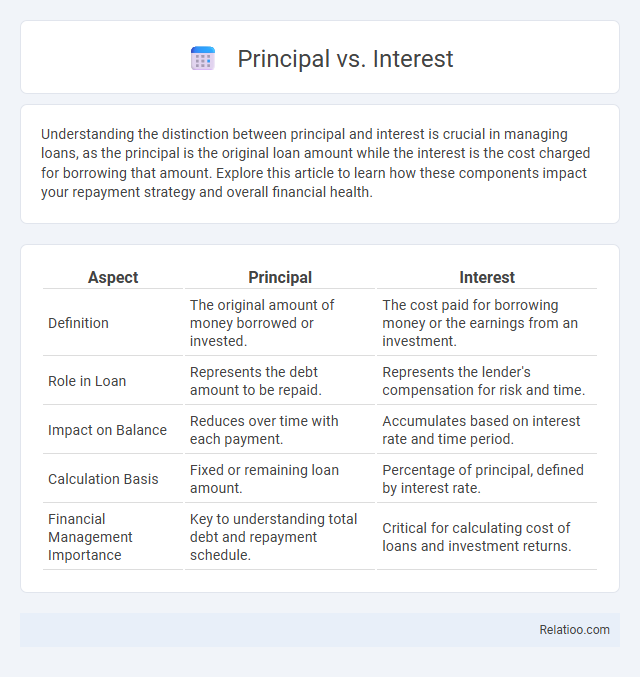

Understanding the distinction between principal and interest is crucial in managing loans, as the principal is the original loan amount while the interest is the cost charged for borrowing that amount. Explore this article to learn how these components impact your repayment strategy and overall financial health.

Table of Comparison

| Aspect | Principal | Interest |

|---|---|---|

| Definition | The original amount of money borrowed or invested. | The cost paid for borrowing money or the earnings from an investment. |

| Role in Loan | Represents the debt amount to be repaid. | Represents the lender's compensation for risk and time. |

| Impact on Balance | Reduces over time with each payment. | Accumulates based on interest rate and time period. |

| Calculation Basis | Fixed or remaining loan amount. | Percentage of principal, defined by interest rate. |

| Financial Management Importance | Key to understanding total debt and repayment schedule. | Critical for calculating cost of loans and investment returns. |

Understanding Principal and Interest

Understanding principal and interest is essential for managing loans and investments effectively. Principal refers to the original sum of money borrowed or invested, while interest represents the cost of borrowing that principal or the earnings from the investment. Distinguishing between these two helps in calculating repayment schedules, determining loan affordability, and maximizing return on investments.

Key Differences Between Principal and Interest

Principal represents the original sum of money borrowed or invested, while interest is the cost incurred for borrowing that money or the earnings from that investment. The principal remains constant unless payments reduce it, whereas interest fluctuates based on the principal amount, interest rate, and loan term. Understanding these differences is essential for managing loans, calculating mortgage payments, and optimizing investment returns.

How Principal Impacts Your Loan

The principal is the original amount of money you borrow, and it directly influences the total interest accrued over the life of your loan. Larger principal balances result in higher interest charges because interest is calculated based on the remaining principal. By making extra payments toward your principal, you can reduce your loan term and save significant money on interest.

The Role of Interest in Borrowing

Interest represents the cost you pay to borrow money, calculated as a percentage of the principal loan amount. Unlike the principal, which is the original sum borrowed, interest compensates lenders for the risk and time value of money. Understanding the role of interest helps you manage loan repayments more effectively by distinguishing between reducing your principal balance and covering borrowing costs.

Calculating Principal and Interest Payments

Calculating principal and interest payments involves understanding how each payment affects your loan balance and total cost over time. Your monthly payment typically consists of a portion that reduces the principal--the original loan amount--and a portion that covers the interest, which is calculated based on the outstanding principal balance and the interest rate. By accurately calculating these components, you can better plan your finances and minimize total interest paid throughout the life of the loan.

Principal vs Interest: Effects on Total Repayment

Understanding the difference between principal and interest is crucial for managing loan repayments effectively. The principal is the original loan amount borrowed, while interest is the cost charged by the lender for borrowing that money. Higher interest rates increase the total repayment amount significantly, as interest accumulates over time on the remaining principal balance, influencing the overall cost and duration of the loan.

Strategies to Reduce Interest Payments

Reducing interest payments can be effectively achieved by increasing principal payments, which directly lowers the loan balance and the amount of interest accrued over time. Strategies such as making bi-weekly payments instead of monthly, applying windfalls like tax refunds or bonuses toward the principal, and refinancing to a lower interest rate can significantly decrease total interest costs. Prioritizing extra payments on the principal accelerates loan payoff and minimizes the overall interest paid.

Principal and Interest in Mortgages

Principal in mortgages refers to the original loan amount you borrow, which decreases as you make payments. Interest is the cost charged by the lender, calculated as a percentage of the remaining principal balance, representing your payment for borrowing money. Understanding the balance between principal and interest is crucial to managing your mortgage effectively and reducing the total cost over time.

How Extra Payments Affect Principal and Interest

Extra payments directly reduce Your loan's principal balance, which decreases the amount of interest accrued over time. By lowering the principal earlier, more of each monthly payment applies toward the principal rather than interest, accelerating loan payoff and saving on total interest paid. Regularly making extra payments can significantly shorten the loan term and improve Your overall financial health.

Frequently Asked Questions about Principal vs Interest

Principal refers to the original amount of a loan or investment, while interest is the cost of borrowing that amount, expressed as a percentage. Frequently asked questions about principal vs interest include how payments are allocated, with initial payments mostly covering interest and later payments reducing principal. Understanding the difference is essential for budgeting loan repayments and calculating the total cost of borrowing over time.

Infographic: Principal vs Interest

relatioo.com

relatioo.com