Taxable income differs from accounting income as it follows tax regulations and excludes non-deductible expenses, while accounting income adheres to accounting standards and reflects a company's financial performance. Explore this article to understand the detailed distinctions and implications of taxable income versus accounting income.

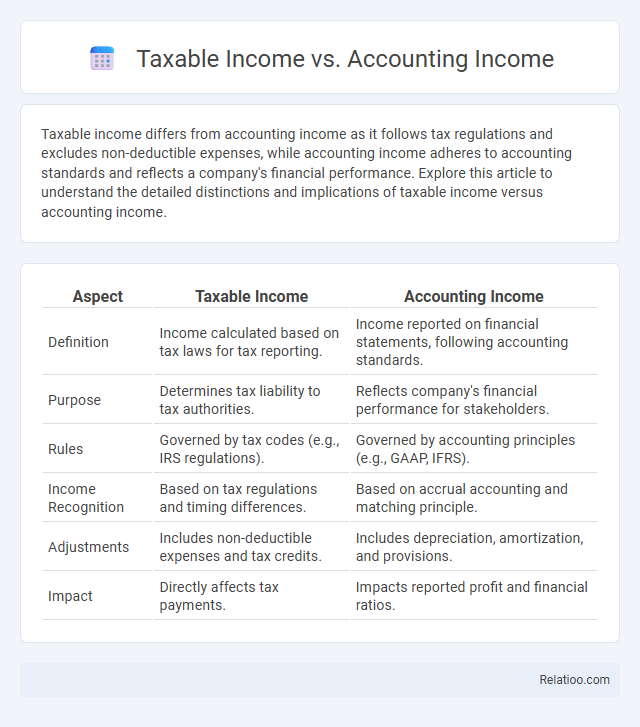

Table of Comparison

| Aspect | Taxable Income | Accounting Income |

|---|---|---|

| Definition | Income calculated based on tax laws for tax reporting. | Income reported on financial statements, following accounting standards. |

| Purpose | Determines tax liability to tax authorities. | Reflects company's financial performance for stakeholders. |

| Rules | Governed by tax codes (e.g., IRS regulations). | Governed by accounting principles (e.g., GAAP, IFRS). |

| Income Recognition | Based on tax regulations and timing differences. | Based on accrual accounting and matching principle. |

| Adjustments | Includes non-deductible expenses and tax credits. | Includes depreciation, amortization, and provisions. |

| Impact | Directly affects tax payments. | Impacts reported profit and financial ratios. |

Introduction to Taxable Income and Accounting Income

Taxable income represents the amount of income subject to taxation according to tax laws, often adjusted for allowable deductions and exemptions, whereas accounting income, also known as financial or book income, reflects the net profit reported on financial statements based on accounting principles like GAAP or IFRS. Taxable income focuses on cash inflows and outflows recognized by tax authorities, while accounting income includes non-cash items such as depreciation and amortization. Understanding the distinctions between taxable and accounting income is crucial for accurate tax reporting and financial analysis.

Defining Taxable Income

Taxable income represents the amount of income subject to taxation according to government tax laws and differs from accounting income, which follows generally accepted accounting principles (GAAP) for financial reporting. It is calculated by adjusting accounting income for non-deductible expenses, tax-exempt revenues, and specific tax allowances or deductions. Understanding taxable income is essential for accurate tax compliance and effective financial planning.

Defining Accounting Income

Accounting income represents the net profit or loss reported on financial statements, calculated according to Generally Accepted Accounting Principles (GAAP) and focusing on capturing all revenue and expenses within an accounting period. Unlike taxable income, which is determined based on tax laws and regulations to calculate tax liability, accounting income provides a standardized measure of business performance for investors and management. Your understanding of accounting income ensures accurate financial analysis and decision-making, differentiating it clearly from taxable income and broader income concepts.

Key Differences Between Taxable and Accounting Income

Taxable income is the amount of income subject to taxation according to the tax laws, reflecting adjustments, deductions, and exemptions, while accounting income represents the net profit reported on financial statements based on generally accepted accounting principles (GAAP). Your taxable income often differs from accounting income due to differences in revenue recognition, expense timing, and non-deductible expenses for tax purposes. Understanding these key distinctions helps in accurately managing tax liabilities and financial reporting compliance.

Methods of Calculating Taxable Income

Taxable income is calculated using IRS guidelines that adjust accounting income by adding non-deductible expenses and subtracting allowable tax deductions, such as depreciation methods under the Modified Accelerated Cost Recovery System (MACRS). Accounting income follows Generally Accepted Accounting Principles (GAAP) and reflects revenue and expenses recognized during the period, inclusive of non-cash items like accruals and amortization. Your accurate tax planning hinges on understanding these differing calculations to ensure compliance and optimize tax liability.

Methods of Calculating Accounting Income

Methods of calculating accounting income primarily involve accrual accounting, where revenues and expenses are recognized when earned or incurred, regardless of cash flow timing. This method contrasts with taxable income calculation, which follows tax regulations emphasizing realized cash transactions and permissible deductions. Accurate accounting income calculation requires adjusting gross revenue for non-cash expenses like depreciation, amortization, and provisions to reflect true financial performance.

Common Adjustments and Reconciliations

Taxable income and accounting income differ primarily due to timing and recognition differences arising from tax laws versus accounting standards, necessitating common adjustments such as depreciation methods, revenue recognition, and expense deductibility. Reconciling these incomes involves adding back non-deductible expenses, subtracting tax-exempt income, and accounting for temporary differences like accrued expenses or unearned revenues. These adjustments ensure accurate tax reporting and financial statement presentation, reflecting the entity's true economic performance and compliance with tax regulations.

Impact on Financial Statements

Taxable income determines the amount of tax payable and is calculated based on tax laws, often differing from accounting income, which follows GAAP or IFRS for financial reporting. Accounting income reflects the company's financial performance and affects retained earnings and equity on financial statements, while taxable income influences current tax liabilities and deferred tax assets or liabilities. Understanding the distinction helps you accurately assess tax obligations and the true financial health shown in your financial statements.

Practical Implications for Businesses

Taxable income determines your business's tax liability based on IRS rules, while accounting income reflects financial performance under GAAP, emphasizing accuracy and transparency for stakeholders. Understanding the differences helps you optimize cash flow, manage tax obligations, and ensure regulatory compliance. Practical implications include strategic tax planning, accurate financial reporting, and aligning business decisions with both tax and accounting frameworks.

Conclusion: Choosing the Right Approach

Selecting the appropriate income measurement depends on the specific financial objective and regulatory context. Taxable income follows IRS guidelines and is essential for accurate tax compliance, while accounting income reflects a company's financial performance based on GAAP or IFRS standards, aiding investors and management decisions. Evaluating these differences ensures the right approach aligns with reporting requirements, strategic planning, and stakeholder communication.

Infographic: Taxable Income vs Accounting Income

relatioo.com

relatioo.com