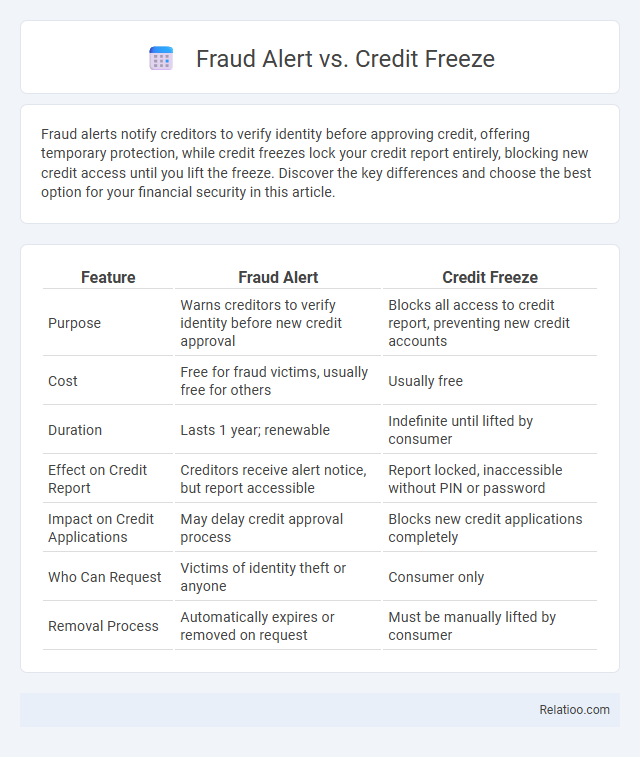

Fraud alerts notify creditors to verify identity before approving credit, offering temporary protection, while credit freezes lock your credit report entirely, blocking new credit access until you lift the freeze. Discover the key differences and choose the best option for your financial security in this article.

Table of Comparison

| Feature | Fraud Alert | Credit Freeze |

|---|---|---|

| Purpose | Warns creditors to verify identity before new credit approval | Blocks all access to credit report, preventing new credit accounts |

| Cost | Free for fraud victims, usually free for others | Usually free |

| Duration | Lasts 1 year; renewable | Indefinite until lifted by consumer |

| Effect on Credit Report | Creditors receive alert notice, but report accessible | Report locked, inaccessible without PIN or password |

| Impact on Credit Applications | May delay credit approval process | Blocks new credit applications completely |

| Who Can Request | Victims of identity theft or anyone | Consumer only |

| Removal Process | Automatically expires or removed on request | Must be manually lifted by consumer |

Understanding Fraud Alerts: Definition and Purpose

Fraud alerts are notifications placed on your credit report to warn potential lenders of possible identity theft, prompting them to take extra steps to verify your identity before granting credit. Unlike credit freezes, which restrict access to your credit report entirely, fraud alerts allow credit checks but add a layer of protection by alerting creditors to potential unauthorized activity. The primary purpose of a fraud alert is to help consumers prevent fraudulent accounts from being opened in their name while maintaining easier access to credit when needed.

What Is a Credit Freeze?

A credit freeze restricts access to your credit reports, making it difficult for identity thieves to open new accounts in your name by preventing lenders from viewing your credit data. Unlike a fraud alert, which only warns potential creditors to verify your identity, a credit freeze completely blocks access until you lift it. This proactive security measure gives you control over who views your credit information, significantly reducing the risk of identity theft.

Key Differences Between Fraud Alerts and Credit Freezes

Fraud alerts notify creditors to verify identity before approving new credit, offering temporary protection but allowing access to credit reports; they typically last one year. Credit freezes restrict all access to credit reports, preventing new credit accounts from being opened until the freeze is lifted, providing stronger security against identity theft. Identity theft involves unauthorized use of personal information, making understanding the distinct functions of fraud alerts and credit freezes critical for effective credit protection.

How Fraud Alerts Work: Step-by-Step Process

Fraud alerts activate a warning on your credit report, signaling lenders to verify your identity before granting new credit, effectively reducing the risk of unauthorized accounts. When you place a fraud alert, credit bureaus notify potential creditors to request extra identification, typically lasting 90 days or up to seven years for extended alerts due to identity theft. This proactive step helps protect your credit while allowing legitimate transactions to proceed with added security.

How a Credit Freeze Operates: Detailed Overview

A credit freeze restricts access to your credit report by preventing creditors and lenders from viewing it without your explicit authorization, effectively stopping new credit accounts from being opened in your name. This security measure requires you to provide a PIN or password to temporarily lift the freeze when you need to apply for credit, ensuring controlled access. Unlike a fraud alert, which only warns potential creditors to verify identity, a credit freeze provides a stronger barrier by blocking all unsolicited credit inquiries entirely.

Pros and Cons of Fraud Alerts

Fraud alerts notify creditors to verify your identity before opening new accounts, providing early warning and improved protection against unauthorized credit activity. You benefit from increased security without significant impact on your credit access, but fraud alerts last only 90 days (or one year for extended alerts) and do not block access to your credit reports, leaving some risk exposure. Unlike credit freezes that restrict all access, fraud alerts offer a balance between security and convenience, though they require active renewal and monitoring for ongoing protection.

Advantages and Disadvantages of Credit Freezes

Credit freezes offer strong protection by restricting access to your credit report, preventing unauthorized accounts and reducing identity theft risks. However, they may delay credit approvals for new applications and require lifting the freeze temporarily for creditors, which can be inconvenient. While fraud alerts notify creditors to verify identity before granting credit, they do not block access to your credit report like freezes do, making freezes more secure but less flexible.

When Should You Use a Fraud Alert?

A fraud alert should be used immediately when you suspect your personal information has been compromised or if you are at risk of identity theft. It notifies potential lenders to verify your identity before extending credit, providing a crucial layer of protection without locking down your credit completely as a credit freeze does. This option is ideal for those wanting to maintain credit accessibility while increasing security during a potential fraud situation.

When Is a Credit Freeze the Best Choice?

A credit freeze is the best choice when you want to prevent new credit accounts from being opened in your name without your permission, offering a stronger layer of protection compared to a fraud alert which only warns creditors to verify identity. Identity theft involves unauthorized use of your personal information, and a credit freeze halts all access to your credit report, making it nearly impossible for identity thieves to open new accounts. You should opt for a credit freeze if you're not planning to apply for new credit soon and want to fully safeguard your credit profile.

Fraud Alert vs Credit Freeze: Which Is Right for You?

A fraud alert flags your credit report to warn potential lenders of possible identity theft, allowing you to retain access to your credit while adding a layer of protection. A credit freeze, on the other hand, completely restricts access to your credit report, effectively preventing new credit accounts but requiring you to unfreeze it for legitimate credit checks. Understanding the differences between a fraud alert and a credit freeze helps you decide which option best protects your financial identity based on your risk level and credit needs.

Infographic: Fraud Alert vs Credit Freeze

relatioo.com

relatioo.com