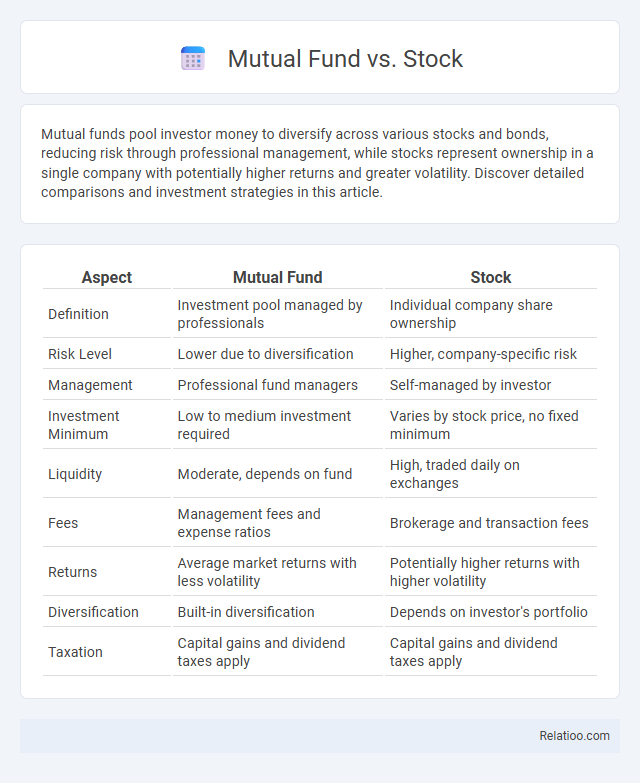

Mutual funds pool investor money to diversify across various stocks and bonds, reducing risk through professional management, while stocks represent ownership in a single company with potentially higher returns and greater volatility. Discover detailed comparisons and investment strategies in this article.

Table of Comparison

| Aspect | Mutual Fund | Stock |

|---|---|---|

| Definition | Investment pool managed by professionals | Individual company share ownership |

| Risk Level | Lower due to diversification | Higher, company-specific risk |

| Management | Professional fund managers | Self-managed by investor |

| Investment Minimum | Low to medium investment required | Varies by stock price, no fixed minimum |

| Liquidity | Moderate, depends on fund | High, traded daily on exchanges |

| Fees | Management fees and expense ratios | Brokerage and transaction fees |

| Returns | Average market returns with less volatility | Potentially higher returns with higher volatility |

| Diversification | Built-in diversification | Depends on investor's portfolio |

| Taxation | Capital gains and dividend taxes apply | Capital gains and dividend taxes apply |

Introduction to Mutual Funds and Stocks

Mutual funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities, offering professional management and reduced risk for Your investments. Stocks represent ownership in a single company, providing potential for high returns but with greater volatility and risk compared to mutual funds. Understanding these fundamental differences helps You choose the right investment approach based on Your financial goals and risk tolerance.

Key Differences Between Mutual Funds and Stocks

Stocks represent individual shares of ownership in a company, offering potential for high returns but with higher risk and market volatility. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, providing professional management and reduced risk. Your choice between stocks and mutual funds depends on your risk tolerance, investment goals, and preference for hands-on management versus diversification.

How Mutual Funds Work

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities managed by professional fund managers, reducing risk compared to individual stock purchases. Unlike buying stocks directly, investing in mutual funds allows you to benefit from expert asset allocation and continuous portfolio monitoring, which can optimize returns. Your investment grows through the appreciation of the underlying assets and reinvested dividends, making mutual funds an accessible option for long-term wealth building.

How Stocks Work

Stocks represent ownership shares in a company, allowing you to earn returns through price appreciation and dividends based on the company's performance. Unlike mutual funds, which pool money from multiple investors to buy a diversified portfolio managed by professionals, stocks require individual decision-making and carry higher risk due to market volatility. Understanding how stocks work helps you gauge potential rewards and risks when comparing direct stock investment versus mutual fund options.

Benefits of Investing in Mutual Funds

Mutual funds offer diversified investment portfolios managed by professional fund managers, reducing individual risk compared to investing directly in stocks. They provide liquidity, ease of access, and the potential for steady returns through a mix of equities, bonds, and other assets tailored to investors' risk tolerance. Mutual funds also benefit from economies of scale, lower transaction costs, and regulatory oversight, enhancing transparency and investor protection.

Advantages of Investing in Stocks

Investing in stocks offers significant advantages such as direct ownership in companies, enabling you to benefit from capital appreciation and dividend income. Stocks provide higher liquidity compared to mutual funds, allowing quicker buying and selling on stock exchanges like NYSE or NASDAQ. Your portfolio can be actively managed with greater control over individual stock selections, potentially leading to higher returns than pooled investments in mutual funds.

Risks Involved in Mutual Funds vs Stocks

Mutual funds diversify investments across multiple assets, reducing risk exposure compared to individual stocks, which carry higher volatility tied to single-company performance. Stock investments involve market risk, company-specific risk, and potential for significant price fluctuations, while mutual funds mitigate risk through professional management and portfolio diversification. Investors in mutual funds face risks such as market risk, management risk, and fees, but these are generally lower than the direct risks associated with stock trading.

Costs and Fees Comparison

Mutual funds typically charge management fees ranging from 0.5% to 2%, which cover professional portfolio management and administrative expenses, while stocks do not have ongoing fees but incur brokerage commissions and potential account maintenance costs. Exchange-Traded Funds (ETFs), a type of mutual fund, often have lower expense ratios around 0.1% to 0.5%, making them cost-effective for frequent trading. Understanding these cost structures helps You optimize investments by balancing ongoing fees in mutual funds against transaction costs in individual stocks.

Suitability: Who Should Invest in Mutual Funds or Stocks?

Mutual funds suit investors seeking diversified portfolios managed by professionals, ideal for those with limited time or experience in market analysis. Stocks appeal to individuals comfortable with higher risk and who prefer direct control over their investments for potentially greater returns. Your choice depends on your risk tolerance, investment knowledge, and financial goals, with mutual funds offering a safer, hands-off approach and stocks providing active growth opportunities.

Conclusion: Choosing Between Mutual Funds and Stocks

Choosing between mutual funds and stocks depends on individual investment goals, risk tolerance, and time horizon. Mutual funds offer diversified portfolios managed by professionals, reducing risk for novice investors, while stocks provide direct ownership and potential for higher returns but with greater volatility. Investors seeking balanced growth with less hands-on management often prefer mutual funds, whereas those aiming for aggressive growth and willing to actively manage their portfolios tend to choose stocks.

Infographic: Mutual Fund vs Stock

relatioo.com

relatioo.com