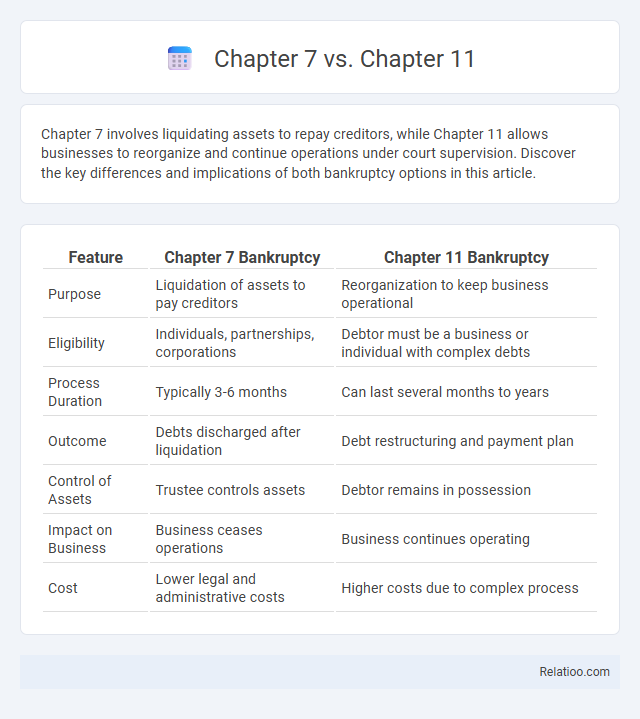

Chapter 7 involves liquidating assets to repay creditors, while Chapter 11 allows businesses to reorganize and continue operations under court supervision. Discover the key differences and implications of both bankruptcy options in this article.

Table of Comparison

| Feature | Chapter 7 Bankruptcy | Chapter 11 Bankruptcy |

|---|---|---|

| Purpose | Liquidation of assets to pay creditors | Reorganization to keep business operational |

| Eligibility | Individuals, partnerships, corporations | Debtor must be a business or individual with complex debts |

| Process Duration | Typically 3-6 months | Can last several months to years |

| Outcome | Debts discharged after liquidation | Debt restructuring and payment plan |

| Control of Assets | Trustee controls assets | Debtor remains in possession |

| Impact on Business | Business ceases operations | Business continues operating |

| Cost | Lower legal and administrative costs | Higher costs due to complex process |

Introduction to Chapter 7 and Chapter 11 Bankruptcy

Chapter 7 bankruptcy involves the liquidation of a debtor's non-exempt assets to repay creditors, typically used by individuals or businesses seeking a fresh financial start. Chapter 11 bankruptcy allows businesses to reorganize their debts and operations while continuing to operate, offering a chance to restructure and negotiate with creditors under court supervision. Both chapters serve distinct purposes in the bankruptcy code, with Chapter 7 focused on asset liquidation and Chapter 11 emphasizing debt reorganization.

Key Differences Between Chapter 7 and Chapter 11

Chapter 7 bankruptcy involves liquidation of a debtor's non-exempt assets to pay creditors, typically resulting in the closure of the business, while Chapter 11 bankruptcy allows for reorganization and continuation of business operations under a court-approved plan to restructure debts. Chapter 7 is often chosen by individuals or businesses unable to continue operations, whereas Chapter 11 suits businesses seeking to remain operational and regain profitability through debt renegotiation. Key differences include Chapter 7's focus on asset liquidation and Chapter 11's emphasis on reorganization and debt restructuring.

Eligibility Criteria for Chapter 7 vs Chapter 11

Chapter 7 bankruptcy eligibility requires passing the means test, demonstrating insufficient income to repay debts, and is typically suited for individuals or businesses seeking liquidation. Chapter 11 bankruptcy eligibility is broader, allowing businesses, corporations, and individuals with higher debt levels to reorganize while continuing operations. Unlike Chapter 7, Chapter 11 does not mandate a means test but requires proof of the debtor's ability to propose a feasible repayment plan to creditors.

