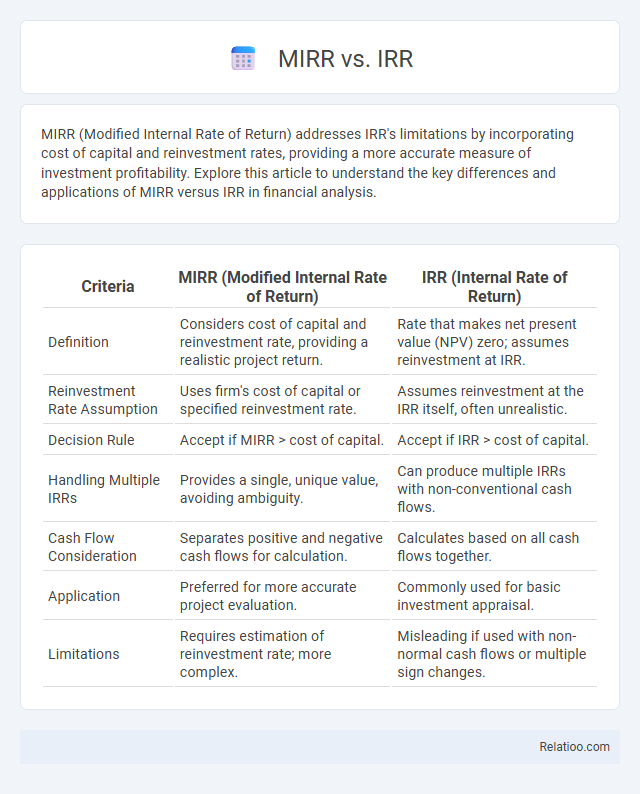

MIRR (Modified Internal Rate of Return) addresses IRR's limitations by incorporating cost of capital and reinvestment rates, providing a more accurate measure of investment profitability. Explore this article to understand the key differences and applications of MIRR versus IRR in financial analysis.

Table of Comparison

| Criteria | MIRR (Modified Internal Rate of Return) | IRR (Internal Rate of Return) |

|---|---|---|

| Definition | Considers cost of capital and reinvestment rate, providing a realistic project return. | Rate that makes net present value (NPV) zero; assumes reinvestment at IRR. |

| Reinvestment Rate Assumption | Uses firm's cost of capital or specified reinvestment rate. | Assumes reinvestment at the IRR itself, often unrealistic. |

| Decision Rule | Accept if MIRR > cost of capital. | Accept if IRR > cost of capital. |

| Handling Multiple IRRs | Provides a single, unique value, avoiding ambiguity. | Can produce multiple IRRs with non-conventional cash flows. |

| Cash Flow Consideration | Separates positive and negative cash flows for calculation. | Calculates based on all cash flows together. |

| Application | Preferred for more accurate project evaluation. | Commonly used for basic investment appraisal. |

| Limitations | Requires estimation of reinvestment rate; more complex. | Misleading if used with non-normal cash flows or multiple sign changes. |

Introduction to Investment Appraisal Methods

The Modified Internal Rate of Return (MIRR) addresses the reinvestment rate assumption flaws of the Internal Rate of Return (IRR) by incorporating a cost of capital, providing a more accurate measure of investment profitability. IRR calculates the discount rate that equates the net present value (NPV) of cash flows to zero, often leading to multiple or misleading rates for projects with non-conventional cash flows. Return, often expressed as return on investment (ROI), measures the overall gain or loss relative to the initial investment, but lacks the time value of money considerations inherent in MIRR and IRR.

Understanding Internal Rate of Return (IRR)

Internal Rate of Return (IRR) measures the discount rate that makes the net present value (NPV) of all cash flows from a project equal to zero, providing a clear metric for evaluating investment profitability. Modified Internal Rate of Return (MIRR) improves upon IRR by considering cost of capital and reinvestment rates, offering a more realistic assessment of potential returns. Understanding your IRR helps you compare projects effectively, but MIRR and overall return metrics provide a fuller picture of investment performance.

