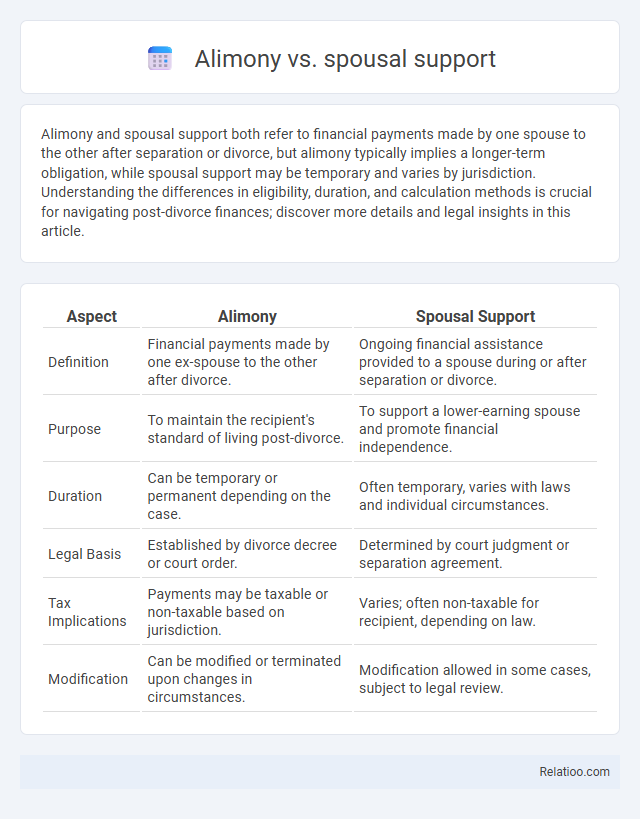

Alimony and spousal support both refer to financial payments made by one spouse to the other after separation or divorce, but alimony typically implies a longer-term obligation, while spousal support may be temporary and varies by jurisdiction. Understanding the differences in eligibility, duration, and calculation methods is crucial for navigating post-divorce finances; discover more details and legal insights in this article.

Table of Comparison

| Aspect | Alimony | Spousal Support |

|---|---|---|

| Definition | Financial payments made by one ex-spouse to the other after divorce. | Ongoing financial assistance provided to a spouse during or after separation or divorce. |

| Purpose | To maintain the recipient's standard of living post-divorce. | To support a lower-earning spouse and promote financial independence. |

| Duration | Can be temporary or permanent depending on the case. | Often temporary, varies with laws and individual circumstances. |

| Legal Basis | Established by divorce decree or court order. | Determined by court judgment or separation agreement. |

| Tax Implications | Payments may be taxable or non-taxable based on jurisdiction. | Varies; often non-taxable for recipient, depending on law. |

| Modification | Can be modified or terminated upon changes in circumstances. | Modification allowed in some cases, subject to legal review. |

Introduction to Alimony and Spousal Support

Alimony and spousal support refer to financial payments made by one spouse to another following separation or divorce, aimed at maintaining the lower-earning partner's standard of living. Alimony typically denotes court-ordered payments based on factors like marriage duration, income disparity, and the recipient's needs, while spousal support often serves as a broader term encompassing negotiated settlements and temporary assistance. Understanding the legal definitions and obligations of alimony versus spousal support is essential for managing post-divorce financial responsibilities effectively.

Defining Alimony: Traditional Perspectives

Alimony, traditionally defined as financial support one spouse pays to the other after separation or divorce, aims to balance economic disparities arising from the marriage. Spousal support and alimony are often used interchangeably, but spousal support can encompass broader arrangements, including temporary or rehabilitative payments. Your understanding of alimony should reflect its historical role in ensuring fair financial maintenance for the lower-earning spouse following marital dissolution.

What Is Spousal Support? Modern Legal Terminology

Spousal support, also known as alimony, refers to financial payments one spouse may be required to make to the other after separation or divorce, aimed at ensuring fair economic support. Modern legal terminology distinguishes spousal support as encompassing rehabilitative, permanent, or temporary payments based on the recipient's needs and the payer's ability to pay. Courts evaluate factors such as marriage duration, income disparity, and contributions to the marriage to determine the type and amount of spousal support awarded.

Key Differences Between Alimony and Spousal Support

Alimony and spousal support are often used interchangeably but can vary based on jurisdiction, with alimony typically referring to court-ordered financial payments after divorce, while spousal support may include a broader range of financial assistance during separation or legal proceedings. Key differences include duration, eligibility criteria, and calculation methods, with alimony often being long-term and spousal support potentially temporary or rehabilitative. Understanding these distinctions helps you navigate your rights and obligations effectively during and after marriage dissolution.

Legal Basis for Alimony and Spousal Support Awards

Alimony and spousal support are legally mandated payments designed to provide financial assistance to a lower-earning spouse after separation or divorce, with the legal basis typically rooted in family law statutes that aim to ensure economic fairness. Courts consider factors such as the duration of the marriage, the standard of living during the marriage, each spouse's earning capacity, and contributions to marital assets when awarding alimony or spousal support. While these terms are often used interchangeably, variations in jurisdiction influence the precise legal criteria and terminology applied to alimony versus spousal support awards.

Factors Influencing Payment Amounts

Alimony, spousal support, and maintenance payments are influenced by several key factors including the length of the marriage, the income disparity between spouses, and each party's financial needs and contributions during the relationship. Courts consider your earning capacity, health, age, and the standard of living established during the marriage when determining payment amounts. Understanding these elements helps in accurately estimating potential financial obligations or entitlements in separation or divorce proceedings.

Duration and Modification of Support Orders

Alimony, spousal support, and maintenance typically refer to financial payments made by one spouse to another following a divorce or separation, with variations primarily in terminology depending on jurisdiction. The duration of these support orders varies widely; some may be temporary during divorce proceedings, while others extend for a fixed term or indefinitely, often influenced by factors such as the length of the marriage, each spouse's earning capacity, and state laws. Your ability to modify or terminate these orders hinges on significant changes in circumstances, like changes in income, remarriage, or cohabitation, with courts requiring substantial proof to adjust the duration or amount.

Tax Implications: Alimony vs Spousal Support

Alimony and spousal support often refer to court-ordered payments from one spouse to another following a divorce or separation, but their tax treatment can differ significantly based on jurisdiction and current tax laws. In the United States, alimony payments agreed upon or ordered before 2019 are typically tax-deductible for the payer and considered taxable income for the recipient, while payments after 2018 are usually neither deductible nor taxable. Understanding these distinctions is crucial for your financial planning and compliance with IRS regulations regarding alimony versus spousal support.

Common Myths and Misconceptions

Alimony, spousal support, and maintenance are often used interchangeably, but they vary by jurisdiction and legal context, leading to confusion about eligibility and duration. Common myths include the belief that only women receive alimony and that it lasts indefinitely, whereas in many cases, payments are time-limited and based on specific financial need and fault considerations. Misconceptions also persist regarding lump-sum versus periodic payments, with courts typically aiming to balance fairness and the recipient's post-divorce financial stability.

Choosing the Right Path: Legal Guidance and Resources

Understanding the distinctions between alimony, spousal support, and maintenance is crucial for navigating post-divorce financial responsibilities effectively. Legal guidance from family law attorneys ensures appropriate claims and payments aligned with state-specific regulations and individual circumstances. Utilizing resources such as state legal aid websites, support groups, and mediation services enhances informed decision-making and supports fair resolutions.

Infographic: Alimony vs Spousal Support

relatioo.com

relatioo.com