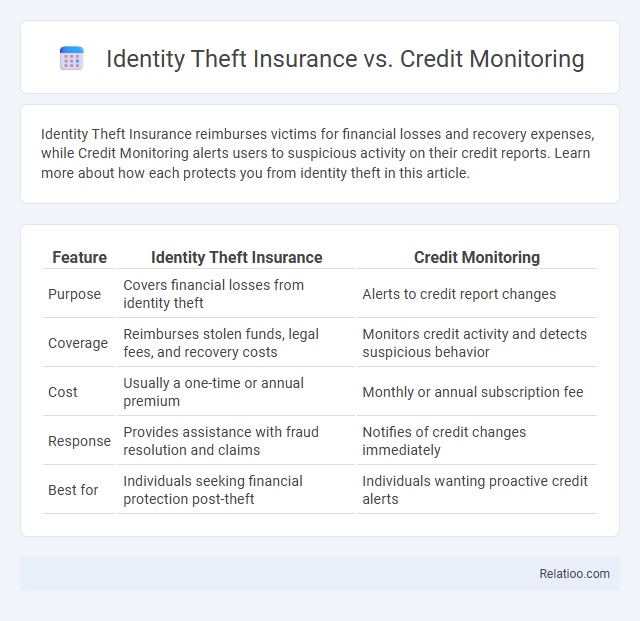

Identity Theft Insurance reimburses victims for financial losses and recovery expenses, while Credit Monitoring alerts users to suspicious activity on their credit reports. Learn more about how each protects you from identity theft in this article.

Table of Comparison

| Feature | Identity Theft Insurance | Credit Monitoring |

|---|---|---|

| Purpose | Covers financial losses from identity theft | Alerts to credit report changes |

| Coverage | Reimburses stolen funds, legal fees, and recovery costs | Monitors credit activity and detects suspicious behavior |

| Cost | Usually a one-time or annual premium | Monthly or annual subscription fee |

| Response | Provides assistance with fraud resolution and claims | Notifies of credit changes immediately |

| Best for | Individuals seeking financial protection post-theft | Individuals wanting proactive credit alerts |

Understanding Identity Theft Insurance

Identity Theft Insurance provides financial protection by covering expenses related to restoring your identity after fraudulent activities, including legal fees, lost wages, and unauthorized credit card charges. Unlike Credit Monitoring, which alerts you to suspicious activity, Identity Theft Insurance helps manage the aftermath of identity theft incidents. Understanding these distinctions is crucial for selecting comprehensive protection against identity fraud and minimizing financial and emotional impacts.

What Is Credit Monitoring?

Credit monitoring is a service that continuously tracks changes in your credit reports from major credit bureaus like Experian, Equifax, and TransUnion, alerting you to suspicious activities such as new accounts or inquiries. Unlike identity theft insurance, which provides financial protection and reimbursement for fraud-related expenses, credit monitoring focuses on early detection to help prevent identity theft before significant damage occurs. This proactive approach helps individuals respond quickly to potential threats and maintain better control over their personal financial security.

Key Features of Identity Theft Insurance

Identity Theft Insurance provides financial reimbursement for expenses related to restoring your identity after fraud, such as legal fees and lost wages, whereas Credit Monitoring services alert you to suspicious changes in your credit reports. Key features of Identity Theft Insurance include coverage for identity restoration costs, reimbursement for out-of-pocket expenses, and expert assistance in resolving identity theft issues. Unlike credit monitoring, this insurance offers direct financial protection against the consequences of identity theft incidents.

Core Benefits of Credit Monitoring Services

Credit monitoring services provide continuous surveillance of your credit reports, alerting you immediately to suspicious activities such as new account openings or credit inquiries, which is crucial for early fraud detection. These services help protect your financial reputation by allowing you to respond quickly to potential identity theft, reducing the risk of long-term damage to your credit score. While identity theft insurance offers financial reimbursement and identity theft covers the broader risk management, credit monitoring specifically empowers you with proactive insights to prevent unauthorized use of your personal information.

Comparing Costs: Identity Theft Insurance vs Credit Monitoring

Identity theft insurance typically involves a monthly or annual premium ranging from $10 to $30, covering expenses such as legal fees and lost wages due to identity restoration, whereas credit monitoring services usually cost between $10 and $20 per month and focus on alerting consumers to suspicious activity on their credit reports. Identity theft insurance provides direct financial protection against identity fraud-related costs, while credit monitoring acts as an early warning system to detect fraudulent activity but does not cover financial losses. Consumers seeking comprehensive identity protection may consider combining both services, weighing the added cost of insurance against the proactive benefits of credit monitoring alerts.

Coverage Differences Explained

Identity Theft Insurance provides financial reimbursement for losses and expenses incurred from identity fraud, covering costs such as legal fees and loan reapplications. Credit Monitoring tracks your credit report for suspicious activity but does not cover financial damages, offering alerts rather than protection. Understanding these coverage differences helps You choose whether to protect Your finances directly or monitor potential identity threats.

Pros and Cons of Identity Theft Insurance

Identity Theft Insurance provides financial protection by covering expenses related to restoring your identity and credit after theft, offering peace of mind for costly recovery processes. It can reimburse lost wages, legal fees, and costs associated with identity restoration; however, it does not prevent identity theft or monitor your accounts, which are services provided by credit monitoring and other protective measures. Your choice should balance the insurance's financial security benefits against the proactive alert features of credit monitoring to effectively manage identity theft risks.

Pros and Cons of Credit Monitoring

Credit monitoring services provide real-time alerts on suspicious activity, helping you detect potential identity theft early, but they do not cover financial losses resulting from fraud. While these services offer convenience and ongoing surveillance of your credit reports, they often come with subscription fees and may lead to false alarms causing unnecessary stress. Unlike identity theft insurance, credit monitoring lacks financial protection, making it essential to combine both for comprehensive security.

Which Option Is Right for You?

Choosing between identity theft insurance, credit monitoring, and identity theft protection depends on your specific needs and risk factors. Identity theft insurance offers financial reimbursement for losses related to identity theft, while credit monitoring alerts you to suspicious activity on your credit reports in real time. Combining both services provides comprehensive protection by enabling early detection and covering potential financial damages, making it ideal for individuals seeking robust security.

Tips for Maximizing Protection Against Identity Theft

Maximizing protection against identity theft involves leveraging identity theft insurance, credit monitoring, and proactive personal habits. Identity theft insurance provides financial reimbursement for losses and recovery costs, while credit monitoring services alert users to suspicious activities like unauthorized credit inquiries or new account openings. Regularly reviewing credit reports, using strong, unique passwords, enabling multi-factor authentication, and promptly addressing alerts from monitoring services ensure a comprehensive defense against identity theft risks.

Infographic: Identity Theft Insurance vs Credit Monitoring

relatioo.com

relatioo.com