Capital expenditure involves long-term investments in assets, while revenue expenditure covers day-to-day operational costs. Learn more about how these expenditures impact financial strategy in this article.

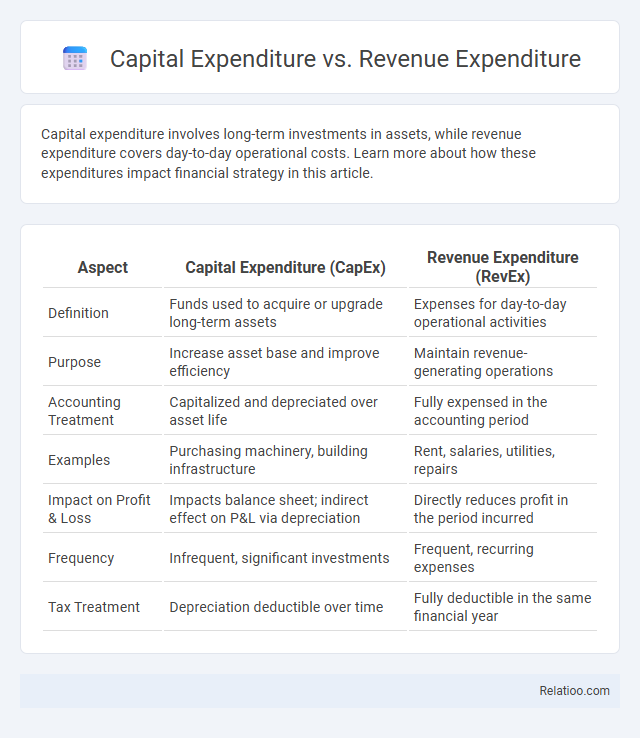

Table of Comparison

| Aspect | Capital Expenditure (CapEx) | Revenue Expenditure (RevEx) |

|---|---|---|

| Definition | Funds used to acquire or upgrade long-term assets | Expenses for day-to-day operational activities |

| Purpose | Increase asset base and improve efficiency | Maintain revenue-generating operations |

| Accounting Treatment | Capitalized and depreciated over asset life | Fully expensed in the accounting period |

| Examples | Purchasing machinery, building infrastructure | Rent, salaries, utilities, repairs |

| Impact on Profit & Loss | Impacts balance sheet; indirect effect on P&L via depreciation | Directly reduces profit in the period incurred |

| Frequency | Infrequent, significant investments | Frequent, recurring expenses |

| Tax Treatment | Depreciation deductible over time | Fully deductible in the same financial year |

Introduction to Capital and Revenue Expenditure

Capital expenditure refers to funds used by a business to acquire or upgrade physical assets such as buildings, machinery, or equipment, enhancing long-term value and operational capacity. Revenue expenditure involves costs incurred for day-to-day operational activities, like repairs, rent, and utilities, which do not improve the asset's lifespan but are necessary for maintaining business functions. Your understanding of capital and revenue expenditures is crucial for accurate financial reporting and effective budgeting.

Defining Capital Expenditure

Capital Expenditure (CapEx) refers to the funds used by a business to acquire, upgrade, or maintain physical assets such as property, industrial buildings, or equipment, aimed at generating long-term benefits. Unlike Revenue Expenditure, which covers daily operational costs necessary for running the business, Capital Expenditure is capitalized and depreciated over the asset's useful life. Understanding the distinction between CapEx and regular expenses is crucial for accurate financial planning and reporting, as it impacts cash flow and profitability analysis.

Defining Revenue Expenditure

Revenue expenditure refers to the costs incurred for the day-to-day functioning of a business, such as wages, rent, utilities, and repairs, which are fully deducted in the accounting period they occur. Unlike capital expenditure, which is invested in acquiring or upgrading long-term assets to generate future benefits, revenue expenditure maintains the current operations without creating lasting value. Proper classification of revenue expenditure ensures accurate financial reporting and aids in calculating operational profitability.

Key Differences Between Capital and Revenue Expenditure

Capital expenditure involves spending on acquiring or upgrading fixed assets like machinery or buildings, providing benefits over multiple years. Revenue expenditure covers day-to-day operational costs such as wages, repairs, and utilities, affecting the profit and loss statement within the same accounting period. Your financial management should distinguish between these to ensure accurate asset valuation and expense reporting, optimizing tax treatment and budgeting.

Examples of Capital Expenditure

Capital Expenditure (CapEx) involves purchasing or upgrading physical assets like machinery, buildings, and vehicles, which provide long-term value to your business. Examples of Capital Expenditure include investing in new manufacturing equipment, acquiring office space, or upgrading computer systems. These investments differ from Revenue Expenditure, which covers day-to-day operational costs such as rent, utilities, and maintenance expenses.

Examples of Revenue Expenditure

Revenue expenditure refers to costs incurred for the day-to-day functioning of a business and are fully expensed in the accounting period they occur. Examples of revenue expenditures include utility bills, salaries, rent, maintenance, and repair expenses that maintain assets without extending their useful life. Understanding the distinction helps you accurately classify transactions, ensuring precise financial reporting and budgeting.

Impact on Financial Statements

Capital expenditure increases your company's asset base by adding value to long-term assets, reflected on the balance sheet and depreciated over time, influencing both asset values and future profit margins. Revenue expenditure is recorded as an immediate expense on the income statement, reducing current profits without affecting the asset base, thus impacting operational results directly. Expenses encompass both these costs, with capital expenditures improving financial position and revenue expenditures lowering net income, each playing distinct roles in financial reporting and analysis.

Importance in Business Decision-Making

Capital expenditure (CapEx) involves investments in long-term assets that enhance a company's operational capacity, directly impacting strategic growth and financial planning. Revenue expenditure (RevEx) includes costs incurred for daily operations, essential for maintaining business efficiency and profitability in the short term. Clear differentiation between CapEx, RevEx, and general expenses supports accurate budgeting, tax planning, and performance evaluation, enabling informed business decision-making.

Tax Implications: Capital vs Revenue Expenditure

Capital expenditure (CapEx) involves investments in assets that provide benefits beyond the current tax year and is typically capitalized and depreciated over time, reducing taxable income gradually. Revenue expenditure (RevEx) refers to costs incurred for day-to-day operations and maintenance, which are fully deductible in the tax year they are incurred, directly lowering your taxable income. Understanding these distinctions is crucial for tax planning, as misclassifying expenses can lead to compliance issues and affect your overall tax liability.

Best Practices for Managing Business Expenditures

Effective management of business expenditures involves distinguishing Capital Expenditure (CapEx), which includes investments in long-term assets like machinery or property, from Revenue Expenditure, which covers short-term operational costs such as salaries and utilities. Best practices emphasize rigorous budgeting, accurate classification, and regular monitoring to optimize cash flow and ensure compliance with accounting standards. Implementing automated expense tracking systems and periodic financial audits further enhances transparency and decision-making in controlling both CapEx and Revenue Expenditure.

Infographic: Capital Expenditure vs Revenue Expenditure

relatioo.com

relatioo.com