Prepaid card limits are restricted to the amount loaded onto the card, whereas credit card limits are set by the issuer based on creditworthiness, allowing users to borrow funds up to a specified ceiling. Explore this article to understand how these limits impact your spending and financial management.

Table of Comparison

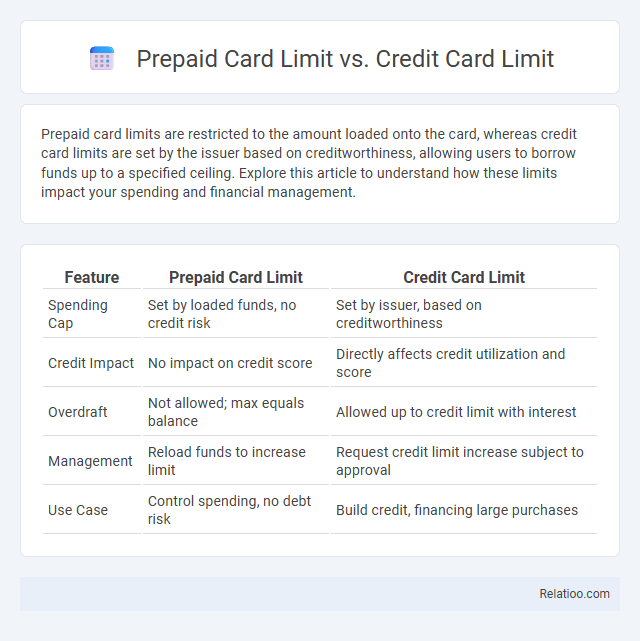

| Feature | Prepaid Card Limit | Credit Card Limit |

|---|---|---|

| Spending Cap | Set by loaded funds, no credit risk | Set by issuer, based on creditworthiness |

| Credit Impact | No impact on credit score | Directly affects credit utilization and score |

| Overdraft | Not allowed; max equals balance | Allowed up to credit limit with interest |

| Management | Reload funds to increase limit | Request credit limit increase subject to approval |

| Use Case | Control spending, no debt risk | Build credit, financing large purchases |

Understanding Prepaid Card Limits

Prepaid card limits are predefined by the card issuer and restrict the amount of money that can be loaded or spent, unlike credit card limits which represent the maximum borrowing capacity based on creditworthiness. Spending limits on prepaid cards help users manage budgets effectively by only allowing expenditures up to the loaded balance, preventing overspending and debt accumulation. Understanding prepaid card limits involves recognizing the fixed available funds, reload restrictions, and possible transaction caps set by the card provider.

What Is a Credit Card Limit?

A credit card limit is the maximum amount of credit your card issuer allows you to borrow on your credit card, based on factors like your credit score, income, and payment history. Unlike prepaid card limits, which cap your spending based on the amount loaded onto the card, credit card limits enable you to spend up to a set amount and repay later, often with interest if not paid in full. Understanding your credit card limit helps you manage your spending, avoid overcharges, and maintain a healthy credit utilization ratio.

Key Differences Between Prepaid and Credit Card Limits

Prepaid card limits are typically set by the amount loaded onto the card, restricting your spending to the prepaid balance without the possibility of overdraft or interest charges. Credit card limits represent the maximum credit line assigned by the issuer, allowing you to borrow up to that amount with the requirement to repay and potential interest on outstanding balances. Spending limits on both types of cards may include transaction or daily caps, but prepaid cards do not offer revolving credit, making their limits strictly controlled by your deposited funds.

Factors Influencing Prepaid Card Limits

Prepaid card limits are primarily influenced by regulatory requirements, issuer policies, and the cardholder's verification status, which can vary significantly between providers. Unlike credit cards, whose limits depend on creditworthiness and income, prepaid card limits are often fixed or tiered based on anti-money laundering regulations and the need to prevent fraud. Spending limits may also be affected by daily or transaction caps set by the card issuer, ensuring controlled use and reducing risk exposure.

How Credit Card Limits Are Determined

Credit card limits are determined primarily based on an individual's credit score, income, debt-to-income ratio, and credit history, allowing issuers to assess risk and set a maximum borrowing capacity accordingly. Prepaid card limits, in contrast, are usually fixed by the card issuer or user's deposit amount, reflecting the maximum spendable balance without credit extension. Spending limits on both card types are designed to control and manage expenses, but credit card limits represent a revolving credit ceiling, while prepaid and spending limits are often static values imposed to ensure responsible usage.

Pros and Cons of Prepaid Card Limits

Prepaid card limits provide users with controlled spending by capping the maximum balance and transaction amounts, reducing the risk of overspending and debt accumulation, making them ideal for budgeting and cautious financial management. However, prepaid cards often have lower limits compared to credit cards, restricting high-value purchases and offering limited benefits such as rewards or credit-building opportunities. Unlike credit card limits tied to creditworthiness and debt capacity, prepaid card limits require users to preload funds, which eliminates credit risk but also limits purchasing power and emergency fund access.

Advantages and Disadvantages of Credit Card Limits

Credit card limits offer the advantage of flexible borrowing up to a preset threshold, enabling consumers to manage cash flow and build credit history through responsible use. However, exceeding the limit can result in over-limit fees, higher interest rates, and potential credit score damage, making it essential to monitor spending carefully. Unlike prepaid cards with fixed balances and spending limits capped by loaded funds, credit card limits provide a revolving credit line but demand disciplined repayment to avoid debt accumulation.

Managing Spending With Prepaid vs Credit Card Limits

Prepaid card limits are capped by the amount loaded onto the card, providing direct control over spending and preventing overspending by restricting funds to the prepaid balance. Credit card limits represent the maximum credit extended by the issuer, which can lead to debt accumulation if not monitored carefully. Managing spending with prepaid cards offers a more disciplined approach by only allowing expenditures within the preloaded amount, while credit cards require vigilant tracking to avoid surpassing credit limits and incurring interest charges.

Increasing Your Card Limit: Prepaid vs Credit Options

Increasing your prepaid card limit typically involves reloading funds or upgrading to a higher-tier card with a preset maximum balance, whereas credit card limit increases depend on creditworthiness, payment history, and issuer evaluation. Prepaid cards offer controlled spending with fixed limits, ideal for budgeting, while credit cards allow flexible borrowing up to a revolving limit subject to periodic reassessment. Understanding these differences helps optimize spending capacity: prepaid cards require managing reload amounts, while credit cards offer potential limit raises through credit reviews and responsible usage.

Choosing the Right Card Limit for Your Financial Needs

Choosing the right card limit depends on your financial goals, spending habits, and credit management strategies. Prepaid card limits are typically predetermined based on the loaded amount, ensuring strict budget control without the risk of debt, while credit card limits vary according to creditworthiness and issuer policies, offering flexibility and revolving credit. Spending limits, whether enforced by prepaid or credit cards, influence your ability to manage expenses effectively and avoid overspending, making it crucial to select a limit that aligns with your income, financial discipline, and short-term or long-term monetary objectives.

Infographic: Prepaid Card Limit vs Credit Card Limit

relatioo.com

relatioo.com