Net worth represents the total value of an individual's or entity's assets minus liabilities, while equity specifically refers to ownership value in a particular asset or business. Explore this article to understand how net worth and equity interrelate and impact financial health.

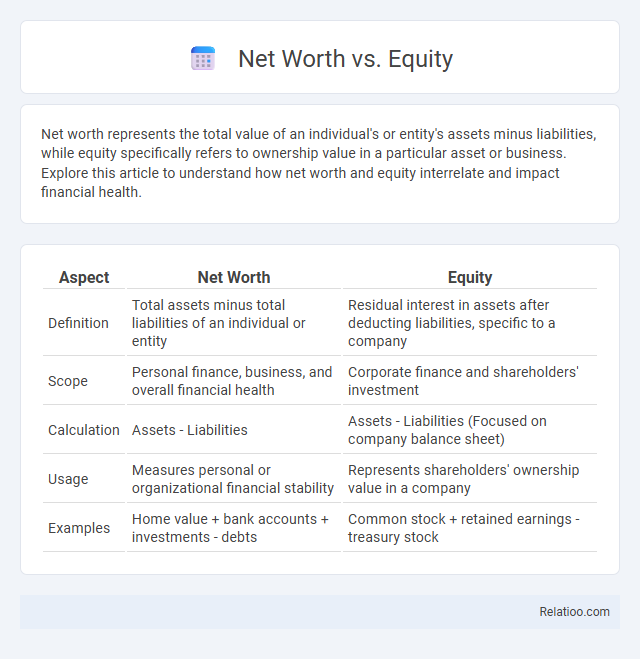

Table of Comparison

| Aspect | Net Worth | Equity |

|---|---|---|

| Definition | Total assets minus total liabilities of an individual or entity | Residual interest in assets after deducting liabilities, specific to a company |

| Scope | Personal finance, business, and overall financial health | Corporate finance and shareholders' investment |

| Calculation | Assets - Liabilities | Assets - Liabilities (Focused on company balance sheet) |

| Usage | Measures personal or organizational financial stability | Represents shareholders' ownership value in a company |

| Examples | Home value + bank accounts + investments - debts | Common stock + retained earnings - treasury stock |

Introduction to Net Worth and Equity

Net worth represents the total value of an individual's or business's assets minus liabilities, reflecting overall financial health. Equity specifically refers to ownership interest in an asset, such as shares in a company or real estate, indicating the residual claim after debts are settled. Understanding the distinction between net worth and equity is essential for accurate financial analysis and investment evaluation.

Defining Net Worth

Net worth represents the total value of an individual's or company's assets minus liabilities, serving as a key indicator of financial health. Equity refers specifically to the ownership interest in an asset or business after subtracting debts, often used in the context of shareholders' equity in a corporation. Understanding net worth provides a comprehensive measure of overall financial stability by encompassing all assets and obligations, unlike equity which focuses on ownership value within a specific entity.

Understanding Equity

Equity represents your ownership value in an asset after subtracting liabilities, crucial for assessing your financial standing. Unlike net worth, which aggregates all assets minus all liabilities across your entire financial portfolio, equity specifically relates to a single asset like real estate or a business. Understanding equity helps you make informed decisions about borrowing, investing, and growing your wealth effectively.

Key Differences Between Net Worth and Equity

Net worth represents the total value of all your assets minus liabilities, providing a comprehensive picture of your overall financial health, while equity specifically refers to ownership interest in a particular asset or company. Equity is a component of net worth but focuses on the value attributable to shareholders or owners after debts are subtracted from the asset's market value. Understanding the distinction helps you accurately assess personal wealth versus the value held in specific investments or business ventures.

How to Calculate Net Worth

Net worth is calculated by subtracting total liabilities from total assets, providing a clear picture of an individual's or company's financial health. Equity represents ownership interest in assets after all debts are paid and is a component of net worth, especially in business contexts. Understanding the distinction is critical: net worth encompasses overall financial position, while equity specifically refers to ownership value within an entity.

Methods for Calculating Equity

Calculating equity involves subtracting total liabilities from total assets, providing a clear picture of your company's ownership value. This method differs from net worth calculations, which often consider personal assets and liabilities, essential for understanding individual financial health. By focusing on accurate asset valuation and liability assessment, you can determine your equity with precision for informed financial decision-making.

Net Worth in Personal Finance

Net worth in personal finance represents the total value of an individual's assets minus liabilities, offering a clear snapshot of financial health. Equity refers specifically to ownership in an asset, such as a home or business, and contributes to overall net worth when calculating personal wealth. Understanding net worth helps individuals make informed decisions about savings, investments, and debt management to improve financial stability.

Equity in Business Context

Equity in a business context represents ownership value, calculated as total assets minus liabilities, directly reflecting the company's net worth. Your equity indicates your stake in the business, showing how much of the company's value you truly own after debts are accounted for. Understanding the distinction between equity and net worth helps in assessing financial health and investment potential accurately.

Common Misconceptions: Net Worth vs Equity

Net worth and equity are often confused but represent distinct financial metrics; net worth is the total value of all assets minus liabilities owned by an individual or business, while equity specifically refers to the ownership interest in an asset, such as a home or company. Many mistakenly equate net worth solely with equity in a single property, overlooking other assets and liabilities that contribute to overall net worth. Understanding that equity is a component of net worth clarifies financial statements and aids in accurate wealth assessment.

Which Metric Matters More?

Equity represents the ownership value in a specific asset or company, calculated as total assets minus liabilities, while net worth encompasses an individual's or entity's overall financial position, including all assets and liabilities. Investors typically prioritize equity when evaluating business health and shareholder value, as it directly reflects ownership interest and potential returns. Conversely, net worth is crucial for assessing personal financial stability and long-term wealth accumulation, making the importance of each metric dependent on the context of individual goals or investment objectives.

Infographic: Net Worth vs Equity

relatioo.com

relatioo.com