The Bankruptcy Process: Chapter 7 Explained

Chapter 7 bankruptcy involves liquidating your non-exempt assets to pay off creditors, providing a faster path to debt relief compared to Chapter 11's complex reorganization. The bankruptcy process begins with filing a petition, followed by appointing a trustee who supervises asset liquidation and creditor payments. Understanding the differences helps you choose the right bankruptcy option tailored to your financial situation.

The Bankruptcy Process: Chapter 11 Explained

Chapter 11 bankruptcy allows businesses to reorganize their debts and continue operations while developing a repayment plan subject to court approval. The bankruptcy process under Chapter 11 involves filing a petition, automatic stay protection from creditors, negotiating with creditors, and gaining court confirmation of the reorganization plan. Unlike Chapter 7, which involves liquidation, Chapter 11 focuses on restructuring finances to help companies regain profitability and avoid complete shutdown.

Impact on Assets and Debt Discharge

Chapter 7 bankruptcy results in the liquidation of a debtor's non-exempt assets to repay creditors, with most remaining unsecured debts discharged following asset liquidation. Chapter 11 bankruptcy allows for reorganization where the debtor retains control of assets while developing a repayment plan to restructure debts, often preserving business operations and minimizing asset loss. Unlike these, bankruptcy broadly refers to the legal process of resolving insolvency, with Chapter 7 and Chapter 11 specifically addressing how assets are handled and debts are discharged under different frameworks.

Effects on Credit Score and Future Borrowing

Chapter 7 bankruptcy typically causes a significant drop in credit score, remaining on credit reports for up to 10 years, which severely limits future borrowing opportunities. Chapter 11, often used by businesses, also impacts credit scores negatively but allows for restructuring debt, potentially enabling better access to credit over time compared to Chapter 7. Both types of bankruptcy harm creditworthiness, but Chapter 11's focus on reorganization can facilitate improved credit recovery and borrowing capacity in the long term.

Costs and Timeline of Chapter 7 vs Chapter 11

Chapter 7 bankruptcy typically involves lower costs and a faster timeline, often concluding within four to six months, since it focuses on liquidation of assets to pay creditors. In contrast, Chapter 11 bankruptcy incurs higher legal and administrative expenses due to its complex reorganization process, which can extend from several months to multiple years depending on the case complexity. Businesses filing Chapter 11 benefit from the option to restructure debts and operations, but the extended timeline and elevated costs often make Chapter 7 more suitable for individuals or small entities seeking quick debt resolution.

Pros and Cons: Chapter 7 Compared to Chapter 11

Chapter 7 bankruptcy involves liquidation of assets to pay creditors, offering a quicker resolution but often resulting in loss of property and potential damage to credit scores for up to 10 years. Chapter 11 bankruptcy allows businesses to restructure debts and continue operations, providing flexibility and the opportunity to regain profitability, but it can be complex, costly, and time-consuming. Deciding between Chapter 7 and Chapter 11 depends on factors such as the debtor's financial goals, asset structure, and desire to maintain business operations while addressing creditor obligations.

Choosing the Right Bankruptcy Chapter for Your Situation

Choosing the right bankruptcy chapter depends on your financial goals and business structure, with Chapter 7 focusing on liquidation for individuals or businesses unable to repay debts, while Chapter 11 offers reorganization options primarily for businesses aiming to continue operations. Chapter 11 allows debtors to propose a repayment plan to creditors, often preserving assets and enabling a fresh start, whereas Chapter 7 results in asset liquidation to satisfy outstanding debts. Understanding the differences in eligibility, process duration, and impact on assets is crucial in selecting the appropriate bankruptcy chapter to effectively manage debt and protect financial interests.

Infographic: Chapter 7 vs Chapter 11

relatioo.com

relatioo.com