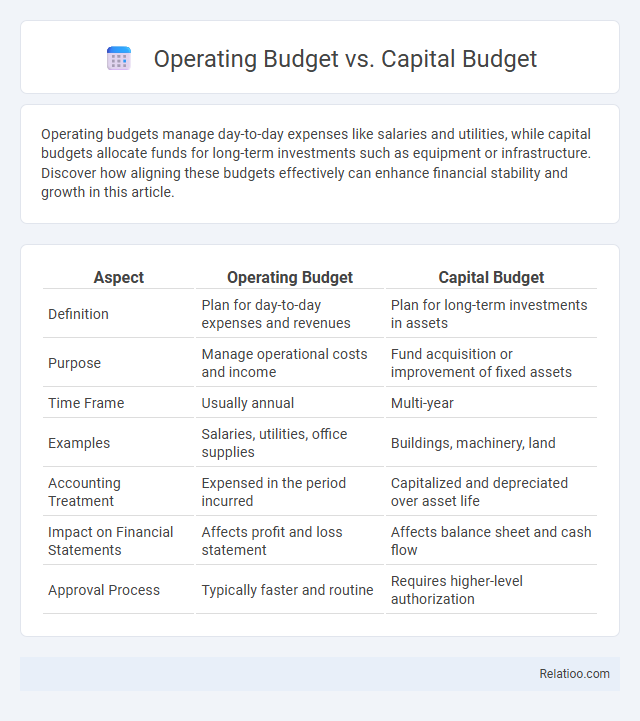

Operating budgets manage day-to-day expenses like salaries and utilities, while capital budgets allocate funds for long-term investments such as equipment or infrastructure. Discover how aligning these budgets effectively can enhance financial stability and growth in this article.

Table of Comparison

| Aspect | Operating Budget | Capital Budget |

|---|---|---|

| Definition | Plan for day-to-day expenses and revenues | Plan for long-term investments in assets |

| Purpose | Manage operational costs and income | Fund acquisition or improvement of fixed assets |

| Time Frame | Usually annual | Multi-year |

| Examples | Salaries, utilities, office supplies | Buildings, machinery, land |

| Accounting Treatment | Expensed in the period incurred | Capitalized and depreciated over asset life |

| Impact on Financial Statements | Affects profit and loss statement | Affects balance sheet and cash flow |

| Approval Process | Typically faster and routine | Requires higher-level authorization |

Introduction to Operating and Capital Budgets

Operating budgets detail the projected revenue and expenses related to daily business operations over a specific period, often a fiscal year, emphasizing recurring costs such as salaries, utilities, and supplies. Capital budgets focus on long-term investments in assets like property, equipment, and infrastructure, outlining the funding and expenditure plans for projects that extend beyond a single fiscal cycle. Understanding the distinction between operating and capital budgets is essential for effective financial planning, ensuring operational efficiency while strategically allocating resources for growth and development.

Definition of Operating Budget

An operating budget outlines a company's projected revenues and expenses for day-to-day business activities, encompassing costs such as salaries, utilities, and inventory replenishment. It serves as a financial blueprint to manage short-term operational efficiency within a fiscal period. Unlike a capital budget, which focuses on long-term asset investments and infrastructure projects, the operating budget emphasizes routine expenditures necessary to maintain standard business functions.

Definition of Capital Budget

The capital budget outlines expenditures for acquiring or upgrading physical assets such as buildings, machinery, and equipment, typically involving long-term investments exceeding one fiscal year. Unlike the operating budget, which covers daily operational expenses and revenues, the capital budget focuses on funding projects that enhance your organization's asset base and support future growth. A comprehensive financial plan integrates both budgets to ensure sustainable fiscal management and strategic allocation of resources.

Key Differences Between Operating and Capital Budgets

Operating budgets primarily cover day-to-day expenses like salaries, utilities, and office supplies, reflecting your organization's routine financial activities. Capital budgets focus on long-term investments such as purchasing equipment, infrastructure projects, or property acquisitions, emphasizing asset acquisition and improvement. The key difference lies in the timing and nature of expenditures: operating budgets deal with short-term operational costs, while capital budgets address significant, long-term financial commitments.

Components of an Operating Budget

Operating budgets primarily consist of revenue projections, direct costs such as salaries and utilities, and fixed indirect expenses like rent or insurance. Key components include sales forecasts, production costs, administrative expenses, and variable overheads that fluctuate with business activity. This budget differs from capital budgets, which focus on long-term asset investments, and financial plans that encompass comprehensive financial strategies including both operating and capital budgets.

Components of a Capital Budget

The capital budget includes components such as long-term investments, acquisition of fixed assets, major infrastructure projects, and large-scale equipment purchases that support an organization's strategic goals. It allocates funds for funding sources, project cost estimates, timelines, and anticipated returns or benefits over the asset's lifecycle. Properly structured capital budgets ensure efficient capital allocation, risk assessment, and alignment with overall financial strategy within an organization's comprehensive financial plan.

Importance of Accurate Budgeting

Accurate budgeting in the operating budget, capital budget, and financial plan is crucial for effective resource allocation, cost control, and long-term financial stability. Misestimating expenses or revenues can lead to cash flow problems, project delays, or overspending, undermining organizational goals. Precise budgets enable better decision-making, risk management, and alignment of financial activities with strategic priorities.

Common Challenges in Budget Management

Common challenges in managing operating budgets, capital budgets, and financial plans include accurately forecasting expenses and revenues, balancing short-term operational needs with long-term investment goals, and ensuring compliance with regulatory requirements. Misalignment between budget assumptions and actual financial performance often leads to resource constraints and project delays. Effective communication across departments and continuous monitoring are critical to address discrepancies and maintain fiscal discipline.

Best Practices for Budget Planning

Effective budget planning requires distinguishing between operating budgets, which cover day-to-day expenses like salaries and utilities, and capital budgets, which allocate funds for long-term investments such as infrastructure or equipment. Best practices include integrating both budgets into a comprehensive financial plan that aligns with organizational goals and ensures cash flow management, risk assessment, and performance tracking. Utilizing data-driven forecasting tools and regular updates enhances accuracy and responsiveness to changing financial conditions.

Conclusion: Choosing the Right Budget for Your Organization

Selecting the appropriate budget depends on an organization's strategic priorities: an operating budget manages daily expenses and revenue, ensuring smooth short-term operations, while a capital budget focuses on long-term investments in assets like equipment and infrastructure, driving growth and expansion. A comprehensive financial plan integrates both budgets, providing a holistic view of financial health and guiding sustainable decision-making. Aligning budget type with organizational goals maximizes resource efficiency and supports sustained financial stability.

Infographic: Operating Budget vs Capital Budget

relatioo.com

relatioo.com