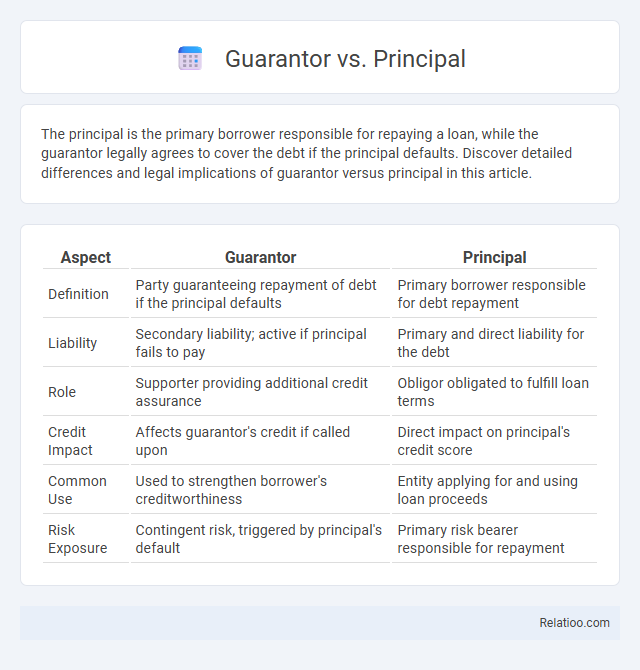

The principal is the primary borrower responsible for repaying a loan, while the guarantor legally agrees to cover the debt if the principal defaults. Discover detailed differences and legal implications of guarantor versus principal in this article.

Table of Comparison

| Aspect | Guarantor | Principal |

|---|---|---|

| Definition | Party guaranteeing repayment of debt if the principal defaults | Primary borrower responsible for debt repayment |

| Liability | Secondary liability; active if principal fails to pay | Primary and direct liability for the debt |

| Role | Supporter providing additional credit assurance | Obligor obligated to fulfill loan terms |

| Credit Impact | Affects guarantor's credit if called upon | Direct impact on principal's credit score |

| Common Use | Used to strengthen borrower's creditworthiness | Entity applying for and using loan proceeds |

| Risk Exposure | Contingent risk, triggered by principal's default | Primary risk bearer responsible for repayment |

Introduction to Guarantor and Principal

A guarantor is an individual or entity that agrees to be responsible for another party's debt or obligations if the principal fails to fulfill them. The principal is the primary borrower or party obligated to repay the loan or complete the contract. Understanding the distinct roles of guarantor and principal is essential for managing liability and ensuring loan security in financial agreements.

Definition of Guarantor

A guarantor is a person or entity that agrees to be responsible for another party's debt or obligations if that party defaults. The principal is the primary borrower or obligor who initially assumes responsibility for the debt or contract. Unlike the principal, the guarantor acts as a secondary party providing a financial safety net to the lender or creditor.

Definition of Principal

The principal is the primary party responsible for fulfilling the obligations of a contract or loan, directly liable for repayment or performance. A guarantor provides a secondary commitment to fulfill the principal's obligations if the principal defaults, serving as a backup source of repayment. You must understand that unlike a guarantor, the principal holds the main responsibility for the contractual duties.

Key Differences Between Guarantor and Principal

The principal is the primary party responsible for fulfilling a contract or debt obligation, while the guarantor provides a secondary assurance to cover the principal's liabilities if they default. Key differences include that the guarantor's liability is conditional upon the principal's failure to meet obligations, whereas the principal holds direct, primary responsibility. Legal contracts specify these distinct roles, impacting risk allocation and enforcement in financial and legal agreements.

Legal Obligations of a Guarantor

The legal obligations of a guarantor include the responsibility to fulfill the debt or obligation if the principal borrower defaults, often determined by the terms outlined in the guaranty agreement. Unlike the principal, who is primarily liable for the debt, the guarantor's liability is secondary and contingent upon the principal's failure to perform. Courts typically require clear evidence of the guarantor's consent to the obligations, and the guarantor may have limited defenses compared to the principal.

Legal Obligations of a Principal

The legal obligations of a principal in a loan or contract require full responsibility for repayment or performance under the terms agreed upon. Unlike a guarantor, who is only liable if the principal defaults, the principal must fulfill all contractual duties personally and without delay. This primary liability establishes the principal as the main party accountable for any breaches or debts arising from the agreement.

Roles and Responsibilities

The principal is the primary party responsible for fulfilling the terms of a contract or loan, including repayment and performance obligations. The guarantor acts as a secondary party who guarantees the principal's obligations, stepping in to fulfill them if the principal defaults. Unlike the principal, the guarantor's role is conditional and contingent on non-performance by the principal, providing an added layer of financial security to lenders or obligees.

Situations Requiring a Guarantor

Situations requiring a guarantor often involve a principal who may have insufficient credit history or financial stability to secure a loan or lease independently. A guarantor legally agrees to take responsibility for the principal's obligations if they default, providing lenders or landlords with added security. Understanding the distinct roles clarifies that while the principal is the primary debtor, your guarantor acts as a backup to ensure repayment or fulfillment of terms.

Benefits and Risks for Guarantors and Principals

Guarantors assume the risk of fulfilling the debt if the principal defaults, providing added security for lenders but exposing themselves to potential financial liability. Principals benefit from direct access to credit and control over their obligations but face the risk of damaging their credit if repayments are missed. You should carefully evaluate the financial responsibilities and potential consequences before agreeing to act as a guarantor or principal in any loan agreement.

Conclusion: Choosing Between Guarantor and Principal

Choosing between a guarantor and a principal depends on the risk tolerance and financial responsibility of the parties involved in a contract or loan agreement. The principal is primarily responsible for fulfilling the obligations, while the guarantor provides a secondary assurance of payment or performance if the principal defaults. Evaluating creditworthiness, legal implications, and the potential impact on personal finances is essential when deciding which role to assume or require.

Infographic: Guarantor vs Principal

relatioo.com

relatioo.com