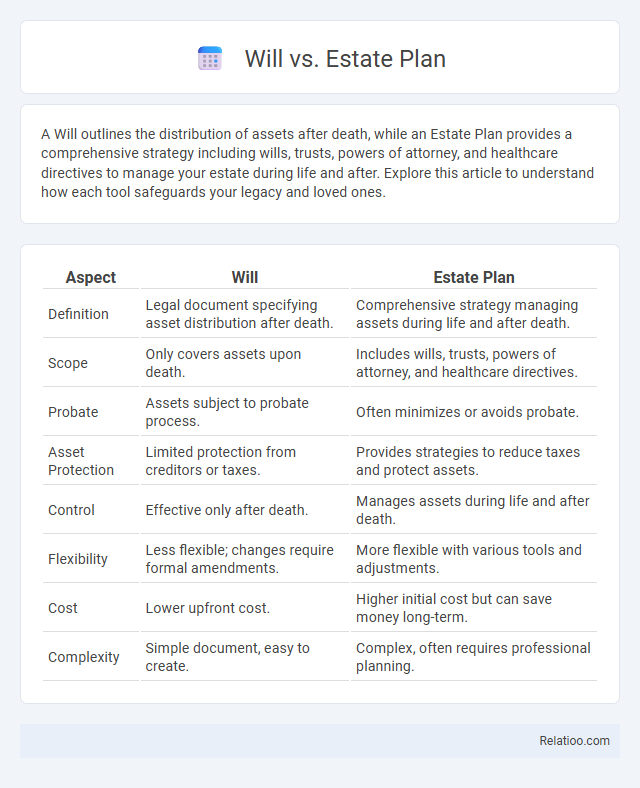

A Will outlines the distribution of assets after death, while an Estate Plan provides a comprehensive strategy including wills, trusts, powers of attorney, and healthcare directives to manage your estate during life and after. Explore this article to understand how each tool safeguards your legacy and loved ones.

Table of Comparison

| Aspect | Will | Estate Plan |

|---|---|---|

| Definition | Legal document specifying asset distribution after death. | Comprehensive strategy managing assets during life and after death. |

| Scope | Only covers assets upon death. | Includes wills, trusts, powers of attorney, and healthcare directives. |

| Probate | Assets subject to probate process. | Often minimizes or avoids probate. |

| Asset Protection | Limited protection from creditors or taxes. | Provides strategies to reduce taxes and protect assets. |

| Control | Effective only after death. | Manages assets during life and after death. |

| Flexibility | Less flexible; changes require formal amendments. | More flexible with various tools and adjustments. |

| Cost | Lower upfront cost. | Higher initial cost but can save money long-term. |

| Complexity | Simple document, easy to create. | Complex, often requires professional planning. |

Understanding the Basics: Will vs Estate Plan

A will is a legal document that specifies how a person's assets will be distributed after their death, while an estate plan encompasses a broader strategy including wills, trusts, powers of attorney, and healthcare directives. Estate planning ensures not only asset distribution but also addresses tax implications, guardianship for minors, and financial management during incapacity. Understanding the difference between a will and an estate plan is essential for comprehensive asset protection and ensuring your wishes are fulfilled effectively.

Key Components of a Will

A Will outlines your key intentions regarding asset distribution, guardianship of minors, and appointment of an executor to manage your estate after death. It specifies how you want your property, finances, and personal belongings allocated, ensuring that your wishes are legally recognized. Understanding the fundamental components of a Will is essential to create a clear estate plan that protects your loved ones and minimizes legal challenges.

Essential Elements of an Estate Plan

An estate plan integrates a will, trusts, powers of attorney, and healthcare directives to ensure comprehensive asset management and distribution. Essential elements include a valid will to outline asset allocation, durable power of attorney for financial decisions, healthcare proxy appointing medical decision-makers, and trusts to manage tax implications and protect beneficiaries. Coordination of these components minimizes probate delays, reduces tax burdens, and guarantees the grantor's wishes are honored effectively.

Major Differences Between a Will and an Estate Plan

A Will primarily outlines how your assets will be distributed after your death, while an Estate Plan encompasses a broader strategy including trusts, powers of attorney, and healthcare directives to manage your estate during and after your lifetime. Your Estate Plan addresses tax implications, asset protection, and guardianship for minors, offering comprehensive control beyond the Will's scope. Understanding these major differences ensures your wishes are honored and your assets are efficiently managed.

Advantages of Having a Will

A Will provides clear instructions for distributing Your assets, ensuring Your wishes are honored and reducing potential family disputes. It allows You to appoint guardians for minor children and specify beneficiaries, which an estate plan without a Will may overlook. Having a Will streamlines the probate process, potentially saving time and legal costs for Your heirs.

Benefits of a Comprehensive Estate Plan

A comprehensive estate plan offers significant benefits over a simple will by integrating various legal documents such as trusts, powers of attorney, and healthcare directives to ensure assets are managed and distributed according to precise wishes. This plan minimizes probate costs, reduces estate taxes, and provides clear instructions for guardianship and medical decisions, protecting beneficiaries and loved ones. By addressing both asset management during life and efficient transfer after death, a comprehensive estate plan enhances financial security and peace of mind for individuals and their families.

Common Misconceptions About Wills and Estate Plans

Many individuals incorrectly assume that a will alone is sufficient for comprehensive estate planning, overlooking the need for additional documents like trusts, powers of attorney, and healthcare directives. Wills become public record after probate, which can compromise privacy, whereas estate plans often include strategies to avoid probate and maintain confidentiality. Confusion also arises from the misconception that wills cover all assets, but certain assets transfer outside of a will through beneficiary designations or joint ownership, highlighting the importance of a coordinated estate plan.

When Should You Choose a Will or Estate Plan?

Choosing between a will and an estate plan depends on the complexity of Your assets and financial situation. A will is suitable for straightforward asset distribution and appointing guardians for minor children, while an estate plan offers a comprehensive approach, including trusts, power of attorney, and healthcare directives to manage Your wealth and healthcare decisions effectively. You should choose an estate plan if You have significant assets, want to minimize probate, or need to protect beneficiaries after Your passing.

How to Create a Will or Estate Plan

Creating a will involves clearly listing assets, naming beneficiaries, and appointing an executor to manage the distribution process after death. An estate plan expands beyond a will by incorporating trusts, power of attorney, healthcare directives, and tax planning strategies to ensure comprehensive management of assets during and after life. Consulting an estate planning attorney helps tailor the documents to individual needs, comply with state laws, and avoid probate complications.

Frequently Asked Questions: Will vs Estate Plan

A will outlines how your assets are distributed after death, whereas an estate plan encompasses a comprehensive strategy including wills, trusts, powers of attorney, and healthcare directives to manage your assets during and after life. Frequently asked questions about will vs estate plan often address differences in probate avoidance, control over asset distribution, and protection for beneficiaries. Estate plans provide more flexibility and control for complex situations compared to a standalone will.

Infographic: Will vs Estate Plan

relatioo.com

relatioo.com