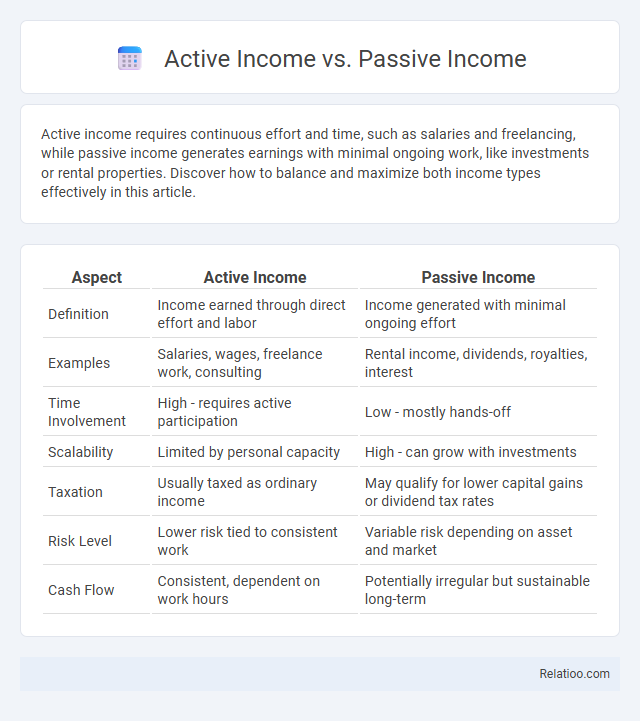

Active income requires continuous effort and time, such as salaries and freelancing, while passive income generates earnings with minimal ongoing work, like investments or rental properties. Discover how to balance and maximize both income types effectively in this article.

Table of Comparison

| Aspect | Active Income | Passive Income |

|---|---|---|

| Definition | Income earned through direct effort and labor | Income generated with minimal ongoing effort |

| Examples | Salaries, wages, freelance work, consulting | Rental income, dividends, royalties, interest |

| Time Involvement | High - requires active participation | Low - mostly hands-off |

| Scalability | Limited by personal capacity | High - can grow with investments |

| Taxation | Usually taxed as ordinary income | May qualify for lower capital gains or dividend tax rates |

| Risk Level | Lower risk tied to consistent work | Variable risk depending on asset and market |

| Cash Flow | Consistent, dependent on work hours | Potentially irregular but sustainable long-term |

Introduction to Income Types

Active income derives from direct labor or services performed, such as salaries, wages, and freelance work, requiring continuous effort and time investment. Passive income, generated through investments like rental properties, dividends, or royalties, provides earnings with minimal ongoing involvement. Effective money management is crucial to balance and grow both income types, ensuring financial stability and long-term wealth accumulation.

Defining Active Income

Active income refers to earnings generated through direct effort and time investment, such as salaries, wages, or freelance work. It requires continuous participation to maintain cash flow, unlike passive income, which comes from investments or assets that earn money with minimal ongoing involvement. Understanding the distinction helps you optimize your money management strategy by balancing immediate earnings with long-term financial growth.

Defining Passive Income

Passive income refers to earnings generated with minimal ongoing effort, often derived from investments, rental properties, or royalties. Unlike active income, which requires continuous work, passive income allows your money to grow independently over time. Effective money management involves balancing both income types to maximize financial stability and wealth-building potential.

Key Differences Between Active and Passive Income

Active income requires direct effort and time investment, such as salaries, freelance work, or business operations, generating earnings through continuous engagement. Passive income involves earnings from assets or investments like rental properties, dividends, or royalties, requiring minimal daily involvement once established. Effective money management balances these income types by maximizing cash flow, minimizing risks, and optimizing investment strategies to build long-term financial stability.

Pros and Cons of Active Income

Active income offers consistent earnings through direct work, providing financial stability and immediate cash flow, but it demands continuous time and effort, limiting your flexibility. Unlike passive income, active income ceases when work stops, making it less scalable and vulnerable to burnout. Effective money management is essential to maximize active income's benefits and create opportunities for future passive income streams.

Pros and Cons of Passive Income

Passive income provides financial stability by generating revenue with minimal ongoing effort, allowing for time freedom and potential scalability. However, it often requires significant upfront investment and involves risks such as market volatility, management challenges, and potential income inconsistency. Effective money management is essential to balance passive income streams alongside active income, optimizing overall financial growth and risk mitigation.

Common Sources of Active Income

Common sources of active income include salaries, hourly wages, freelance work, and commissions, all of which require continuous effort and time investment. This type of income typically depends on performing specific tasks or services regularly to earn money. Effective money management involves budgeting active income to cover expenses, savings, and investments, ensuring financial stability and growth.

Popular Passive Income Streams

Popular passive income streams include rental properties, dividend investing, and creating digital products like eBooks or online courses. You can build wealth over time by leveraging these methods, as they require initial effort but generate ongoing revenue with minimal active involvement. Effective money management ensures that passive income is reinvested wisely to maximize long-term financial growth and stability.

Choosing the Right Income Strategy

Choosing the right income strategy involves evaluating active income sources such as salaries and freelance work against passive income streams like investments and rental properties. Effective money management plays a crucial role in balancing these income types by optimizing cash flow, minimizing taxes, and ensuring financial stability. Prioritizing a blend of active and passive income aligned with personal financial goals enhances long-term wealth growth and security.

Conclusion: Balancing Active and Passive Income

Balancing active and passive income streams enhances financial stability by diversifying cash flow sources and reducing reliance on a single revenue channel. Effective money management, including budgeting and strategic investment, maximizes the benefits of both income types while mitigating risks. Prioritizing a hybrid approach promotes sustainable wealth growth and long-term financial independence.

Infographic: Active Income vs Passive Income

relatioo.com

relatioo.com