Personal financial goals prioritize individual wealth growth and security, while corporate financial goals focus on maximizing shareholder value and business sustainability. Explore this article to understand how aligning these goals can enhance overall financial success.

Table of Comparison

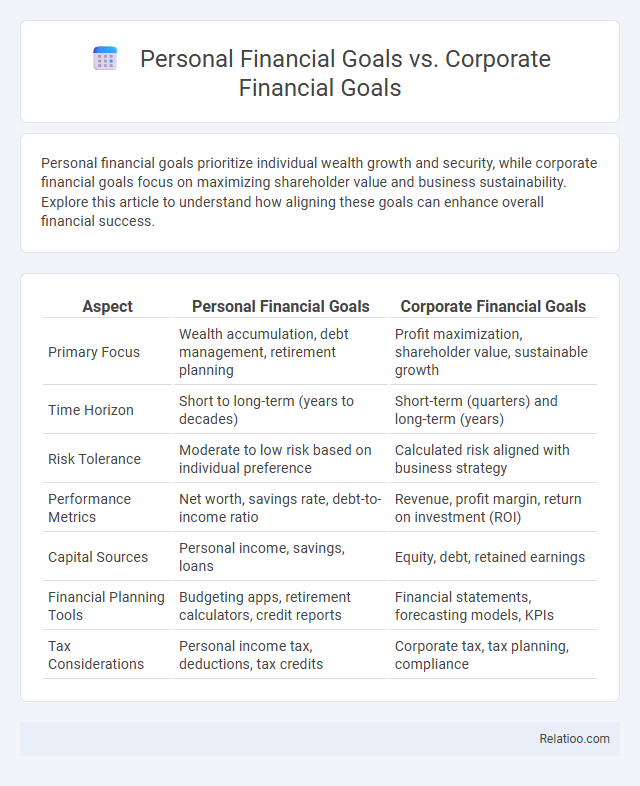

| Aspect | Personal Financial Goals | Corporate Financial Goals |

|---|---|---|

| Primary Focus | Wealth accumulation, debt management, retirement planning | Profit maximization, shareholder value, sustainable growth |

| Time Horizon | Short to long-term (years to decades) | Short-term (quarters) and long-term (years) |

| Risk Tolerance | Moderate to low risk based on individual preference | Calculated risk aligned with business strategy |

| Performance Metrics | Net worth, savings rate, debt-to-income ratio | Revenue, profit margin, return on investment (ROI) |

| Capital Sources | Personal income, savings, loans | Equity, debt, retained earnings |

| Financial Planning Tools | Budgeting apps, retirement calculators, credit reports | Financial statements, forecasting models, KPIs |

| Tax Considerations | Personal income tax, deductions, tax credits | Corporate tax, tax planning, compliance |

Defining Personal Financial Goals

Personal financial goals are specific targets related to individual wealth accumulation, budgeting, saving, investing, and managing debt to achieve financial security and independence. Unlike corporate financial goals focused on maximizing shareholder value, profitability, and business growth, personal financial goals emphasize lifetime financial planning, retirement readiness, and emergency fund establishment. Understanding the distinction helps individuals tailor strategies for personal budgeting, asset allocation, and risk management aligned with their unique financial aspirations.

Understanding Corporate Financial Goals

Corporate financial goals prioritize maximizing shareholder value, optimizing capital structure, and ensuring sustainable profit growth to support long-term business viability. Understanding these objectives helps you align investment decisions with strategic priorities such as cash flow management, cost reduction, and revenue enhancement. Unlike personal financial goals, which emphasize individual wealth accumulation and financial security, corporate goals require balancing stakeholder interests and regulatory compliance for overall organizational success.

Key Differences Between Personal and Corporate Financial Goals

Personal financial goals prioritize individual wealth management, budgeting, and long-term security tailored to your lifestyle and needs. Corporate financial goals focus on maximizing shareholder value, revenue growth, and market expansion to ensure business sustainability and profitability. Key differences include the scale of impact, decision-making criteria, and metrics used to measure success, with personal finance centered on individual benefits and corporate finance oriented towards organizational performance.

Time Horizons: Short-Term vs. Long-Term Objectives

Personal financial goals typically focus on short-term objectives such as saving for emergencies or paying off debt, while corporate financial goals often emphasize long-term growth, including capital investment and market expansion. Financial goals in any context require clear time horizons to allocate resources effectively, balancing immediate needs with future wealth accumulation or business sustainability. Understanding the distinct time frames helps in tailoring strategies that align personal savings plans with corporate financial planning and broader economic goals.

Risk Tolerance and Decision-Making

Personal financial goals prioritize your individual risk tolerance, often emphasizing stability and long-term growth tailored to your unique circumstances. Corporate financial goals focus on maximizing shareholder value by balancing risk and return through strategic decision-making and market competitiveness. Understanding the differences in risk tolerance and decision-making frameworks is crucial for aligning your financial goals with appropriate investment and management strategies.

Measurement of Success: Metrics and Benchmarks

Personal financial goals are measured using metrics such as savings rate, debt reduction, net worth growth, and investment returns, with benchmarks often based on age-specific financial milestones and inflation-adjusted targets. Corporate financial goals rely on metrics like revenue growth, profit margins, return on investment (ROI), earnings per share (EPS), and cash flow, with benchmarks compared to industry standards and competitor performance. Financial goals broadly require clear, quantifiable metrics and time-bound benchmarks to effectively track progress and ensure success across individual and organizational levels.

Strategic Planning Approaches

Personal financial goals prioritize individual wealth accumulation, debt reduction, and retirement planning, requiring tailored budgeting and investment strategies. Corporate financial goals emphasize maximizing shareholder value, revenue growth, and cost efficiency, relying heavily on market analysis, capital structuring, and risk management in strategic planning. Your success in aligning personal or corporate financial goals depends on adopting disciplined approaches that balance immediate needs with long-term financial sustainability.

Influencing Factors in Setting Financial Goals

Personal financial goals are influenced by individual income, family needs, risk tolerance, and life stage, while corporate financial goals depend on market conditions, shareholder expectations, regulatory environment, and competitive landscape. Both types of goals are shaped by economic factors such as inflation rates, interest rates, and fiscal policies. Understanding these influencing factors ensures realistic and achievable financial goal setting tailored to either personal aspirations or organizational strategies.

Alignment and Conflicts Between Personal and Corporate Goals

Personal financial goals prioritize wealth accumulation, liquidity, and risk tolerance tailored to individual needs, while corporate financial goals focus on maximizing shareholder value, revenue growth, and sustainable competitive advantage. Alignment occurs when personal ambitions harmonize with corporate objectives, such as when employee stock ownership incentivizes both parties toward profitability. Conflicts arise when personal goals, like job security or work-life balance, clash with corporate demands for cost-cutting or aggressive expansion, necessitating clear communication and strategic compromise.

Best Practices for Achieving Financial Goals

Setting clear, measurable financial goals tailored to individual, corporate, or general contexts ensures focused progress and resource allocation. You should prioritize SMART (Specific, Measurable, Achievable, Relevant, Time-bound) criteria, regular monitoring, and flexibility to adjust plans based on changing circumstances. Using effective tools like budgeting software, performance metrics, and professional advice enhances goal achievement and financial stability.

Infographic: Personal Financial Goals vs Corporate Financial Goals

relatioo.com

relatioo.com