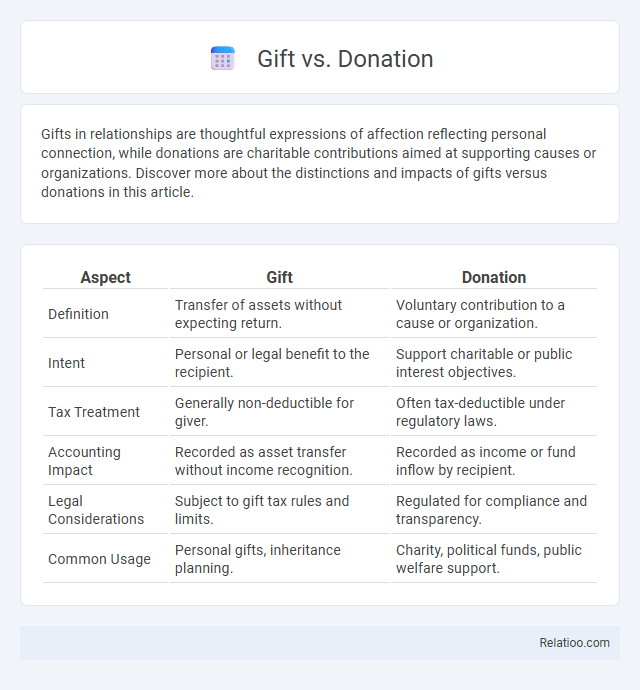

Gifts in relationships are thoughtful expressions of affection reflecting personal connection, while donations are charitable contributions aimed at supporting causes or organizations. Discover more about the distinctions and impacts of gifts versus donations in this article.

Table of Comparison

| Aspect | Gift | Donation |

|---|---|---|

| Definition | Transfer of assets without expecting return. | Voluntary contribution to a cause or organization. |

| Intent | Personal or legal benefit to the recipient. | Support charitable or public interest objectives. |

| Tax Treatment | Generally non-deductible for giver. | Often tax-deductible under regulatory laws. |

| Accounting Impact | Recorded as asset transfer without income recognition. | Recorded as income or fund inflow by recipient. |

| Legal Considerations | Subject to gift tax rules and limits. | Regulated for compliance and transparency. |

| Common Usage | Personal gifts, inheritance planning. | Charity, political funds, public welfare support. |

Understanding the Difference: Gift vs Donation

A gift is a voluntary transfer of property or money made without expecting anything in return, often given for personal occasions or celebrations. A donation typically refers to a gift made for charitable purposes, intended to support a cause or organization and may qualify for tax deductions under specific regulations. Understanding the difference involves recognizing that while all donations are gifts, not all gifts are considered donations unless directed towards charitable contributions.

Legal Definitions of Gifts and Donations

Gifts and donations differ primarily in their legal definitions and tax implications; a gift is typically a voluntary transfer of property or money without consideration, recognized under gift tax laws, whereas a donation often refers to contributions made to charitable organizations and may qualify for tax deductions under charitable contribution rules. Legally, gifts can be made to individuals or entities, requiring clear donative intent and delivery, while donations are usually governed by nonprofit regulations and must be used for public benefit to maintain tax-exempt status. Understanding the distinctions in jurisdictions is critical, as the terms influence legal responsibilities, reporting requirements, and eligibility for tax credits.

Tax Implications: Gift vs Donation

Gift and donation both involve transferring assets without receiving something in return, but their tax implications differ significantly. Gifts typically require you to file a gift tax return if the amount exceeds the annual exclusion limit, and the recipient usually does not get a tax deduction. Donations made to qualified charitable organizations are often tax-deductible for you, reducing your taxable income, making donations more advantageous for tax savings compared to personal gifts.

Motivation Behind Giving: Personal vs Charitable

Gifts stem from personal motivations such as expressing affection, gratitude, or celebrating milestones, directly strengthening relationships. Donations, particularly charitable donations, are driven by altruistic intentions aimed at supporting causes, addressing social issues, or contributing to community welfare. Your choice between a gift and a donation reflects whether you prioritize personal connection or broader humanitarian impact.

Types of Gifts and Types of Donations

Gifts typically refer to voluntary transfers of property or money without expectation of return, including inter vivos gifts given during the donor's lifetime and testamentary gifts made through a will. Donations often categorize into charitable donations, supporting nonprofit organizations or causes, and political donations, which fund political campaigns or parties. Understanding these distinctions aids in tax planning and legal compliance for both donors and recipients.

Process and Documentation Requirements

Gift transactions typically involve a straightforward process with minimal documentation, often limited to a gift receipt or acknowledgment letter for tax purposes. Donations require more formal procedures, including detailed documentation such as donation agreements, proof of transfer, and compliance with nonprofit reporting standards to ensure transparency and legal adherence. Gift-in-kind donations necessitate additional valuation documents and charitable organization acknowledgments to accurately record the non-cash contributions and maximize tax benefits.

Recipient Rights and Obligations

A gift transfers ownership with no obligations for the recipient, allowing You full control without legal duties. A donation, often given to charitable organizations, may come with specific usage restrictions or reporting requirements to ensure funds are used appropriately. Recipients of donations must comply with donor conditions and legal obligations, safeguarding transparency and accountability.

Common Misconceptions About Gifts and Donations

Gifts and donations are often mistakenly used interchangeably, but gifts typically imply personal giving without tax benefits, whereas donations are usually contributions to charitable organizations eligible for tax deductions. Many believe all donations must be monetary, yet non-cash items and services can also qualify as donations if they meet IRS guidelines. Another common misconception is that gifts to individuals are always tax-free; however, large gifts may be subject to gift tax regulations depending on the amount and jurisdiction.

Ethical Considerations in Gifting and Donating

Ethical considerations in gifting and donating emphasize transparency, intent, and impact on recipients and communities. Gifts often involve personal relationships and may carry expectations or obligations, requiring sensitivity to fairness and reciprocity. Donations prioritize altruism and social benefit, demanding accountability, proper allocation, and respect for the dignity and autonomy of beneficiaries.

Choosing the Right Approach: When to Gift or Donate

Selecting between gifting and donating depends on the intention and context: a gift usually implies a personal transfer of ownership without expecting a return, often given directly to individuals, while a donation is a charitable contribution aimed at supporting organizations or causes. Gifts can be tax-exempt if they meet specific IRS criteria, whereas donations to registered nonprofits typically qualify for tax deductions, making donation the preferable approach for philanthropy. Evaluating goals, recipient type, tax implications, and legal requirements guides the decision to gift or donate effectively.

Infographic: Gift vs Donation

relatioo.com

relatioo.com