Group insurance offers cost-effective coverage through employer or organizational plans, while individual insurance provides personalized benefits tailored to specific health needs. Discover the key differences and benefits of each type of insurance in this article.

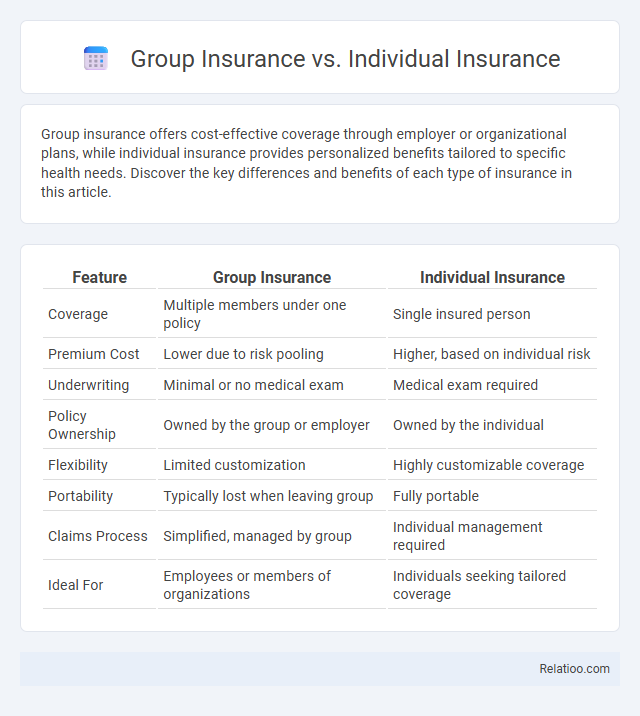

Table of Comparison

| Feature | Group Insurance | Individual Insurance |

|---|---|---|

| Coverage | Multiple members under one policy | Single insured person |

| Premium Cost | Lower due to risk pooling | Higher, based on individual risk |

| Underwriting | Minimal or no medical exam | Medical exam required |

| Policy Ownership | Owned by the group or employer | Owned by the individual |

| Flexibility | Limited customization | Highly customizable coverage |

| Portability | Typically lost when leaving group | Fully portable |

| Claims Process | Simplified, managed by group | Individual management required |

| Ideal For | Employees or members of organizations | Individuals seeking tailored coverage |

Introduction to Group and Individual Insurance

Group insurance covers multiple individuals under a single policy, often provided by employers to offer collective benefits such as health, life, or disability coverage. Individual insurance is tailored to your specific needs, offering personalized protection with customizable terms and premiums based on your unique risk profile. Understanding these distinctions helps you evaluate which insurance type best aligns with your financial security goals and coverage requirements.

Key Differences Between Group and Individual Insurance

Group insurance covers multiple people under a single policy, often provided by employers, offering lower premiums and shared risk. Individual insurance is tailored to your specific needs, with customized coverage options but typically higher costs due to personalized underwriting. Key differences include eligibility criteria, premium costs, coverage flexibility, and claim processes, making it essential to evaluate your personal situation when choosing between group and individual insurance.

Eligibility Requirements

Group insurance typically requires membership in a specific organization, employer, or association, making eligibility dependent on your affiliation with these entities. Individual insurance eligibility is based primarily on personal factors like age, health status, and lifestyle, with underwriting processes evaluating your risk profile independently. Understanding these distinct eligibility requirements allows you to choose between group coverage's collective risk model and the personalized approach of individual insurance.

Coverage Options and Flexibility

Group insurance offers broad coverage options often tailored to collective needs with limited flexibility for individual customization. Individual insurance provides extensive flexibility, allowing policyholders to select personalized coverage based on specific risks and preferences. Insurance, in general, encompasses both types but varies significantly in terms of plan customization, coverage limits, and eligibility criteria.

Premium Costs and Payment Structures

Group insurance typically offers lower premium costs due to risk pooling among members, making it more affordable than individual insurance, which has higher premiums based on personal risk factors. Individual insurance premiums are calculated using your specific health, age, and lifestyle, often resulting in more tailored but costly payment structures. Insurance payment structures vary, with group plans usually featuring employer or group contributions, while individual policies require you to handle the full premium amount directly.

Advantages of Group Insurance

Group insurance offers lower premium costs compared to individual insurance due to risk pooling among members, making it a cost-effective choice for Your coverage needs. It often provides broader coverage options, including health, dental, and life insurance, that might be more affordable and accessible than individual plans. Employers typically handle administrative tasks and premium payments for group insurance, simplifying the process and enhancing convenience for policyholders.

Benefits of Individual Insurance

Individual insurance offers personalized coverage tailored to your specific needs, providing flexibility in policy choices and benefits. Unlike group insurance, it allows you to maintain your coverage regardless of employment status or changes in group eligibility. This autonomy ensures continuous protection and control over your insurance plan, optimizing financial security and peace of mind.

Portability and Continuity of Coverage

Group insurance typically offers better portability within the same employer or affiliated organizations but may lose coverage when changing jobs, whereas individual insurance provides continuous coverage regardless of employment status, ensuring uninterrupted protection. Continuity of coverage is a critical advantage of individual insurance since it remains active regardless of employment changes, while group insurance often requires policy renewal or new enrollment after leaving a group. Insurance portability in individual plans ensures consistent benefits across different providers or regions, unlike group insurance which is tied closely to the employer's plan, potentially causing coverage gaps.

Suitability: Which Option Fits Your Needs?

Group insurance offers cost-effective coverage ideal for employees or members of an organization, while individual insurance provides personalized plans tailored to unique health profiles and financial situations. Choosing between group and individual insurance depends on factors such as budget constraints, coverage flexibility, and specific medical needs. Evaluating eligibility criteria, coverage limits, and potential benefits helps determine which insurance type best fits personal or group requirements.

Conclusion: Making an Informed Choice

Choosing between group insurance, individual insurance, and general insurance depends on factors like coverage needs, budget, and eligibility. Group insurance offers cost-effective, employer-sponsored benefits with limited customization, while individual insurance provides tailored policies suited for personal health or asset protection. Understanding policy features, financial objectives, and risk tolerance helps make an informed decision aligning with long-term security and financial goals.

Infographic: Group Insurance vs Individual Insurance

relatioo.com

relatioo.com