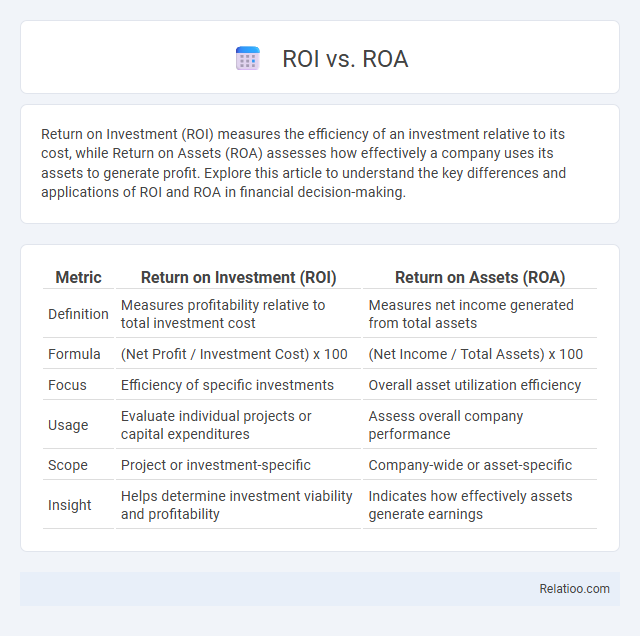

Return on Investment (ROI) measures the efficiency of an investment relative to its cost, while Return on Assets (ROA) assesses how effectively a company uses its assets to generate profit. Explore this article to understand the key differences and applications of ROI and ROA in financial decision-making.

Table of Comparison

| Metric | Return on Investment (ROI) | Return on Assets (ROA) |

|---|---|---|

| Definition | Measures profitability relative to total investment cost | Measures net income generated from total assets |

| Formula | (Net Profit / Investment Cost) x 100 | (Net Income / Total Assets) x 100 |

| Focus | Efficiency of specific investments | Overall asset utilization efficiency |

| Usage | Evaluate individual projects or capital expenditures | Assess overall company performance |

| Scope | Project or investment-specific | Company-wide or asset-specific |

| Insight | Helps determine investment viability and profitability | Indicates how effectively assets generate earnings |

Introduction to ROI and ROA

ROI (Return on Investment) measures the profitability of an investment relative to its cost, providing insights into how effectively Your capital is being utilized. ROA (Return on Assets) evaluates a company's ability to generate profit from its total assets, highlighting operational efficiency. Understanding both ROI and ROA enables better decision-making by balancing investment returns with asset productivity.

Defining ROI (Return on Investment)

ROI (Return on Investment) measures the efficiency of an investment by comparing net profit to the initial cost, expressed as a percentage. Unlike ROA (Return on Assets) which assesses how effectively assets generate profit, ROI specifically evaluates the financial return relative to the capital invested in a project or asset. To maximize Your profitability, understanding ROI helps in making informed decisions about where to allocate resources for the best financial gains.

Defining ROA (Return on Assets)

Return on Assets (ROA) measures a company's profitability relative to its total assets, indicating how efficiently management uses assets to generate earnings. Calculated by dividing net income by average total assets, ROA provides insights into asset utilization efficiency compared to ROI (Return on Investment), which focuses on specific investment returns. Understanding ROA helps investors assess operational performance and asset productivity across industries.

Key Differences Between ROI and ROA

ROI (Return on Investment) measures the profitability of an investment relative to its cost, while ROA (Return on Assets) evaluates how efficiently a company uses its assets to generate profit. The key difference lies in ROI focusing on the return from a specific investment, whereas ROA assesses overall asset performance, expressing net income as a percentage of total assets. ROI is often used to guide individual investment decisions, whereas ROA provides insights into management effectiveness and operational efficiency.

Calculation Methods for ROI and ROA

ROI (Return on Investment) measures the efficiency of an investment by dividing net profit by the initial investment cost, expressed as a percentage. ROA (Return on Assets) evaluates a company's profitability relative to its total assets, calculated by dividing net income by average total assets. Your understanding of these calculation methods helps assess financial performance from investment and asset utilization perspectives.

Advantages of Using ROI

ROI (Return on Investment) offers advantages by directly measuring the profitability of specific investments, enabling precise comparison across projects or assets. Unlike ROA (Return on Assets) which assesses overall asset efficiency, ROI focuses on the actual return relative to the invested capital, making it valuable for targeted decision-making. This metric simplifies evaluating investment performance, enhancing strategic allocation of resources to maximize financial gains.

Benefits of Using ROA

Return on Assets (ROA) measures how efficiently your company uses its assets to generate profits, offering a clear view of operational performance irrespective of financing structure. Unlike ROI, which considers total investment, ROA focuses solely on asset productivity, helping you identify how well your resources are managed. Employing ROA as a key metric enhances decision-making by highlighting true asset efficiency, ultimately driving more informed strategies for sustainable growth.

Limitations of ROI and ROA

ROI and ROA are crucial metrics for evaluating investment performance but have distinct limitations that affect their accuracy in assessing profitability. ROI focuses on the return relative to the invested capital without considering asset utilization efficiency or the time value of money, which can lead to an incomplete picture of your investment's true profitability. ROA measures how effectively assets generate earnings but may overlook financial leverage and operating risks, making it less comprehensive for comparing companies with different capital structures.

Choosing the Right Metric for Your Business

Choosing the right financial performance metric depends on your business goals and asset structure; ROI (Return on Investment) measures the efficiency of specific investments, while ROA (Return on Assets) evaluates how effectively overall assets generate profit. Return, a broader term, can refer to various profit metrics including ROI, ROA, and return on equity, each offering unique insights. Aligning the metric with your strategic objectives ensures accurate assessment and better decision-making for growth and profitability.

Conclusion: ROI vs ROA – Which Is Better?

ROI (Return on Investment) measures the efficiency of an investment by comparing net profit to the initial cost, making it ideal for evaluating specific projects or marketing campaigns. ROA (Return on Assets) assesses how effectively a company utilizes its total assets to generate profit, reflecting overall operational efficiency. ROI is better for targeted investment decisions, while ROA provides a broader perspective on asset management and corporate performance.

Infographic: ROI vs ROA

relatioo.com

relatioo.com