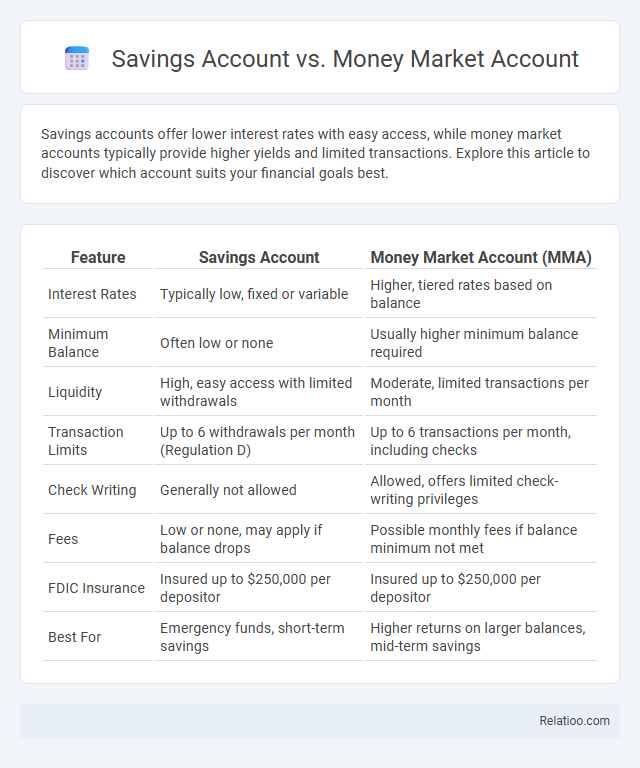

Savings accounts offer lower interest rates with easy access, while money market accounts typically provide higher yields and limited transactions. Explore this article to discover which account suits your financial goals best.

Table of Comparison

| Feature | Savings Account | Money Market Account (MMA) |

|---|---|---|

| Interest Rates | Typically low, fixed or variable | Higher, tiered rates based on balance |

| Minimum Balance | Often low or none | Usually higher minimum balance required |

| Liquidity | High, easy access with limited withdrawals | Moderate, limited transactions per month |

| Transaction Limits | Up to 6 withdrawals per month (Regulation D) | Up to 6 transactions per month, including checks |

| Check Writing | Generally not allowed | Allowed, offers limited check-writing privileges |

| Fees | Low or none, may apply if balance drops | Possible monthly fees if balance minimum not met |

| FDIC Insurance | Insured up to $250,000 per depositor | Insured up to $250,000 per depositor |

| Best For | Emergency funds, short-term savings | Higher returns on larger balances, mid-term savings |

Introduction: Comparing Savings and Money Market Accounts

Savings accounts offer a secure way to grow Your emergency funds with consistent interest rates and easy access. Money market accounts combine higher yields with limited check-writing privileges, providing flexible access to funds alongside competitive returns. Understanding the key differences between savings and money market accounts helps You choose the best option for maximizing growth and liquidity.

What Is a Savings Account?

A savings account is a secure banking product designed to help You accumulate funds while earning interest. Compared to a money market account, it typically offers lower interest rates but requires a lower minimum balance, making it accessible for everyday savers. Savings accounts provide easy access to Your money with limited monthly withdrawals, ideal for building an emergency fund or short-term savings.

What Is a Money Market Account?

A Money Market Account (MMA) is a type of savings account that typically offers higher interest rates and limited check-writing or debit card privileges compared to regular savings accounts. MMAs invest in low-risk, short-term securities, providing a balance between liquidity and returns. Unlike traditional savings accounts, money market accounts may require higher minimum balances and often offer tiered interest rates based on the account balance.

Interest Rates: Which Account Pays More?

Money Market Accounts typically offer higher interest rates than traditional Savings Accounts due to their investment in short-term, low-risk securities, making them a better choice if You seek higher returns with some liquidity. However, high-yield Savings Accounts often compete closely with Money Market rates, especially online banks that provide competitive APYs without minimum balance requirements. Evaluating specific interest rates and fees on these accounts will help You determine which option pays more based on current market conditions.

Accessibility and Withdrawal Limits

Savings accounts typically offer easy accessibility with unlimited withdrawals through ATMs, online transfers, and in-branch transactions, making them ideal for frequent use. Money market accounts often provide higher interest rates but impose stricter withdrawal limits, usually up to six transactions per month, including checks and electronic transfers. Savings accounts focus on secure, accessible funds with minimal restrictions, while money market accounts balance accessibility with enhanced earnings through controlled withdrawal capabilities.

Minimum Balance Requirements

Savings accounts typically require low minimum balances, often around $25 to $100, making them accessible for most users. Money market accounts generally have higher minimum balance requirements, ranging from $1,000 to $2,500, due to their investment features and higher interest rates. Your choice should consider these minimum balance thresholds to avoid fees and maximize account benefits.

Safety and FDIC Insurance Comparison

Savings accounts and money market accounts both offer FDIC insurance up to $250,000 per depositor, ensuring principal protection and reducing risk. Money market accounts often provide higher interest rates but may require higher minimum balances compared to traditional savings accounts, maintaining similar safety levels. Savings bonds differ as they are government-backed securities not insured by the FDIC but considered low-risk due to direct U.S. Treasury backing.

Fees and Account Maintenance Costs

Savings accounts typically charge lower fees and have minimal maintenance costs compared to money market accounts, which often require a higher minimum balance to avoid monthly fees. Your choice may affect monthly charges, as money market accounts sometimes impose transaction limits and higher fees if exceeded. Evaluating fee structures and maintenance requirements helps you optimize returns while minimizing unnecessary costs.

Best Use Cases for Each Account Type

Savings accounts offer easy access and FDIC insurance, ideal for emergency funds and short-term goals. Money market accounts combine higher interest rates with limited check-writing privileges, making them suitable for those who want liquidity with better returns. Your best choice depends on whether you prioritize accessibility, interest earnings, or a balance of both for your financial needs.

How to Choose Between Savings and Money Market Accounts

Choosing between a savings account and a money market account depends on your need for liquidity, interest rates, and minimum balance requirements. Money market accounts generally offer higher interest rates and check-writing privileges but require a higher minimum deposit compared to standard savings accounts. You should evaluate your financial goals, monthly transaction needs, and accessibility to determine which account aligns best with your savings strategy.

Infographic: Savings Account vs Money Market Account

relatioo.com

relatioo.com