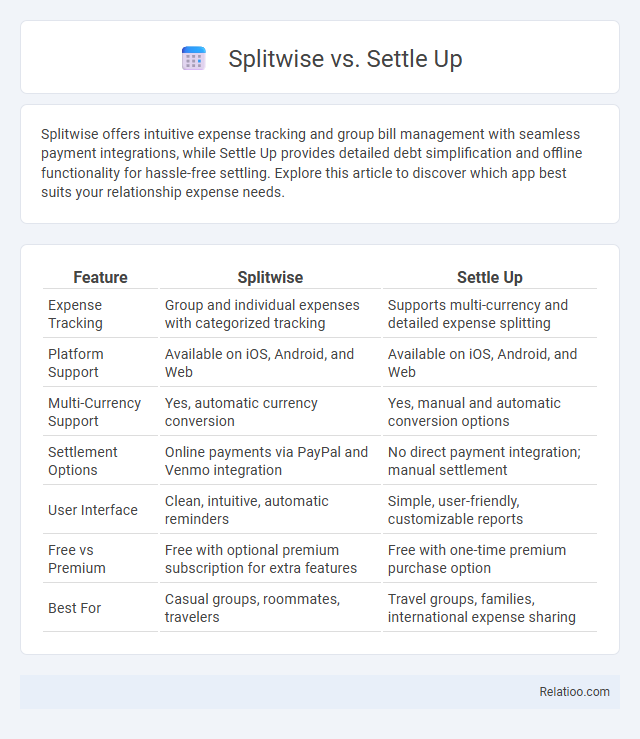

Splitwise offers intuitive expense tracking and group bill management with seamless payment integrations, while Settle Up provides detailed debt simplification and offline functionality for hassle-free settling. Explore this article to discover which app best suits your relationship expense needs.

Table of Comparison

| Feature | Splitwise | Settle Up |

|---|---|---|

| Expense Tracking | Group and individual expenses with categorized tracking | Supports multi-currency and detailed expense splitting |

| Platform Support | Available on iOS, Android, and Web | Available on iOS, Android, and Web |

| Multi-Currency Support | Yes, automatic currency conversion | Yes, manual and automatic conversion options |

| Settlement Options | Online payments via PayPal and Venmo integration | No direct payment integration; manual settlement |

| User Interface | Clean, intuitive, automatic reminders | Simple, user-friendly, customizable reports |

| Free vs Premium | Free with optional premium subscription for extra features | Free with one-time premium purchase option |

| Best For | Casual groups, roommates, travelers | Travel groups, families, international expense sharing |

Introduction to Splitwise vs Settle Up

Splitwise offers a user-friendly platform designed to simplify bill splitting and expense tracking among friends, roommates, and groups, supporting multiple currencies and detailed expense categorization. Settle Up specializes in managing group expenses with real-time balance updates and offline functionality, making it ideal for travel and shared activities without constant internet access. Both apps provide streamlined solutions for expense sharing but differ in interface design and specific usability features tailored to distinct group dynamics.

User Interface and Ease of Use

Splitwise offers an intuitive user interface with clear navigation and easily accessible features, making it simple for users to track shared expenses and balances. Settle Up provides a clean and straightforward design, prioritizing quick input of expenses and effortless settlement calculations for your convenience. Shared Expense features a minimalist UI that emphasizes ease of use through streamlined expense entry and straightforward group management, ideal for users seeking simplicity.

Key Features Comparison

Splitwise offers seamless expense tracking with bill scanning and multi-currency support, ideal for group travel and shared living situations. Settle Up emphasizes straightforward debt calculation and offline access, making it convenient for small groups without constant internet connectivity. Shared Expense focuses on customizable categories and detailed reporting, providing comprehensive expense management for long-term group budgeting.

Supported Platforms and Accessibility

Splitwise supports iOS, Android, and web platforms, providing seamless accessibility across devices for efficient expense tracking. Settle Up is available on iOS, Android, and also offers a web version, enabling you to manage shared expenses both online and offline. Shared Expense primarily supports Android and web platforms, ensuring flexibility but with limited iOS compatibility compared to the others.

Expense Tracking and Management

Splitwise offers intuitive expense tracking with real-time balance updates and multi-currency support, ideal for group travel and shared living situations. Settle Up enhances expense management through automatic payment reminders and detailed transaction histories, ensuring transparent debt settlements among friends. Shared Expense provides customizable categories and export options, catering to users seeking structured budgeting alongside expense splitting.

Group Management Capabilities

Splitwise offers robust group management features, allowing users to create multiple groups, assign expenses to specific members, and track individual balances with ease. Settle Up supports seamless group expense tracking with customizable categories, real-time sync, and debt simplification, enhancing clarity in shared spending. Shared Expense simplifies group bill splitting with straightforward group creation, expense assignment, and comprehensive summary reports for transparent financial management.

Security and Privacy Measures

Splitwise employs bank-level encryption and two-factor authentication to protect your data, while Settle Up uses end-to-end encryption ensuring transactions and expenses remain private. Shared Expense prioritizes data minimization and regularly updates its security protocols to guard against unauthorized access. Choosing any of these apps depends on your specific security needs, but all maintain strong privacy standards to safeguard your financial information.

Cost and Subscription Models

Splitwise offers a free basic plan with optional Splitwise Pro subscription at $3 monthly, providing advanced features like receipt scanning and currency conversion, making it cost-effective for casual users. Settle Up provides a one-time purchase option at around $4, eliminating recurring fees, which appeals to users preferring a straightforward expense-sharing app without subscriptions. Shared Expense typically offers a free tier with limited features and subscription plans averaging $2-$5 per month, balancing affordability with enhanced functionalities for group expense management.

Integration with Other Financial Tools

Splitwise offers seamless integration with PayPal and Venmo, enabling easy expense settlements directly from the app, while also supporting CSV exports for budget tracking in tools like Excel or Google Sheets. Settle Up includes PayPal integration and a simple interface for exporting expenses to CSV, facilitating synchronization with various financial management platforms. Shared Expense prioritizes basic export functions with CSV format but lacks extensive third-party payment integrations, making it less versatile for users seeking automated synchronization with other financial tools.

Pros, Cons, and Final Verdict

Splitwise excels with its user-friendly interface, extensive platform support, and automatic currency conversion, making it ideal for international groups, but its free version limits some features and ads can be intrusive. Settle Up offers a simple, ad-free experience with offline functionality and detailed debt tracking, though it lacks some advanced integrations and currency options available in competitors. Shared Expense provides robust expense categorization and reports but has a steeper learning curve and fewer collaboration tools; overall, Splitwise is best for comprehensive, multilingual use, Settle Up suits offline simplicity seekers, and Shared Expense appeals to users needing detailed reporting.

Infographic: Splitwise vs Settle Up

relatioo.com

relatioo.com