Conventional loans typically require higher credit scores and larger down payments compared to FHA loans, which offer more flexible credit requirements and lower down payments. Discover which loan type best suits your financial situation and homeownership goals in this article.

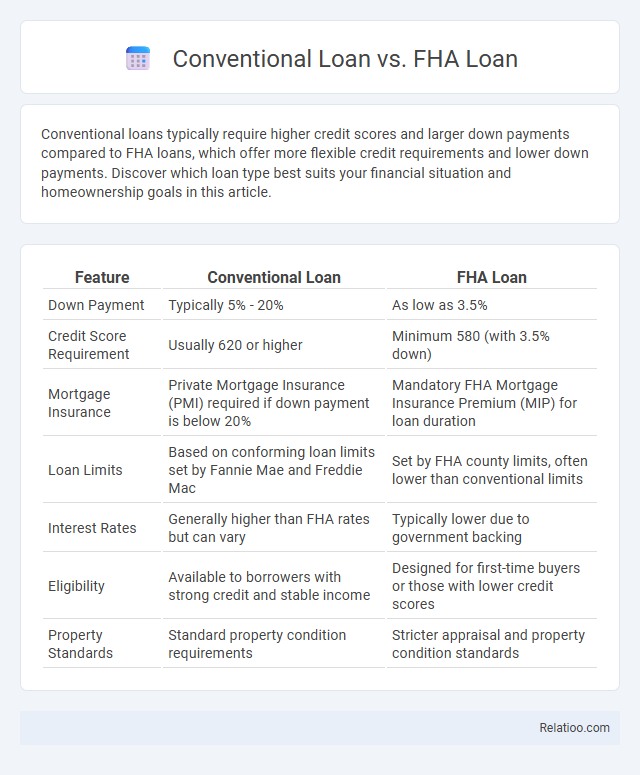

Table of Comparison

| Feature | Conventional Loan | FHA Loan |

|---|---|---|

| Down Payment | Typically 5% - 20% | As low as 3.5% |

| Credit Score Requirement | Usually 620 or higher | Minimum 580 (with 3.5% down) |

| Mortgage Insurance | Private Mortgage Insurance (PMI) required if down payment is below 20% | Mandatory FHA Mortgage Insurance Premium (MIP) for loan duration |

| Loan Limits | Based on conforming loan limits set by Fannie Mae and Freddie Mac | Set by FHA county limits, often lower than conventional limits |

| Interest Rates | Generally higher than FHA rates but can vary | Typically lower due to government backing |

| Eligibility | Available to borrowers with strong credit and stable income | Designed for first-time buyers or those with lower credit scores |

| Property Standards | Standard property condition requirements | Stricter appraisal and property condition standards |

Introduction to Conventional and FHA Loans

Conventional loans are mortgage options not insured by the federal government, typically requiring higher credit scores and larger down payments but offering more flexible terms. FHA loans are government-backed mortgages designed to help lower-income and first-time homebuyers qualify with lower credit score requirements and down payments as low as 3.5%. Your choice between these loan types can significantly affect your borrowing power, interest rates, and overall mortgage experience.

Key Differences Between Conventional and FHA Loans

Conventional loans typically require higher credit scores and larger down payments compared to FHA loans, which are government-backed and designed to support borrowers with lower credit and smaller down payments as low as 3.5%. FHA loans include mortgage insurance premiums (MIP) for the life of the loan or until refinancing, while conventional loans only require private mortgage insurance (PMI) until the equity reaches 20%. Conventional loans generally offer more flexibility in loan limits and property types, whereas FHA loans have strict limits and guidelines set by the Federal Housing Administration.

Eligibility Requirements for Each Loan Type

Conventional loans require a higher credit score, typically above 620, and a lower debt-to-income ratio, often below 43%, making them suitable for borrowers with strong financial profiles. FHA loans have more lenient eligibility requirements, accepting credit scores as low as 500 with a 10% down payment or 580 with 3.5% down, which benefits first-time buyers or those with limited credit history. Your eligibility for a mortgage depends on verifying income, employment history, and debt levels, with each loan type targeting different borrower qualifications to match varied financial situations.

Down Payment Comparison

Conventional loans typically require a down payment ranging from 5% to 20%, with higher credit scores often qualifying for lower percentages, while FHA loans mandate a minimum down payment of 3.5%, making them accessible to borrowers with lower credit scores or limited savings. Mortgage options like USDA and VA loans may offer zero down payment, but conventional and FHA remain the most common, with FHA loans providing more lenient qualification criteria at the expense of mortgage insurance. Understanding these differences helps borrowers select the right loan based on their financial situation and down payment capability.

Credit Score Considerations

Conventional loans typically require a higher credit score, often around 620 or above, to qualify for favorable interest rates, while FHA loans accept lower credit scores starting at 580, making them accessible for borrowers with limited credit history or past financial challenges. Mortgage lenders evaluate your credit score to assess risk, impacting your loan approval and interest rates, so maintaining or improving your score can significantly reduce borrowing costs. Understanding the differences in credit score requirements between conventional and FHA loans helps you choose the best mortgage option tailored to your financial profile.

Mortgage Insurance: What to Expect

Conventional loans typically require private mortgage insurance (PMI) when your down payment is less than 20%, which can be canceled once you reach 20% equity in your home. FHA loans mandate mortgage insurance premiums (MIP) for the life of the loan if your down payment is under 10%, making it more costly over time. Understanding your mortgage insurance options helps you better manage your monthly payments and long-term loan expenses.

Loan Limits and Property Types

Conventional loans typically have higher loan limits established by the Federal Housing Finance Agency (FHFA), varying by county, and are available for primary residences, second homes, and investment properties. FHA loans have fixed loan limits based on county median home prices, generally lower than conventional limits, and are designed primarily for primary residences with stricter property eligibility requirements, including single-family homes, FHA-approved condos, and manufactured homes. Mortgage options differ significantly in loan limits and eligible property types, impacting borrower choices depending on property location, intended use, and credit qualifications.

Pros and Cons of Conventional Loans

Conventional loans typically offer lower overall costs and fewer restrictions on property types compared to FHA loans, making them ideal for borrowers with strong credit and sizable down payments. However, they require higher credit scores and larger down payments, which can limit accessibility for first-time buyers or those with less robust financial profiles. FHA loans provide more flexible qualification criteria and lower down payment options but often come with mortgage insurance premiums that can increase long-term costs.

Pros and Cons of FHA Loans

FHA loans offer lower down payment requirements, typically as low as 3.5%, making homeownership more accessible for first-time buyers and those with limited credit history. However, FHA loans require mortgage insurance premiums (MIP) both upfront and annually, which can increase overall borrowing costs compared to conventional loans. While FHA loans are more lenient with credit scores and debt-to-income ratios, they also have loan limits that vary by region, potentially restricting the purchase price of a home.

Which Loan Is Best for You?

Choosing between a conventional loan, FHA loan, and mortgage depends on your credit score, down payment ability, and financial goals. Conventional loans often suit borrowers with strong credit and higher down payments, offering competitive interest rates and avoiding mortgage insurance if the down payment is at least 20%. FHA loans benefit those with lower credit scores or smaller down payments by providing government-backed flexibility, while mortgages broadly refer to all home loans, so evaluating your financial situation and lender terms is essential to determine the best option.

Infographic: Conventional Loan vs FHA Loan

relatioo.com

relatioo.com