difference between a comprehensive income statement and a standard income statement lies in the scope of income reported; the standard income statement focuses on net income from operating activities and typical revenues and expenses, while the comprehensive income statement includes other comprehensive income items such as unrealized gains or losses on investments and foreign currency translation adjustments. Comprehensive income provides a broader view of total economic performance, capturing changes in equity not reflected in net income alone. Investors and analysts use the comprehensive income statement to assess the full impact of economic events on a company's financial health beyond core operational results.

Importance of Comprehensive Income Reporting

Comprehensive Income Statements provide a broader view of Your company's financial performance by including all changes in equity not captured by the traditional Income Statement, such as unrealized gains and losses from foreign currency translations and investment securities. While the standard Income Statement reports net income from operating activities, the Comprehensive Income Statement captures both net income and other comprehensive income, offering a complete picture of financial health. Accurate comprehensive income reporting is crucial for investors and stakeholders to fully assess Your organization's economic activities and long-term value.

Impact on Stakeholders and Financial Analysis

The Comprehensive Income Statement provides a broader view of a company's financial performance by including all changes in equity except those resulting from investments by owners or distributions to owners, which gives stakeholders a more complete picture of economic events affecting the business. Unlike the traditional Income Statement that focuses solely on net income from operations within a period, the Comprehensive Income Statement captures unrealized gains and losses, offering deeper insights for investors and creditors assessing financial health and risk. Your financial analysis benefits from examining both statements together to understand not only operational profitability but also the impact of other comprehensive income items on overall equity value and long-term sustainability.

Practical Examples and Format Comparison

The Comprehensive Income Statement expands on the traditional Income Statement by including other comprehensive income such as unrealized gains and losses on investments, foreign currency translation adjustments, and pension plan gains or losses, providing a broader view of company performance. For example, while a basic Income Statement lists revenues, expenses, and net income, a Comprehensive Income Statement adds sections for items like unrealized securities gains, enhancing investor insights. Format-wise, the Income Statement typically follows a straightforward structure of revenue minus expenses, whereas the Comprehensive Income Statement incorporates additional components below net income, illustrating both operating results and comprehensive changes in equity.

Reporting Standards: GAAP vs IFRS Perspectives

The Comprehensive Income Statement includes all changes in equity excluding owner transactions, capturing both net income and other comprehensive income items such as foreign currency translation adjustments and unrealized gains or losses on securities. GAAP requires presentation of comprehensive income either in a single continuous statement or two separate but consecutive statements, while IFRS mandates a single statement of comprehensive income or two statements similarly but emphasizes detailed disclosure for components of other comprehensive income. Your financial reporting choice between GAAP and IFRS impacts how comprehensive income is reported, influencing transparency and comparability for investors and stakeholders.

Choosing the Right Statement for Your Business

Choosing the right financial statement for your business depends on the level of detail required; the Income Statement provides a straightforward summary of revenues and expenses, while the Comprehensive Income Statement includes additional items like unrealized gains and losses for a fuller financial picture. Your decision should consider whether detailed insights into other comprehensive income elements, such as foreign currency translation adjustments or pension plan gains and losses, are necessary for accurate performance evaluation. Utilizing the appropriate statement ensures precise financial analysis and informed strategic decision-making tailored to your business needs.

Infographic: Comprehensive Income Statement vs Income Statement

relatioo.com

relatioo.com