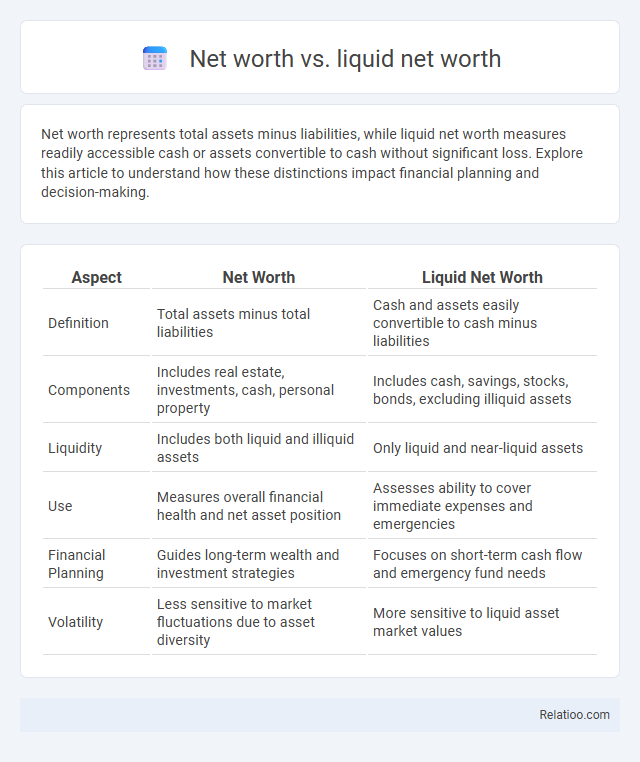

Net worth represents total assets minus liabilities, while liquid net worth measures readily accessible cash or assets convertible to cash without significant loss. Explore this article to understand how these distinctions impact financial planning and decision-making.

Table of Comparison

| Aspect | Net Worth | Liquid Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities | Cash and assets easily convertible to cash minus liabilities |

| Components | Includes real estate, investments, cash, personal property | Includes cash, savings, stocks, bonds, excluding illiquid assets |

| Liquidity | Includes both liquid and illiquid assets | Only liquid and near-liquid assets |

| Use | Measures overall financial health and net asset position | Assesses ability to cover immediate expenses and emergencies |

| Financial Planning | Guides long-term wealth and investment strategies | Focuses on short-term cash flow and emergency fund needs |

| Volatility | Less sensitive to market fluctuations due to asset diversity | More sensitive to liquid asset market values |

Understanding Net Worth: Definition and Components

Net worth represents the total value of an individual's or entity's assets minus liabilities, encompassing everything owned such as properties, investments, and personal belongings. Liquid net worth, a subset of net worth, includes only assets that can be quickly converted to cash without significant loss in value, like cash accounts, stocks, and bonds. Understanding these components is crucial for accurate financial assessment and planning, as net worth provides a broad snapshot of financial health while liquid net worth highlights immediate financial flexibility and access to funds.

What Is Liquid Net Worth?

Liquid net worth represents the portion of an individual's total net worth that can be quickly and easily converted to cash without significantly affecting its value. It includes assets such as cash, checking and savings accounts, money market funds, and other highly liquid investments. Understanding liquid net worth is essential for assessing financial flexibility and the ability to cover immediate expenses or opportunities.

Key Differences Between Net Worth and Liquid Net Worth

Net worth represents the total value of all your assets minus liabilities, including real estate, investments, and personal property, while liquid net worth specifically refers to assets that can be quickly converted into cash without significant loss of value, such as stocks or savings accounts. Understanding the key differences between net worth and liquid net worth helps you gauge financial flexibility versus overall wealth. Your liquid net worth is crucial for assessing immediate financial accessibility compared to your broader, long-term wealth measured by net worth.

Calculating Your Net Worth: Step-by-Step

Calculating your net worth involves subtracting total liabilities from total assets, including property, investments, and cash. Liquid net worth focuses solely on assets that can be quickly converted to cash, such as savings accounts, stocks, and bonds, excluding real estate or retirement accounts. Understanding these distinctions helps assess financial health by measuring overall value versus accessible funds for immediate use.

How to Determine Your Liquid Net Worth

Your liquid net worth represents the portion of your total net worth that can be quickly converted to cash without significant loss in value, including assets like savings accounts, stocks, and bonds. To determine your liquid net worth, sum the market value of all your liquid assets and subtract any short-term liabilities or debts secured against these assets. Accurate calculation of your liquid net worth provides a clearer picture of your immediate financial flexibility compared to your overall net worth, which includes illiquid assets such as real estate and retirement accounts.

The Importance of Liquidity in Financial Planning

Net worth represents the total value of your assets minus liabilities, while liquid net worth specifically measures the assets that can be quickly converted to cash without significant loss. Understanding the distinction is crucial because liquidity ensures you have accessible funds to cover emergencies or investment opportunities without selling long-term assets at a loss. Prioritizing liquid net worth in your financial planning optimizes your ability to manage unexpected expenses and maintain financial stability.

Assets: Liquid vs. Illiquid Explained

Net worth represents the total value of all assets minus liabilities, encompassing both liquid and illiquid assets. Liquid net worth refers specifically to assets that can be quickly converted into cash without significant loss of value, such as savings accounts, stocks, and bonds. Understanding the distinction between liquid and illiquid assets is crucial for financial planning and assessing immediate financial flexibility.

Why Liquid Net Worth Matters for Emergency Situations

Liquid net worth represents the portion of your total net worth that can be quickly converted to cash without significant loss of value, making it crucial for emergency situations when immediate funds are needed. Unlike total net worth, which includes illiquid assets like real estate or retirement accounts, liquid net worth ensures you have accessible resources to cover unexpected expenses such as medical emergencies or urgent repairs. Understanding your liquid net worth helps you prepare financially and provides peace of mind during unforeseen events.

Strategies to Improve Your Liquid Net Worth

Net worth represents the total value of your assets minus liabilities, while liquid net worth focuses specifically on assets easily convertible to cash, such as savings and stocks. Strategies to improve your liquid net worth include prioritizing investments in high-liquidity assets, reducing debts that limit cash flow, and regularly reallocating funds from illiquid holdings like real estate into more liquid instruments. Monitoring and managing these components strategically enhances your financial flexibility and readiness for unexpected expenses.

Net Worth vs Liquid Net Worth: Which Should You Track?

Net worth represents the total value of all your assets minus liabilities, including illiquid assets like real estate and retirement accounts, while liquid net worth focuses solely on cash or assets easily convertible to cash, such as savings and investments. Tracking liquid net worth provides a clearer picture of immediate financial flexibility and emergency fund availability. Prioritizing liquid net worth helps in effective cash flow management and short-term financial planning.

Infographic: Net Worth vs Liquid Net Worth

relatioo.com

relatioo.com