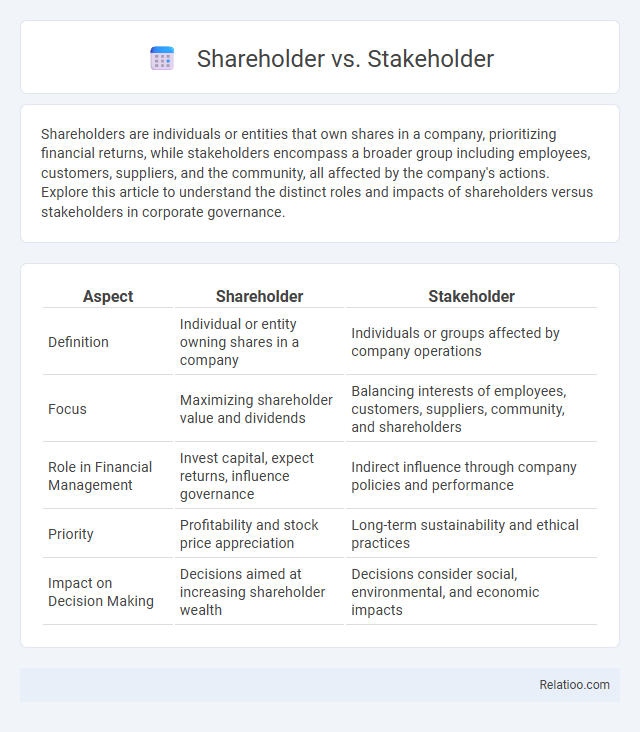

Shareholders are individuals or entities that own shares in a company, prioritizing financial returns, while stakeholders encompass a broader group including employees, customers, suppliers, and the community, all affected by the company's actions. Explore this article to understand the distinct roles and impacts of shareholders versus stakeholders in corporate governance.

Table of Comparison

| Aspect | Shareholder | Stakeholder |

|---|---|---|

| Definition | Individual or entity owning shares in a company | Individuals or groups affected by company operations |

| Focus | Maximizing shareholder value and dividends | Balancing interests of employees, customers, suppliers, community, and shareholders |

| Role in Financial Management | Invest capital, expect returns, influence governance | Indirect influence through company policies and performance |

| Priority | Profitability and stock price appreciation | Long-term sustainability and ethical practices |

| Impact on Decision Making | Decisions aimed at increasing shareholder wealth | Decisions consider social, environmental, and economic impacts |

Introduction to Shareholders and Stakeholders

Shareholders are individuals or entities that own shares in a company, holding equity and expecting financial returns. Stakeholders encompass a broader group, including employees, customers, suppliers, and the community, all impacted by the company's actions. Understanding Your role as either a shareholder or stakeholder clarifies expectations regarding profit, influence, and legal obligations within corporate governance.

Defining Shareholder Theory

Shareholder theory defines a company's primary responsibility as maximizing value for its shareholders, who are the owners of the business holding equity stakes. This theory contrasts with stakeholder theory, which considers the interests of all parties affected by corporate actions, including employees, customers, suppliers, and the community. Understanding your legal obligation involves recognizing that while shareholder interests drive corporate governance, compliance with laws and ethical standards ensures balanced accountability across all stakeholders.

Defining Stakeholder Theory

Stakeholder theory emphasizes that companies must consider the interests of all parties affected by their actions, including employees, customers, suppliers, communities, and shareholders. Unlike shareholder theory, which prioritizes maximizing shareholder value, stakeholder theory advocates balancing diverse stakeholder needs to achieve sustainable business success. Your strategic decisions should reflect legal obligations while addressing the broader responsibilities toward stakeholders to ensure ethical and long-term value creation.

Key Differences Between Shareholders and Stakeholders

Shareholders are individuals or entities that own shares in a company, giving them equity ownership and voting rights, while stakeholders encompass a broader group including employees, customers, suppliers, and the community, all impacted by the company's operations. The legal obligation of a company primarily focuses on maximizing shareholder value, adhering to corporate governance and fiduciary duties, whereas stakeholders' interests often extend beyond financial returns to social and environmental concerns. Understanding these distinctions helps clarify corporate accountability and decision-making priorities in business management.

Historical Development of Both Concepts

The concepts of shareholder and stakeholder emerged from different historical contexts within corporate governance. Shareholder primacy gained prominence in the 20th century, emphasizing maximizing shareholder value as the primary legal obligation of corporations, rooted in the rise of capitalism and modern financial markets. You must understand that the stakeholder theory developed later, recognizing the broader legal and ethical obligations companies have toward employees, customers, communities, and the environment, reflecting evolving societal expectations and regulatory changes.

Impact on Corporate Governance

Shareholders prioritize maximizing financial returns, directly influencing corporate governance through voting rights and board composition. Stakeholders, including employees, customers, and communities, push for governance that balances profit with social and environmental responsibilities, shaping policies and ethical standards. Your understanding of legal obligations ensures compliance with laws and regulations, reinforcing governance frameworks to protect all parties involved.

Advantages and Criticisms of Shareholder Focus

Focusing on shareholders prioritizes maximizing shareholder value, driving higher returns and attracting investment, which can accelerate company growth. Critics argue this approach overlooks broader social responsibilities, potentially harming stakeholders like employees, customers, and communities while fostering short-termism. Balancing your legal obligations with shareholder interests ensures compliance and sustainable business practices.

Benefits and Challenges of Stakeholder Approach

The stakeholder approach broadens organizational responsibility beyond shareholders to include employees, customers, suppliers, and the community, enhancing trust and fostering sustainable growth. Embracing diverse stakeholder interests benefits your company by improving reputation and encouraging long-term value creation but presents challenges in balancing conflicting priorities and ensuring transparent communication. Addressing these legal obligations and ethical considerations requires comprehensive governance frameworks to align stakeholder expectations with corporate objectives effectively.

Case Studies: Shareholder vs Stakeholder Decisions

Case studies highlight the tension between shareholder primacy and stakeholder inclusivity, demonstrating how companies balance profit motives against social responsibilities. Your understanding of legal obligations underscores that shareholders demand financial returns, while stakeholders encompass employees, communities, and customers whose interests may conflict. Resolving these disputes often involves navigating regulatory frameworks and ethical considerations, shaping corporate strategies that reflect both fiduciary duties and broader impact.

The Future of Corporate Responsibility

The future of corporate responsibility increasingly balances shareholder interests with broader stakeholder concerns, including employees, communities, and the environment. Companies face evolving legal obligations to integrate environmental, social, and governance (ESG) criteria into decision-making processes, reflecting regulatory trends and societal expectations. Emphasizing sustainable growth, transparency, and accountability ensures long-term value creation beyond traditional shareholder profit maximization.

Infographic: Shareholder vs Stakeholder

relatioo.com

relatioo.com