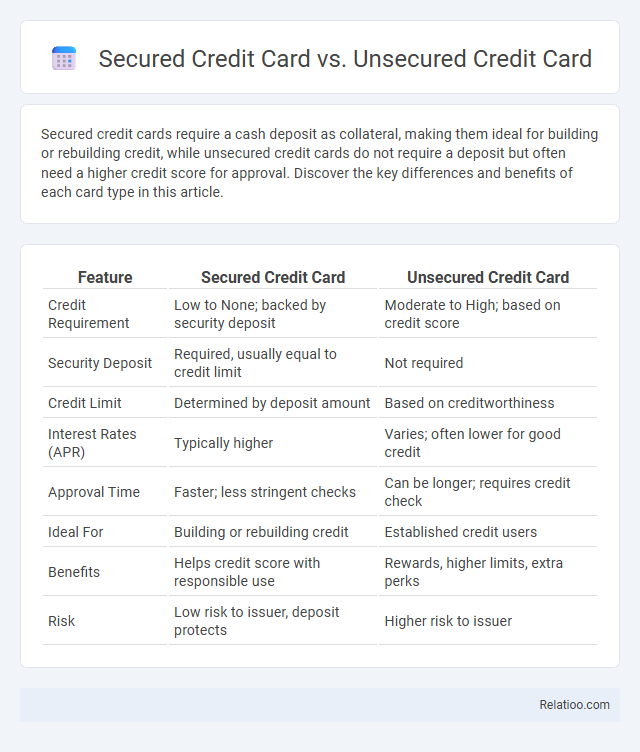

Secured credit cards require a cash deposit as collateral, making them ideal for building or rebuilding credit, while unsecured credit cards do not require a deposit but often need a higher credit score for approval. Discover the key differences and benefits of each card type in this article.

Table of Comparison

| Feature | Secured Credit Card | Unsecured Credit Card |

|---|---|---|

| Credit Requirement | Low to None; backed by security deposit | Moderate to High; based on credit score |

| Security Deposit | Required, usually equal to credit limit | Not required |

| Credit Limit | Determined by deposit amount | Based on creditworthiness |

| Interest Rates (APR) | Typically higher | Varies; often lower for good credit |

| Approval Time | Faster; less stringent checks | Can be longer; requires credit check |

| Ideal For | Building or rebuilding credit | Established credit users |

| Benefits | Helps credit score with responsible use | Rewards, higher limits, extra perks |

| Risk | Low risk to issuer, deposit protects | Higher risk to issuer |

Introduction to Secured and Unsecured Credit Cards

Secured credit cards require a cash deposit as collateral, making them ideal for individuals looking to build or rebuild their credit, while unsecured credit cards do not require a deposit and are typically offered to those with established credit histories. Your credit score plays a crucial role in determining eligibility and terms for unsecured cards, whereas secured cards can help improve your credit score by demonstrating responsible payment behavior. Choosing between secured and unsecured cards depends on your current credit standing and financial goals.

What is a Secured Credit Card?

A secured credit card requires a cash deposit as collateral, which typically sets your credit limit and minimizes the risk for the lender, making it ideal for building or rebuilding your credit score. Unlike unsecured credit cards, which do not require a security deposit and often demand higher creditworthiness, secured cards provide a pathway to demonstrate responsible credit usage and improve your credit profile. Using a secured credit card effectively can help you establish a positive payment history that boosts your credit score over time.

What is an Unsecured Credit Card?

An unsecured credit card does not require a security deposit, making it different from secured credit cards that demand collateral. These cards rely on the cardholder's creditworthiness, which directly impacts credit score development through timely payments and credit utilization. Understanding the distinctions between secured and unsecured cards is crucial for managing credit scores effectively and building financial trustworthiness.

Key Differences Between Secured and Unsecured Credit Cards

Secured credit cards require a refundable security deposit that acts as your credit limit, making them ideal for building or repairing your credit history. Unsecured credit cards do not require a deposit and offer higher credit limits but typically require good to excellent credit scores for approval. Understanding these differences helps you choose the right card to improve your credit score while managing financial risk effectively.

Credit Score Requirements: Secured vs Unsecured

Your credit score requirements differ significantly between secured and unsecured credit cards, with secured cards often accessible to individuals with low or no credit history because they require a security deposit. Unsecured credit cards typically demand a higher credit score, reflecting the issuer's reduced risk, and are suited for those with established credit profiles. Understanding these differences can help you choose the right card to build or improve your credit score effectively.

Pros and Cons of Secured Credit Cards

Secured credit cards require a security deposit as collateral, reducing the risk for lenders and making them accessible to individuals with poor or no credit history, which helps build or rebuild credit scores effectively. The main downside is the need to tie up funds in the deposit and often higher interest rates or fees compared to unsecured cards, which do not require collateral but typically demand a better credit score for approval. Secured cards offer a practical path to improve credit scores through timely payments and responsible use but may limit credit line growth until the deposit increases.

Pros and Cons of Unsecured Credit Cards

Unsecured credit cards do not require a security deposit, offering easier access and potential for higher credit limits than secured cards, but they often demand good credit scores for approval and can have higher interest rates. Your credit score impacts eligibility and terms for unsecured cards, with timely payments helping to improve credit standing over time. While unsecured cards provide greater spending flexibility, they come with increased risk of debt due to lack of collateral and potentially higher fees compared to secured credit cards.

Which Card Type Builds Credit Faster?

Secured credit cards typically build credit faster for individuals with limited or poor credit history because they require a cash deposit that serves as collateral, reducing risk for lenders and encouraging responsible use. Unsecured credit cards, while offering more flexibility and rewards, often have higher approval thresholds and may not be accessible to those needing to build credit initially. Consistent on-time payments and low credit utilization on either card type significantly improve credit scores, but secured cards provide a practical pathway to establish or rebuild credit more quickly.

Who Should Choose a Secured Credit Card?

Individuals with limited or poor credit history should consider a secured credit card because it requires a refundable security deposit, reducing the risk for lenders and helping build or rebuild your credit score effectively. Unlike unsecured credit cards, which demand higher creditworthiness, secured cards provide a practical way to demonstrate responsible credit use and improve creditworthiness over time. Choosing a secured credit card is an ideal step for those aiming to establish credit or recover from past financial challenges, setting a foundation for better credit opportunities in the future.

How to Upgrade from Secured to Unsecured Credit Card

Upgrading from a secured credit card to an unsecured credit card requires demonstrating responsible credit behavior, such as making timely payments and maintaining a low credit utilization ratio, which positively impacts your credit score. Once your credit score reaches a satisfactory range, typically above 650, you can request a credit limit increase or apply directly for an unsecured card with your issuer. Monitoring your credit report regularly and keeping your debt-to-income ratio low further improves your chances of a successful upgrade from secured to unsecured credit.

Infographic: Secured Credit Card vs Unsecured Credit Card

relatioo.com

relatioo.com