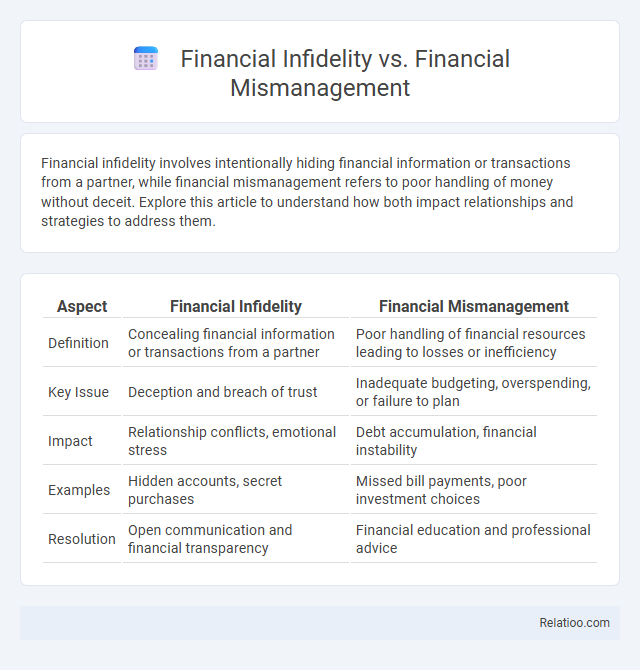

Financial infidelity involves intentionally hiding financial information or transactions from a partner, while financial mismanagement refers to poor handling of money without deceit. Explore this article to understand how both impact relationships and strategies to address them.

Table of Comparison

| Aspect | Financial Infidelity | Financial Mismanagement |

|---|---|---|

| Definition | Concealing financial information or transactions from a partner | Poor handling of financial resources leading to losses or inefficiency |

| Key Issue | Deception and breach of trust | Inadequate budgeting, overspending, or failure to plan |

| Impact | Relationship conflicts, emotional stress | Debt accumulation, financial instability |

| Examples | Hidden accounts, secret purchases | Missed bill payments, poor investment choices |

| Resolution | Open communication and financial transparency | Financial education and professional advice |

Understanding Financial Infidelity

Financial infidelity involves deceit or concealment of financial information between partners, such as hiding expenses, debts, or assets, which damages trust and emotional security. Unlike financial mismanagement, which refers to poor budgeting or spending habits, financial infidelity centers on intentional secrecy and betrayal. Understanding financial infidelity requires recognizing the impact of hidden financial behaviors on relationship dynamics and emphasizing transparency for rebuilding trust.

Defining Financial Mismanagement

Financial mismanagement refers to the inefficient or reckless handling of personal or business finances, including overspending, neglecting budgets, and failing to track expenses, which can lead to debt accumulation and financial instability. Unlike financial infidelity, where secrecy and deceit about money arise, financial mismanagement is primarily about poor decision-making or lack of financial literacy. Understanding these distinctions helps You identify underlying issues affecting your financial health and implement appropriate corrective measures.

Key Differences Between Financial Infidelity and Mismanagement

Financial infidelity involves deliberately hiding financial information or transactions from your partner, while financial mismanagement refers to poor handling of finances due to lack of knowledge or discipline without intentional deceit. Key differences include intent and transparency: financial infidelity is characterized by secretive actions that breach trust, whereas mismanagement results from neglect or mistakes without the goal to deceive. Understanding these distinctions helps you address the root causes of financial issues and rebuild trust effectively.

Common Signs of Financial Infidelity

Common signs of financial infidelity include hidden credit card statements, secret accounts, or undisclosed debts that partners conceal to avoid conflict. Financial mismanagement is identified by consistent overspending, failure to pay bills, or accumulating debt despite income levels. Unlike financial infidelity, which involves deliberate deception, financial mismanagement often stems from poor budgeting skills or lack of financial literacy.

Warning Signs of Financial Mismanagement

Warning signs of financial mismanagement include frequent late payments on bills, accumulating unmanageable debt, and lack of transparent communication about money matters. Unlike financial infidelity, which involves deception or secrecy about finances, mismanagement stems from poor budgeting, impulsive spending, or inadequate financial planning. Identifying these warning signs early can prevent escalation into financial infidelity or severe financial distress.

Emotional Impact on Relationships

Financial infidelity causes significant emotional distress, eroding trust and intimacy between partners due to hidden debts or secret spending. Financial mismanagement can lead to stress and frustration but often stems from poor budgeting or lack of financial knowledge rather than intentional deceit. Your relationship's emotional well-being suffers most from financial infidelity because the breach of honesty damages the foundation of mutual respect and security.

Causes and Motivations Behind Each Behavior

Financial infidelity stems from secrecy and mistrust, often motivated by fear of judgment, desire for control, or avoidance of conflict in relationships. Financial mismanagement arises from a lack of knowledge, poor budgeting skills, or impulsive spending habits that lead to chronic debt and instability. Financial dependency, driven by power dynamics or fear of independence, causes reliance on a partner's income or resources, creating imbalance and potential conflict.

Consequences for Couples and Families

Financial infidelity, involving secretive behaviors like hidden debts or undisclosed accounts, often leads to severe trust erosion and emotional distress in couples, escalating conflicts and potentially causing separation or divorce. In contrast, financial mismanagement, characterized by poor budgeting or excessive spending, primarily results in economic instability, increased stress, and reduced financial security for families without necessarily breaching trust. Both issues damage relationships, but financial infidelity uniquely compromises transparency and trust, critical foundations for healthy financial partnership and family cohesion.

Strategies for Prevention and Recovery

Effective strategies for preventing financial infidelity include fostering transparent communication about finances, establishing joint budgeting sessions, and agreeing on shared financial goals to build trust. In cases of financial mismanagement, implementing detailed budgeting tools, seeking financial counseling, and setting clear spending limits can facilitate recovery and restore fiscal stability. Recovery from financial infidelity requires a combination of honesty, structured financial planning, and possibly professional mediation to rebuild trust and ensure accountability.

When to Seek Professional Help

Recognizing the differences between financial infidelity, financial mismanagement, and financial abuse is crucial when deciding to seek professional help. You should consider consulting a financial advisor or counselor if secretive financial behavior undermines trust, poor money management leads to significant debt, or coercion creates harmful financial dependence. Early intervention by experts can prevent long-term damage to your financial health and relationships.

Infographic: Financial Infidelity vs Financial Mismanagement

relatioo.com

relatioo.com