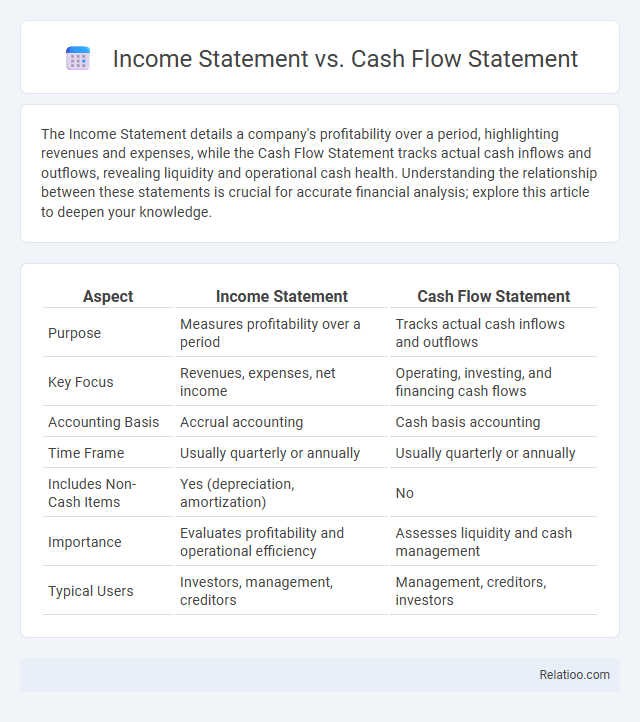

The Income Statement details a company's profitability over a period, highlighting revenues and expenses, while the Cash Flow Statement tracks actual cash inflows and outflows, revealing liquidity and operational cash health. Understanding the relationship between these statements is crucial for accurate financial analysis; explore this article to deepen your knowledge.

Table of Comparison

| Aspect | Income Statement | Cash Flow Statement |

|---|---|---|

| Purpose | Measures profitability over a period | Tracks actual cash inflows and outflows |

| Key Focus | Revenues, expenses, net income | Operating, investing, and financing cash flows |

| Accounting Basis | Accrual accounting | Cash basis accounting |

| Time Frame | Usually quarterly or annually | Usually quarterly or annually |

| Includes Non-Cash Items | Yes (depreciation, amortization) | No |

| Importance | Evaluates profitability and operational efficiency | Assesses liquidity and cash management |

| Typical Users | Investors, management, creditors | Management, creditors, investors |

Introduction to Financial Statements

Financial statements provide a comprehensive overview of a company's financial health and performance, with the income statement detailing revenues and expenses to show net profit or loss over a specific period. The cash flow statement tracks the actual cash inflows and outflows from operating, investing, and financing activities, highlighting liquidity and cash management. Together, these documents form the foundation of financial reporting, enabling stakeholders to make informed decisions based on profitability, cash position, and overall financial stability.

What is an Income Statement?

An Income Statement, also known as a Profit and Loss Statement, summarizes a company's revenues, expenses, and profits over a specific period, providing key insights into operational performance. It differs from the Cash Flow Statement, which tracks actual cash inflows and outflows, and the broader Financial Statement, which encompasses the Income Statement, Balance Sheet, and Cash Flow Statement to offer a comprehensive view of financial health. Understanding the Income Statement is crucial for You to evaluate profitability and make informed business decisions.

What is a Cash Flow Statement?

A Cash Flow Statement details the inflows and outflows of cash within a business over a specific period, highlighting operational, investing, and financing activities. Unlike Income Statements that show profitability and Financial Statements that provide a comprehensive overview, the Cash Flow Statement focuses solely on liquidity and cash management. Understanding your Cash Flow Statement is essential for assessing your company's ability to cover expenses, invest, and fund growth.

Key Components of the Income Statement

The Income Statement highlights your company's revenues, expenses, and net income over a specific period, providing insight into profitability. Key components include total sales, cost of goods sold (COGS), gross profit, operating expenses, and net profit or loss. Unlike the Cash Flow Statement, which tracks cash inflows and outflows, the Income Statement focuses on accrual accounting to measure performance, while the Financial Statement encompasses both reports along with the balance sheet for a comprehensive view of financial health.

Key Components of the Cash Flow Statement

The Cash Flow Statement highlights three key components: operating activities, investing activities, and financing activities, each detailing cash inflows and outflows in different areas. Unlike the Income Statement, which reports profitability over a period, the Cash Flow Statement provides a real-time snapshot of cash liquidity, crucial for assessing your company's financial health. Understanding its components enables better cash management decisions and ensures accurate tracking of funds available for operations and growth.

Purpose and Importance of Income Statements

Income Statements provide a detailed overview of a company's revenues, expenses, and profits over a specific period, highlighting operational performance and profitability. Unlike Cash Flow Statements, which track actual cash inflows and outflows to assess liquidity, and Financial Statements that encompass a broader range of reports including balance sheets, Income Statements focus specifically on earnings generation and expense management. Understanding Income Statements is crucial for investors and management to evaluate business efficiency, forecast future earnings, and make informed financial decisions.

Purpose and Importance of Cash Flow Statements

Cash Flow Statements provide crucial insights into Your company's liquidity by tracking actual cash inflows and outflows over a specific period, unlike Income Statements that focus on profitability through revenues and expenses. Understanding cash flow is essential for managing daily operations, ensuring Your business can meet short-term obligations, and avoiding insolvency. These statements complement Financial Statements by revealing the cash-generating ability of assets, aiding investors and creditors in evaluating financial health beyond mere earnings.

Major Differences: Income Statement vs Cash Flow Statement

The Income Statement reports a company's revenues, expenses, and profits over a specific period, highlighting operational performance and net income. The Cash Flow Statement tracks the actual inflows and outflows of cash, focusing on liquidity and cash management across operating, investing, and financing activities. You should understand that while the Income Statement shows profitability, the Cash Flow Statement reveals the company's cash position, both essential for a comprehensive Financial Statement analysis.

When to Use Each Statement in Financial Analysis

Use the Income Statement to evaluate a company's profitability over a specific period by analyzing revenues, expenses, and net income. The Cash Flow Statement is essential for assessing liquidity and cash management by tracking cash inflows and outflows from operating, investing, and financing activities. The Financial Statement, encompassing the Income Statement, Cash Flow Statement, and Balance Sheet, provides a comprehensive overview for long-term strategic planning and financial health analysis.

Conclusion: Choosing the Right Financial Statement

Selecting the appropriate financial statement depends on the specific analysis purpose: the income statement highlights profitability over a period, the cash flow statement reveals liquidity and cash management, and the financial statement provides a comprehensive overview of a company's financial health. Investors seeking profitability trends prioritize the income statement, while creditors and managers focused on operational cash sufficiency rely on the cash flow statement. Comprehensive financial analysis integrates all statements to achieve an accurate assessment of business performance and sustainability.

Infographic: Income Statement vs Cash Flow Statement

relatioo.com

relatioo.com