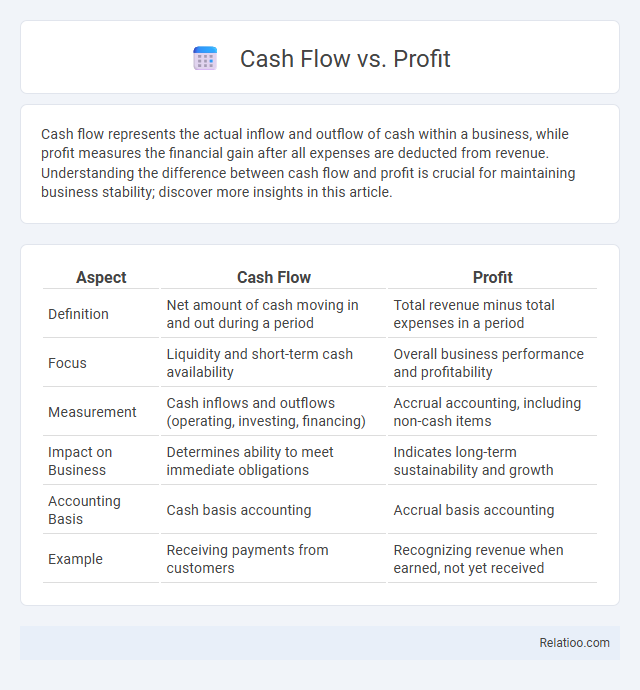

Cash flow represents the actual inflow and outflow of cash within a business, while profit measures the financial gain after all expenses are deducted from revenue. Understanding the difference between cash flow and profit is crucial for maintaining business stability; discover more insights in this article.

Table of Comparison

| Aspect | Cash Flow | Profit |

|---|---|---|

| Definition | Net amount of cash moving in and out during a period | Total revenue minus total expenses in a period |

| Focus | Liquidity and short-term cash availability | Overall business performance and profitability |

| Measurement | Cash inflows and outflows (operating, investing, financing) | Accrual accounting, including non-cash items |

| Impact on Business | Determines ability to meet immediate obligations | Indicates long-term sustainability and growth |

| Accounting Basis | Cash basis accounting | Accrual basis accounting |

| Example | Receiving payments from customers | Recognizing revenue when earned, not yet received |

Understanding Cash Flow: Definition and Importance

Cash flow represents the actual inflow and outflow of cash within a business, crucial for maintaining liquidity and operational stability. Unlike profit, which is an accounting measure reflecting earnings after expenses are deducted, cash flow tracks real-time cash transactions that affect a company's ability to meet immediate financial obligations. Understanding cash flow helps businesses manage working capital, avoid insolvency, and plan for sustainable growth.

What Is Profit? Types and Key Concepts

Profit represents the financial gain a business achieves when its total revenue exceeds total expenses, encompassing gross, operating, and net profit types. Gross profit calculates revenue minus cost of goods sold, operating profit accounts for operational expenses, and net profit reflects the bottom-line earnings after taxes and interest. Understanding profit is crucial for assessing business health, guiding strategic decisions, and attracting investors.

Cash Flow vs Profit: Core Differences Explained

Cash flow represents the actual inflow and outflow of cash in your business, highlighting liquidity and the ability to meet immediate expenses. Profit, on the other hand, is the net income after deducting expenses from revenue, reflecting overall financial performance but not necessarily cash availability. Understanding the distinction between cash flow and profit is crucial for managing your business's operational health and ensuring sustainability.

Why Positive Cash Flow Doesn’t Always Mean Profit

Positive cash flow indicates that more cash is entering your business than leaving, but it doesn't always translate to profit because cash flow includes inflows like loans and investments, which are not revenue. Profit, or net income, is calculated by subtracting expenses from total revenue, reflecting the actual financial gain after accounting for costs, regardless of cash movement. Understanding the distinction between cash flow and profit is crucial for accurate financial management and ensuring your business remains viable beyond just maintaining liquidity.

The Impact of Expenses on Profit vs Cash Flow

Expenses directly reduce profit by decreasing net income on the income statement, while their impact on cash flow depends on whether they involve actual cash outflows or non-cash charges like depreciation. Operating expenses paid in cash immediately lower cash flow, whereas non-cash expenses reduce profit without affecting cash flow. Understanding the difference between profit and cash flow is critical for managing business liquidity and ensuring sustainable financial health.

Cash Flow Management Strategies for Businesses

Effective cash flow management strategies for businesses include accurate forecasting to predict cash inflows and outflows, ensuring sufficient liquidity for operational needs while avoiding excessive idle cash. Implementing strict credit control measures helps speed up receivables collection, improving working capital and reducing cash flow gaps. Maintaining strong vendor relationships and negotiating favorable payment terms also enhances cash flow stability, allowing businesses to better manage profit margins and reinvestment opportunities.

How to Measure and Analyze Cash Flow and Profit

Measuring cash flow requires analyzing your cash inflows and outflows using the cash flow statement, which tracks operating, investing, and financing activities to ensure liquidity management. Profit measurement relies on the income statement, focusing on revenue, expenses, and net income to evaluate overall business profitability. Understanding both cash flow and profit enables you to assess financial health accurately, avoiding cash shortages despite reported profits.

Common Mistakes: Confusing Cash Flow with Profit

Confusing cash flow with profit is a common mistake that leads to mismanaging business finances. Profit represents the net earnings after expenses, while cash flow measures the actual inflow and outflow of cash within a period, impacting the company's liquidity. Businesses must monitor both metrics separately to ensure sustainable operations and avoid cash shortages despite showing profitability.

Effects of Cash Flow and Profit on Business Growth

Cash flow provides the liquidity necessary for daily operations, enabling businesses to invest in inventory, pay employees, and seize growth opportunities, while profit reflects overall financial health and long-term sustainability. Positive cash flow ensures smooth business functioning and prevents insolvency, even when profits are delayed or reinvested. Sustainable business growth depends on managing both cash flow to maintain operational stability and profit to fund expansion and attract investors.

Tips to Improve Both Cash Flow and Profit

Improving both cash flow and profit requires precise expense management and strategic revenue growth, such as negotiating better supplier terms and optimizing pricing strategies. Implementing rigorous invoicing processes and incentivizing timely customer payments enhance cash flow stability. Regularly analyzing business performance metrics helps identify inefficiencies and opportunities for profitability improvement while maintaining healthy liquidity.

Infographic: Cash Flow vs Profit

relatioo.com

relatioo.com