Net worth measures the total value of an individual's assets minus liabilities, while wealth encompasses accumulated resources and long-term financial security. Explore how understanding the difference between net worth and wealth can enhance your financial planning in this article.

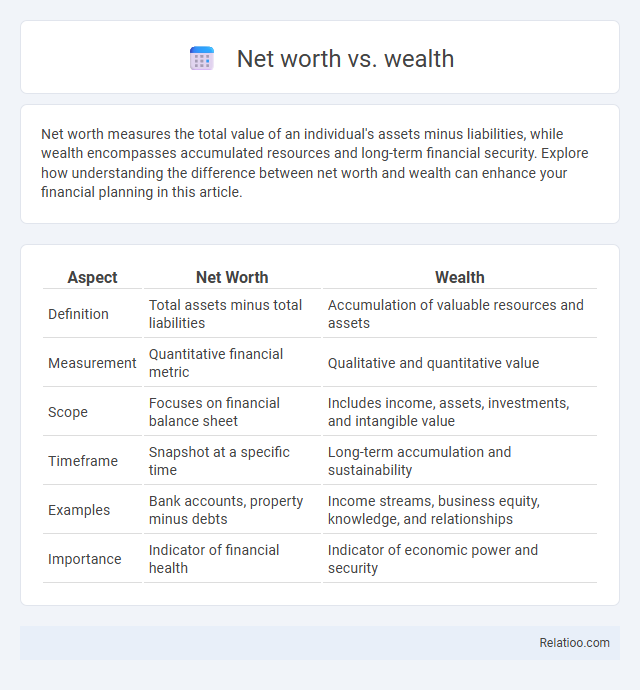

Table of Comparison

| Aspect | Net Worth | Wealth |

|---|---|---|

| Definition | Total assets minus total liabilities | Accumulation of valuable resources and assets |

| Measurement | Quantitative financial metric | Qualitative and quantitative value |

| Scope | Focuses on financial balance sheet | Includes income, assets, investments, and intangible value |

| Timeframe | Snapshot at a specific time | Long-term accumulation and sustainability |

| Examples | Bank accounts, property minus debts | Income streams, business equity, knowledge, and relationships |

| Importance | Indicator of financial health | Indicator of economic power and security |

Introduction to Net Worth and Wealth

Net worth is the total value of your assets minus your liabilities, representing a snapshot of your financial position at a specific time. Wealth encompasses the accumulation and growth of assets over time, including investments, properties, and savings that generate ongoing income. Understanding the distinction between net worth and wealth helps you track financial health while planning long-term prosperity.

Defining Net Worth: What It Means

Net worth represents the total value of your assets minus your liabilities, offering a snapshot of your financial health at a specific moment. Wealth encompasses a broader concept, including accumulated assets, income, and overall financial stability over time. Understanding net worth helps you gauge your current financial position and plan for future growth effectively.

Understanding Wealth: Beyond Numbers

Understanding wealth transcends the simple calculation of net worth, which is the numerical difference between assets and liabilities. Wealth encompasses broader dimensions such as financial security, lifestyle quality, and generational legacy, reflecting an individual's or household's overall economic resilience and capacity for growth. This holistic perspective highlights that true wealth involves long-term stability and well-being, not just the sum of monetary assets.

Key Differences Between Net Worth and Wealth

Net worth represents the numerical value of your assets minus liabilities, providing a snapshot of your financial standing at a specific time. Wealth encompasses a broader concept, including net worth along with income, earning potential, and resources that contribute to your long-term financial security. The key difference between net worth and wealth lies in scope: net worth is a precise financial metric, while wealth reflects overall economic power and lifestyle sustainability.

Calculating Your Net Worth: Step-by-Step Guide

Calculating your net worth involves subtracting total liabilities from total assets, where assets include cash, investments, real estate, and valuable possessions. Accurately tracking and updating these figures regularly provides a clear picture of your financial health and progress toward wealth accumulation. Understanding net worth is crucial for informed decision-making, setting financial goals, and comparing wealth over time.

Measuring True Wealth: Important Factors

Measuring true wealth involves analyzing net worth, which calculates the difference between your total assets and liabilities, providing a snapshot of your financial standing. Wealth encompasses broader dimensions, including income streams, investments, and intangible assets that contribute to long-term financial stability and growth. Understanding the nuances between net worth and overall wealth allows you to make informed decisions that enhance your financial health and future prosperity.

Net Worth Misconceptions

Net worth often gets confused with wealth, but net worth strictly measures total assets minus total liabilities, providing a snapshot of financial standing rather than overall life prosperity. Common misconceptions include equating a high net worth with guaranteed financial stability or wealth, ignoring factors like liquidity and income flow that affect true wealth. Understanding these distinctions helps individuals make better financial decisions and avoid overestimating their economic security based solely on net worth figures.

Building Wealth vs Increasing Net Worth

Building wealth focuses on creating sustainable financial resources through investments, assets, and income streams that grow over time, while increasing net worth measures the difference between Your total assets and liabilities at a specific point. Wealth encompasses overall financial health, including passive income and asset quality, whereas net worth is a snapshot of Your financial position. Prioritizing wealth building often leads to long-term financial security beyond merely increasing net worth numbers.

Why Both Metrics Matter for Financial Health

Net worth and wealth provide distinct yet complementary perspectives on financial health, with net worth representing the difference between assets and liabilities at a specific moment, while wealth encompasses the broader accumulation of valuable resources and income-generating assets. Tracking net worth offers a clear snapshot of current financial stability and debt management, whereas assessing wealth accounts for long-term financial resilience and the ability to generate ongoing income. Both metrics are crucial for comprehensive financial planning, enabling individuals to balance immediate financial obligations with strategies for sustainable wealth growth.

Practical Tips to Grow Your Net Worth and Wealth

Growing your net worth requires a strategic balance of increasing assets while minimizing liabilities, such as paying down high-interest debt and investing in diversified portfolios including stocks, real estate, and retirement accounts. Building wealth goes beyond accumulating assets by also enhancing income streams through side businesses, career advancement, and passive income sources like dividends and rental properties. Practical tips include creating a budget to control expenses, regularly reviewing your financial progress, and leveraging compound interest by starting investments early to maximize long-term financial growth.

Infographic: Net Worth vs Wealth

relatioo.com

relatioo.com