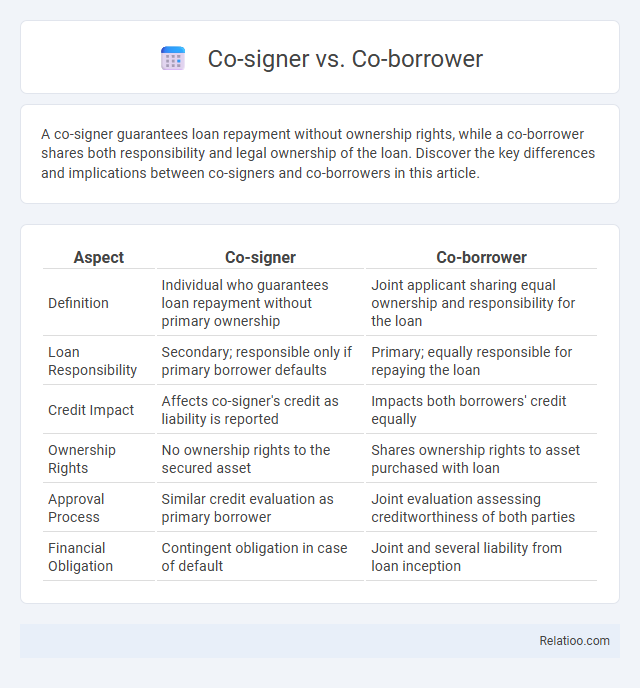

A co-signer guarantees loan repayment without ownership rights, while a co-borrower shares both responsibility and legal ownership of the loan. Discover the key differences and implications between co-signers and co-borrowers in this article.

Table of Comparison

| Aspect | Co-signer | Co-borrower |

|---|---|---|

| Definition | Individual who guarantees loan repayment without primary ownership | Joint applicant sharing equal ownership and responsibility for the loan |

| Loan Responsibility | Secondary; responsible only if primary borrower defaults | Primary; equally responsible for repaying the loan |

| Credit Impact | Affects co-signer's credit as liability is reported | Impacts both borrowers' credit equally |

| Ownership Rights | No ownership rights to the secured asset | Shares ownership rights to asset purchased with loan |

| Approval Process | Similar credit evaluation as primary borrower | Joint evaluation assessing creditworthiness of both parties |

| Financial Obligation | Contingent obligation in case of default | Joint and several liability from loan inception |

Understanding the Roles: Co-signer vs Co-borrower

A co-borrower shares equal responsibility for repaying a loan and has equal rights to the asset, while a co-signer guarantees the loan by promising to pay if the primary borrower defaults, without ownership rights. Co-borrowers typically have their income and credit assessed during loan approval, impacting their credit scores directly. Co-signers mainly serve as a safety net for lenders, boosting loan approval chances for borrowers with limited credit histories or lower income.

Key Differences Between Co-signers and Co-borrowers

Co-signers agree to take responsibility for a loan if the primary borrower defaults, without receiving ownership or direct benefits from the loan, while co-borrowers share equal responsibility and ownership of the loan and its assets. Your credit is impacted by the loan whether you're a co-signer or co-borrower, but co-borrowers have a direct stake in the loan's outcome and repayment process. Understanding these differences is crucial for choosing the right role based on your financial commitment and risk tolerance.

Responsibilities and Liabilities: What You Need to Know

Co-signers agree to pay the debt if the primary borrower defaults but do not have ownership rights in the loan or property, whereas co-borrowers share equal responsibility for the loan and equal ownership in the asset. Your liabilities as a co-signer include full repayment of the loan upon default, impacting your credit score without direct control over the asset, whereas co-borrowers have joint control and both credit and ownership entitlements. Understanding these distinctions is crucial for managing risks and legal obligations in any shared loan agreement.

Credit Impact: How Each Affects Your Credit Score

A co-signer shares equal responsibility for a loan and their credit is directly impacted by payment history, with missed payments negatively affecting their credit score just as they do the primary borrower's. A co-borrower also holds full responsibility and the loan appears on both parties' credit reports, affecting credit utilization and payment history for each. A guarantor, while only stepping in if the primary borrower defaults, may still see a credit impact if the loan enters default status, but typically their credit remains unaffected unless they must fulfill the obligation.

Qualification Criteria for Co-signers and Co-borrowers

Co-signers must typically have strong credit scores, stable income, and low debt-to-income ratios to qualify, as they guarantee loan repayment without receiving ownership rights. Co-borrowers share equal responsibility for the debt and generally need to meet the same credit and income requirements as primary borrowers to qualify, often combining financial profiles. The qualification criteria for co-signers emphasize creditworthiness and financial stability solely for risk mitigation, whereas co-borrowers undergo thorough evaluation since they have ownership stakes and repayment obligations.

When to Choose a Co-signer Over a Co-borrower

Choosing a co-signer over a co-borrower is ideal when Your credit profile or income is insufficient to qualify for a loan independently. A co-signer guarantees the loan without assuming ownership or responsibility for payments like a co-borrower does, minimizing their involvement in asset ownership. This option is best when You want to improve loan approval chances without sharing legal obligations or financial liability equally.

Legal Implications for Both Parties

Understanding the legal implications of co-signer versus co-borrower roles is crucial for your financial decisions. A co-signer guarantees loan repayment without direct ownership rights, making them liable if the primary borrower defaults but having no claim to the loan asset. Conversely, a co-borrower shares equal responsibility and ownership, bearing full liability for the loan and rights to the asset, which significantly impacts credit and legal obligations for both parties.

Risks Involved for Co-signers and Co-borrowers

Co-signers and co-borrowers both share responsibility for a loan, but co-borrowers typically have equal rights and obligations, while co-signers primarily act as backup guarantors. The risks for co-signers include being held liable for the entire debt if the primary borrower defaults, potentially damaging your credit score and limiting your future borrowing ability. Co-borrowers face direct credit impact from payment delinquencies and may lose ownership rights or assets tied to the loan if payments are missed.

Removing a Co-signer or Co-borrower: Is It Possible?

Removing a co-signer or co-borrower from a loan depends on the lender's policies and your creditworthiness. You may be able to remove them by refinancing the loan entirely in your name or by requesting a release agreement if your payment history and income meet the lender's criteria. Understanding the differences between co-signer and co-borrower roles is crucial because co-borrowers share equal responsibility, while co-signers guarantee the debt but do not have ownership rights.

Frequently Asked Questions about Co-signers and Co-borrowers

A co-signer guarantees loan repayment if the primary borrower defaults, while a co-borrower shares equal responsibility for the loan and its repayment. Frequently asked questions include differences in credit impact, legal obligations, and the risk involved for both parties. Understanding distinctions is crucial, as co-signers typically have less control but equal liability, whereas co-borrowers have ownership rights and credit stakes on the loan.

Infographic: Co-signer vs Co-borrower

relatioo.com

relatioo.com