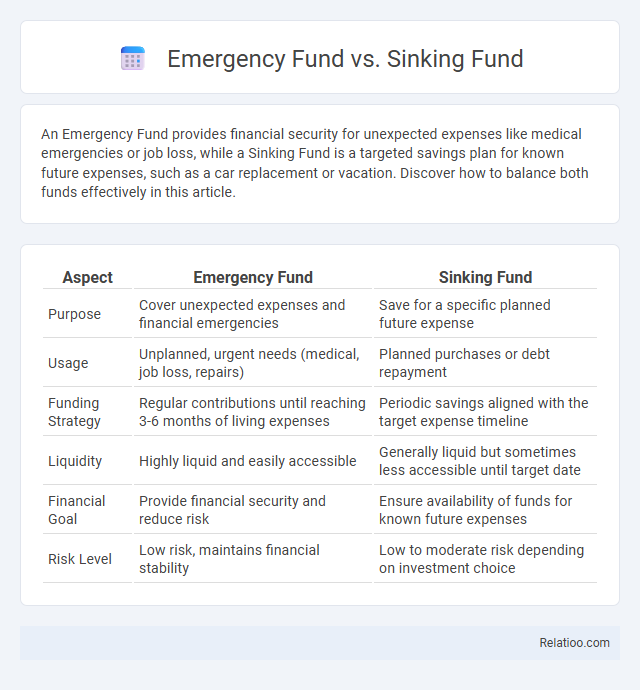

An Emergency Fund provides financial security for unexpected expenses like medical emergencies or job loss, while a Sinking Fund is a targeted savings plan for known future expenses, such as a car replacement or vacation. Discover how to balance both funds effectively in this article.

Table of Comparison

| Aspect | Emergency Fund | Sinking Fund |

|---|---|---|

| Purpose | Cover unexpected expenses and financial emergencies | Save for a specific planned future expense |

| Usage | Unplanned, urgent needs (medical, job loss, repairs) | Planned purchases or debt repayment |

| Funding Strategy | Regular contributions until reaching 3-6 months of living expenses | Periodic savings aligned with the target expense timeline |

| Liquidity | Highly liquid and easily accessible | Generally liquid but sometimes less accessible until target date |

| Financial Goal | Provide financial security and reduce risk | Ensure availability of funds for known future expenses |

| Risk Level | Low risk, maintains financial stability | Low to moderate risk depending on investment choice |

Understanding Emergency Funds: Definition and Purpose

An Emergency Fund is a financial safety net designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring your financial stability during crises. It differs from a Sinking Fund, which is a savings pool for planned future expenses like a vacation or home renovation, allowing you to allocate funds gradually over time. Understanding your Emergency Fund's purpose helps you prioritize liquidity and ease financial stress by having readily accessible cash for unforeseen events.

What Is a Sinking Fund? Key Features Explained

A sinking fund is a financial strategy where You regularly set aside money to repay a debt or replace a major asset, often used by corporations or individuals aiming for targeted savings. Key features include consistent contributions, a clear objective, and use for long-term liabilities or planned expenses, differentiating it from an emergency fund, which covers unexpected costs, and an operating fund, which manages daily financial operations. This disciplined approach helps maintain financial stability by avoiding sudden large payments.

Comparing Emergency and Sinking Funds: Main Differences

Emergency funds are financial reserves set aside for unexpected personal expenses like medical emergencies or job loss, while sinking funds are designated savings allocated systematically for planned future expenses, such as paying off debt or replacing a vehicle. Emergency funds prioritize liquidity and immediate access, typically held in easily accessible accounts, whereas sinking funds emphasize disciplined saving over time for known upcoming costs. The primary difference lies in their purpose: emergency funds cover unforeseen events, while sinking funds target anticipated financial obligations.

When to Use an Emergency Fund

An Emergency Fund is designed for unexpected personal financial crises such as job loss, medical emergencies, or urgent home repairs, providing quick access to cash without incurring debt. Unlike a Sinking Fund, which is allocated for planned expenses like car replacements or vacations, the Emergency Fund is strictly reserved for unforeseen events requiring immediate liquidity. Using the Emergency Fund only during genuine emergencies ensures financial stability and prevents depletion of savings meant for future planned expenses.

Situations Best Suited for a Sinking Fund

A sinking fund is best suited for planned future expenses such as debt repayment, equipment replacement, or major maintenance costs that require systematic savings over time. Unlike an emergency fund, which covers unexpected financial crises like job loss or medical emergencies, a sinking fund allocates money toward predictable, non-urgent liabilities. This targeted approach ensures financial preparedness for specific obligations without compromising liquidity for unforeseen emergencies.

How to Build an Effective Emergency Fund

Building an effective emergency fund requires setting aside three to six months' worth of essential living expenses in a highly accessible savings account to cover unexpected financial emergencies such as medical bills, job loss, or urgent home repairs. Unlike sinking funds, which are designated for planned future expenses like vacations or car replacements, emergency funds prioritize liquidity and immediate availability without penalties or delays. Regularly contributing a fixed percentage of income, automating savings transfers, and avoiding withdrawals except for true emergencies ensure the fund's growth and reliability.

Steps to Set Up Successful Sinking Funds

Setting up successful sinking funds involves identifying specific future expenses, calculating the total amount needed, and dividing it by the number of months until the expense occurs to determine your monthly contribution. You should open separate, easily accessible savings accounts or sub-accounts dedicated to each sinking fund for better tracking and discipline. Regularly reviewing and adjusting contributions ensures you stay on track to meet your financial goals without compromising your emergency fund's liquidity.

Common Mistakes to Avoid With Both Funds

Confusing the purposes of emergency funds and sinking funds often leads to inadequate financial preparedness; emergency funds are designed for unexpected expenses like medical emergencies, while sinking funds are allocated for planned, future costs such as car repairs or vacations. Common mistakes include withdrawing from sinking funds prematurely or underfunding emergency funds, which jeopardizes financial stability during crises. Ensuring clear distinctions and disciplined fund management optimizes liquidity and prevents the depletion of resources needed for specific obligations.

Which Fund Should You Prioritize First?

Prioritize building your Emergency Fund first to cover unexpected expenses like job loss or medical emergencies, typically saving three to six months of living costs. A Sinking Fund, designed for planned future expenses such as car repairs or vacations, comes second to prevent dipping into your emergency savings. Your reserves should focus on liquidity and immediate accessibility to safeguard financial stability before allocating funds to specific goals.

Integrating Both Funds in Your Financial Strategy

Integrating both an emergency fund and a sinking fund in your financial strategy ensures comprehensive financial resilience and targeted savings for future expenses. An emergency fund covers unexpected, urgent costs like medical emergencies or job loss, typically maintaining three to six months of living expenses, while a sinking fund allocates money for planned, non-recurring expenses such as home repairs or vacation costs. Balancing contributions to both funds enhances liquidity management and long-term financial stability, reducing reliance on credit and minimizing financial stress during unforeseen and anticipated events.

Infographic: Emergency Fund vs Sinking Fund

relatioo.com

relatioo.com