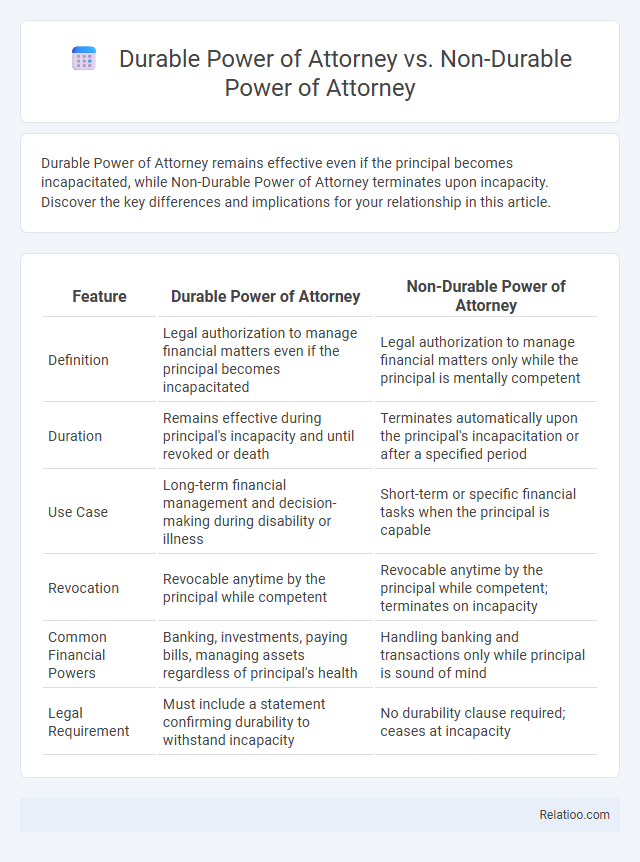

Durable Power of Attorney remains effective even if the principal becomes incapacitated, while Non-Durable Power of Attorney terminates upon incapacity. Discover the key differences and implications for your relationship in this article.

Table of Comparison

| Feature | Durable Power of Attorney | Non-Durable Power of Attorney |

|---|---|---|

| Definition | Legal authorization to manage financial matters even if the principal becomes incapacitated | Legal authorization to manage financial matters only while the principal is mentally competent |

| Duration | Remains effective during principal's incapacity and until revoked or death | Terminates automatically upon the principal's incapacitation or after a specified period |

| Use Case | Long-term financial management and decision-making during disability or illness | Short-term or specific financial tasks when the principal is capable |

| Revocation | Revocable anytime by the principal while competent | Revocable anytime by the principal while competent; terminates on incapacity |

| Common Financial Powers | Banking, investments, paying bills, managing assets regardless of principal's health | Handling banking and transactions only while principal is sound of mind |

| Legal Requirement | Must include a statement confirming durability to withstand incapacity | No durability clause required; ceases at incapacity |

Introduction to Power of Attorney

Power of Attorney (POA) is a legal document granting an individual the authority to act on behalf of another in financial or medical decisions. Durable Power of Attorney remains effective if the principal becomes incapacitated, ensuring continuous representation, while Non-Durable Power of Attorney terminates upon the principal's incapacity or after a specified period. Understanding these distinctions is crucial for selecting the appropriate authorization to meet personal or professional needs.

What Is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that grants an agent the authority to make financial or medical decisions on behalf of the principal even after the principal becomes incapacitated. Unlike a Non-Durable Power of Attorney, which terminates upon the principal's incapacity or after a specific period, the DPOA remains effective through mental or physical incapacitation. The general Power of Attorney refers to any document granting decision-making powers, but only the durable type ensures continuity of authority during incapacity.

What Is a Non-Durable Power of Attorney?

A Non-Durable Power of Attorney grants authority to an agent to act on your behalf but automatically terminates if you become incapacitated or mentally incompetent. This type of power of attorney is suitable for managing financial or legal matters during a specific period, such as a temporary absence or illness. Understanding the differences between Durable, Non-Durable, and general Power of Attorney helps you make informed decisions about granting authority and protecting your interests.

Key Differences Between Durable and Non-Durable POA

Durable Power of Attorney remains effective even if You become incapacitated, allowing the appointed agent to make decisions on Your behalf without interruption. Non-Durable Power of Attorney automatically terminates once You lose mental capacity, limiting its use to specific, temporary situations. Unlike general Power of Attorney, which can vary in scope and duration, the key distinction lies in the durability clause that ensures continuous authority during incapacitation.

When Does Each Power of Attorney Take Effect?

Durable Power of Attorney takes effect immediately upon signing or when you become incapacitated, ensuring your agent can act continuously even if you lose mental capacity. Non-Durable Power of Attorney becomes effective right after signing but terminates if you become incapacitated, limiting your agent's authority during critical times. General Power of Attorney may refer to either type but usually takes effect immediately and varies based on the document's terms and state laws governing activation.

How Each POA Handles Incapacity

Durable Power of Attorney remains effective if you become incapacitated, ensuring continuous management of your financial or medical decisions. Non-Durable Power of Attorney terminates automatically upon your incapacity, requiring a new arrangement to handle your affairs. Power of Attorney, as a general term, varies depending on its durability clause, so understanding the specifics is crucial for effective incapacity planning.

Legal Requirements for Durable and Non-Durable POA

Durable Power of Attorney (DPOA) must meet specific legal requirements, including explicit language indicating that the power remains effective even if the principal becomes incapacitated, and often requires notarization or witnesses depending on jurisdiction. Non-Durable Power of Attorney (NDPOA) generally has fewer formalities, only granting authority effective while the principal is competent and typically lapses upon incapacity, with signing and witnessing requirements varying by state law. Both Durable and Non-Durable POAs require the principal's clear intent, legal capacity at execution, and compliance with state-specific statutes to ensure validity.

Pros and Cons of Durable Power of Attorney

Durable Power of Attorney (DPOA) remains effective even if the principal becomes incapacitated, allowing for seamless financial and medical decision-making without court intervention, which is its primary advantage over Non-Durable Power of Attorney that terminates upon incapacity. The main drawback of DPOA lies in the potential for abuse or misuse of authority by the appointed agent since it grants extensive control and access to the principal's assets and decisions. Power of Attorney in general provides flexibility in managing affairs, but choosing DPOA ensures continuity, making it essential for long-term planning despite the risks of oversight and the need for trustworthy agents.

Pros and Cons of Non-Durable Power of Attorney

A Non-Durable Power of Attorney grants limited decision-making authority, expiring if you become incapacitated, which protects against misuse but limits its effectiveness during health crises. This type offers the advantage of tight control and reduces the risk of prolonged abuse, yet its temporary nature can hinder seamless management of your affairs when you most need assistance. Choosing the right Power of Attorney depends on your specific needs for control, duration, and the ability to respond to changing circumstances.

Choosing the Right Power of Attorney for Your Needs

Choosing the right power of attorney depends on your specific needs and circumstances. A durable power of attorney remains effective even if you become incapacitated, ensuring continuous management of your affairs, while a non-durable power of attorney terminates if you lose mental capacity or after a specified event. Understanding the differences between these powers of attorney helps you protect your financial and healthcare decisions effectively.

Infographic: Durable Power of Attorney vs Non-Durable Power of Attorney

relatioo.com

relatioo.com