Diversification in relationships involves expanding social connections to increase emotional support, while concentration focuses on deepening bonds with a few close individuals for stronger intimacy. Explore the benefits and challenges of both approaches to build meaningful relationships in this article.

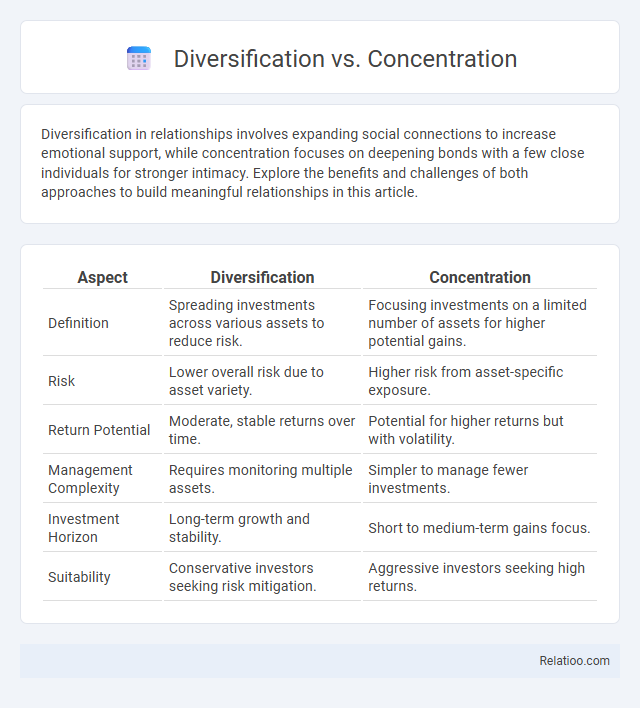

Table of Comparison

| Aspect | Diversification | Concentration |

|---|---|---|

| Definition | Spreading investments across various assets to reduce risk. | Focusing investments on a limited number of assets for higher potential gains. |

| Risk | Lower overall risk due to asset variety. | Higher risk from asset-specific exposure. |

| Return Potential | Moderate, stable returns over time. | Potential for higher returns but with volatility. |

| Management Complexity | Requires monitoring multiple assets. | Simpler to manage fewer investments. |

| Investment Horizon | Long-term growth and stability. | Short to medium-term gains focus. |

| Suitability | Conservative investors seeking risk mitigation. | Aggressive investors seeking high returns. |

Introduction to Diversification and Concentration

Diversification involves spreading your investments across various asset classes, industries, or geographic regions to reduce overall risk and enhance potential returns. Concentration focuses your portfolio on a limited number of assets or sectors, aiming for higher rewards but with increased exposure to volatility. Understanding the balance between diversification and concentration helps you tailor your investment strategy to match your risk tolerance and financial goals.

Defining Diversification: Spreading the Risk

Diversification involves spreading investments across various asset classes, industries, or geographic regions to minimize exposure to any single risk factor. This strategy reduces volatility and potential losses by balancing underperforming assets with those that may perform better in different market conditions. Concentration, in contrast, focuses investments on fewer opportunities, increasing risk but potentially enhancing returns if those assets perform well.

Understanding Concentration: Focused Investment Strategies

Concentration in investment refers to allocating a significant portion of a portfolio to a specific asset or sector, aiming for higher returns through focused exposure. This strategy can lead to greater risk due to reduced diversification, but it allows investors to leverage in-depth knowledge and confidence in selected investments. Understanding concentration helps balance potential rewards with risks, ensuring that focused investment strategies align with an investor's risk tolerance and financial goals.

Key Benefits of Diversification

Diversification reduces investment risk by spreading your assets across various sectors, industries, and geographic regions, minimizing the impact of any single market downturn. This strategy enhances portfolio stability and potential for consistent returns by balancing high-risk investments with safer ones. Your overall financial resilience improves as diversification helps protect against volatility and unexpected market shifts.

Potential Advantages of Concentration

Concentration in investment allows you to capitalize on in-depth knowledge of specific markets or sectors, potentially leading to higher returns due to focused research and expertise. This strategy reduces diversification-related dilution, enabling you to allocate resources more efficiently towards high-conviction opportunities. Concentrated portfolios can respond swiftly to market changes associated with chosen assets, enhancing your ability to maximize gains.

Risks Associated with Diversification

Diversification reduces your investment risk by spreading assets across various sectors, minimizing the impact of poor performance in any single area. Concentration increases exposure to specific market or industry risks, potentially leading to higher volatility in your portfolio. Understanding the risks associated with diversification helps balance potential returns and the safety of your investments.

Downsides of Concentrated Portfolios

Concentrated portfolios increase exposure to specific risks, limiting diversification benefits that help mitigate market volatility. Your investment may suffer significant losses if one sector or asset underperforms, reducing overall financial stability. Diversification spreads risk across multiple assets, enhancing portfolio resilience and long-term growth potential.

Diversification vs Concentration: Performance Comparison

Diversification strategies in investment diversify risk by allocating assets across various sectors, whereas concentration involves focusing investments in fewer assets with potentially higher returns. Studies show diversified portfolios tend to deliver more stable performance with lower volatility, while concentrated portfolios can achieve higher gains but expose investors to increased risk. Empirical data from financial markets indicate that long-term returns of diversified portfolios often outperform over time due to risk mitigation and market fluctuations.

Factors Influencing the Right Strategy

Choosing between diversification, concentration, or a balanced approach depends on factors such as market volatility, industry maturity, and organizational resources. Diversification mitigates risk by spreading investments across multiple sectors, while concentration leverages core competencies for potential higher returns in stable environments. Assessing competitive advantage, risk tolerance, and growth objectives is critical to determining the optimal strategic focus.

Conclusion: Choosing the Optimal Approach

Choosing the optimal approach between diversification and concentration depends on Your risk tolerance, investment goals, and market conditions. Diversification minimizes risk by spreading investments across various assets, while concentration can lead to higher returns but increases exposure to specific market fluctuations. Assessing Your financial objectives and responsiveness to market changes enables informed decisions for a balanced and effective investment strategy.

Infographic: Diversification vs Concentration

relatioo.com

relatioo.com