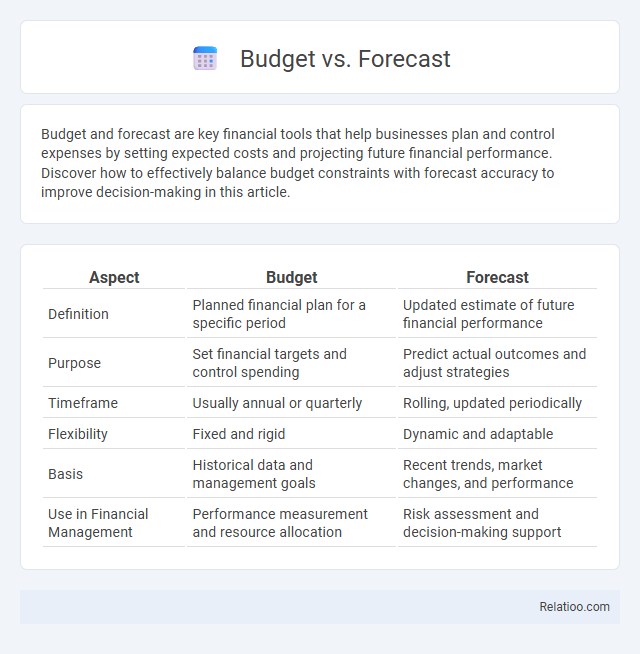

Budget and forecast are key financial tools that help businesses plan and control expenses by setting expected costs and projecting future financial performance. Discover how to effectively balance budget constraints with forecast accuracy to improve decision-making in this article.

Table of Comparison

| Aspect | Budget | Forecast |

|---|---|---|

| Definition | Planned financial plan for a specific period | Updated estimate of future financial performance |

| Purpose | Set financial targets and control spending | Predict actual outcomes and adjust strategies |

| Timeframe | Usually annual or quarterly | Rolling, updated periodically |

| Flexibility | Fixed and rigid | Dynamic and adaptable |

| Basis | Historical data and management goals | Recent trends, market changes, and performance |

| Use in Financial Management | Performance measurement and resource allocation | Risk assessment and decision-making support |

Introduction to Budgeting and Forecasting

Budgeting involves creating a detailed financial plan that allocates resources for specific periods, serving as a baseline for managing expenses and revenues. Forecasting uses historical data and market trends to predict future financial outcomes, helping businesses adjust their strategies proactively. Understanding the distinction between budgets and forecasts is crucial for effective financial planning and resource optimization within an organization.

Key Differences Between Budget and Forecast

A budget is a fixed financial plan outlining expected income and expenses for a specific period, serving as a control tool to manage resources. A forecast provides a dynamic estimate of future financial outcomes based on current data and trends, allowing adjustments as conditions change. The key difference lies in rigidity: budgets are static and set before the period starts, while forecasts are updated regularly to reflect actual performance and market shifts.

Objectives of Budgeting

Budgeting aims to allocate resources efficiently by establishing clear financial targets and controlling expenditures to meet organizational goals. It serves as a benchmark for evaluating actual performance against planned objectives, enabling timely adjustments to ensure financial stability. Your understanding of budgeting objectives helps optimize decision-making and aligns spending with strategic priorities.

Objectives of Forecasting

Forecasting aims to provide accurate predictions of future financial outcomes to guide strategic decision-making and resource allocation. Unlike budgets that set fixed targets, forecasts adjust dynamically based on current trends and market conditions, enhancing adaptability. By anticipating revenue fluctuations and cost variations, forecasting supports risk management and helps organizations maintain financial stability.

Benefits of Budgeting in Financial Planning

Budgeting enhances financial planning by providing a detailed framework for managing cash flow, controlling expenses, and setting realistic financial goals. It enables organizations to allocate resources efficiently, identify potential financial risks early, and make informed strategic decisions. Accurate budgeting supports improved forecasting accuracy and aligns operational activities with overall financial objectives.

Advantages of Forecasting for Business Strategy

Forecasting enhances business strategy by providing dynamic projections based on real-time data, allowing companies to anticipate market trends and adjust operations proactively. It improves resource allocation and risk management through continuous updates, enabling more accurate decision-making under uncertainty. Unlike static budgets, forecasts support flexibility and scenario analysis, helping businesses stay competitive in changing environments.

Challenges in Budgeting and Forecasting

Budgeting and forecasting face challenges such as inaccurate data, unpredictable market conditions, and limited flexibility for rapid changes in business environments. Your ability to compare the budget, forecast, and financial plan depends on the precision of assumptions and real-time updates. Overcoming these difficulties requires integrating advanced analytics tools and continuous monitoring to improve financial decision-making accuracy.

Best Practices for Integrating Budgets and Forecasts

Integrating budgets and forecasts requires aligning assumptions, timelines, and key performance indicators to ensure consistency and accuracy in financial planning. Utilize rolling forecasts to continuously update projections with real-time data, improving responsiveness to market changes and internal performance shifts. Establish clear communication channels between finance teams and operational departments to facilitate timely adjustments and promote collaborative decision-making.

Tools and Techniques for Effective Budgeting and Forecasting

Tools and techniques for effective budgeting and forecasting include advanced software like Excel, SAP, and Oracle Hyperion, which enable detailed financial modeling and real-time data analysis. Techniques such as zero-based budgeting, rolling forecasts, and variance analysis help organizations align their budget with strategic objectives and adapt to changing market conditions. Leveraging scenario planning and predictive analytics enhances accuracy by identifying potential risks and opportunities in both budget and forecast processes.

Conclusion: Choosing the Right Approach for Your Business

Selecting the right approach between budget, forecast, and financial plan depends on your business's goals, flexibility, and accuracy requirements. Budgets provide strict financial targets, forecasts offer dynamic predictions based on current data, and financial plans outline long-term strategies for sustainable growth. Evaluating your company's size, industry, and market conditions ensures you implement the most effective financial tool to drive success.

Infographic: Budget vs Forecast

relatioo.com

relatioo.com