Defining Modified Internal Rate of Return (MIRR)

Modified Internal Rate of Return (MIRR) improves upon the Internal Rate of Return (IRR) by incorporating both the cost of investment and the reinvestment rate of cash flows, providing a more accurate reflection of a project's profitability and efficiency. Unlike IRR, which assumes reinvestment at the internal rate, MIRR assumes reinvestment at the firm's cost of capital or a specified reinvestment rate, addressing multiple IRR issues in non-conventional cash flow scenarios. Return metrics like MIRR and IRR quantify investment performance, but MIRR offers enhanced reliability by adjusting for realistic reinvestment and financing costs, aiding more informed capital budgeting decisions.

Key Differences Between IRR and MIRR

MIRR (Modified Internal Rate of Return) addresses the key limitation of IRR (Internal Rate of Return) by assuming reinvestment at the project's cost of capital rather than the IRR itself, providing a more realistic measure of profitability. Unlike IRR, which can result in multiple values for projects with unconventional cash flows, MIRR yields a single, unique rate that better reflects the project's true economic value. Return broadly measures the overall gain or loss on an investment, while IRR and MIRR specifically evaluate the efficiency and profitability over time considering the time value of money.

Calculation Methods: IRR vs MIRR

The IRR (Internal Rate of Return) calculates the discount rate at which the net present value of cash flows equals zero, assuming reinvestment of interim cash flows at the IRR itself. MIRR (Modified Internal Rate of Return) improves on IRR by assuming reinvestment at the firm's cost of capital or a specified reinvestment rate, providing a more realistic measure of project profitability. Understanding the differences in calculation methods helps you make more accurate investment evaluations by choosing MIRR for projects with varying reinvestment rates and IRR for simpler cash flow scenarios.

Advantages of Using MIRR Over IRR

MIRR offers a more accurate reflection of your investment's profitability by assuming reinvestment at the project's cost of capital, unlike IRR which unrealistically assumes reinvestment at the same internal rate. This makes MIRR a superior metric for comparing projects with different durations and cash flow patterns, providing a consistent basis for decision-making. Investors benefit from MIRR's ability to eliminate multiple IRR issues, offering a clearer picture of potential returns.

Limitations of IRR and MIRR

IRR often produces multiple values or misleading results when cash flows are non-conventional or irregular, which limits its reliability in complex investment scenarios. MIRR addresses some IRR limitations by assuming reinvestment at the firm's cost of capital, offering a more realistic return measure, but it still doesn't capture all risk factors or cash flow timing nuances. You should evaluate both metrics alongside Return on Investment (ROI) for a comprehensive assessment of project profitability and financial viability.

Practical Applications in Capital Budgeting

Modified Internal Rate of Return (MIRR) addresses IRR's multiple rate problem by assuming reinvestment at the firm's cost of capital, making it more reliable for comparing projects with differing cash flow patterns in capital budgeting. Internal Rate of Return (IRR) remains popular for its intuitive percentage return metric but can mislead when used alone due to multiple IRRs or non-conventional cash flows. Return metrics, including MIRR and IRR, are critical in capital budgeting to prioritize investment projects, optimize resource allocation, and maximize shareholder value by accurately reflecting project profitability and risk.

Real-World Examples: MIRR vs IRR in Decision Making

The Modified Internal Rate of Return (MIRR) provides a more accurate measure than Internal Rate of Return (IRR) by assuming reinvestment at the project's cost of capital, which better reflects real-world financing conditions. For example, a renewable energy project with multiple cash outflows showed an IRR of 18% but a MIRR of 14%, aligning more closely with its actual profitability and helping investors avoid overestimating returns. In capital budgeting decisions, MIRR is preferred for projects with non-normal cash flows, while IRR's potential for multiple rates can distort investment comparisons, making MIRR a superior tool for determining true economic return.

Conclusion: Choosing the Right Investment Metric

MIRR provides a more accurate measure of an investment's profitability by accounting for the cost of capital and reinvestment rates, unlike IRR which can overstate returns by assuming reinvestment at the same rate. While IRR remains popular for its simplicity, MIRR offers a clearer picture of potential actual gains, and return rates offer straightforward performance insights but lack timing considerations. Choosing the right investment metric depends on Your financial goals and the complexity of cash flows; MIRR is often preferred for more realistic and practical decision-making.

Infographic: MIRR vs IRR

relatioo.com

relatioo.com