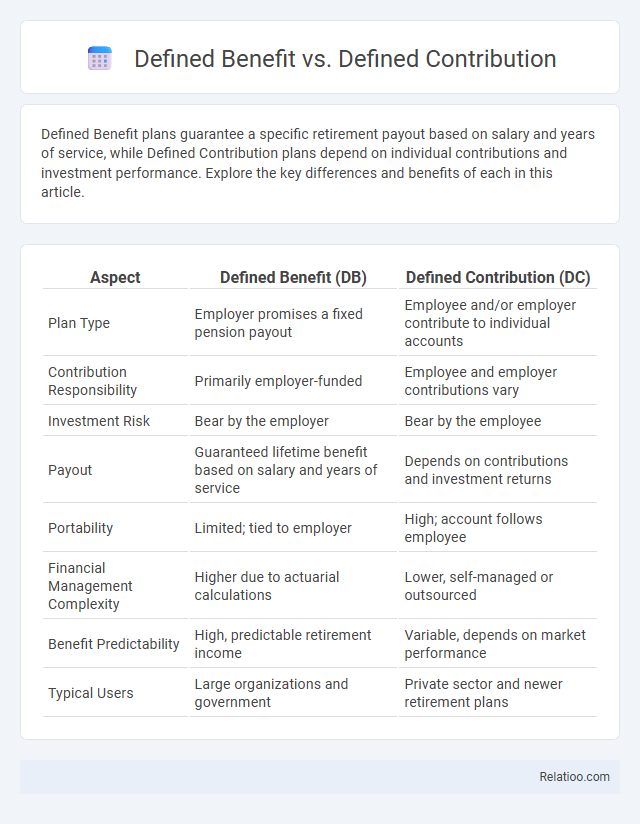

Defined Benefit plans guarantee a specific retirement payout based on salary and years of service, while Defined Contribution plans depend on individual contributions and investment performance. Explore the key differences and benefits of each in this article.

Table of Comparison

| Aspect | Defined Benefit (DB) | Defined Contribution (DC) |

|---|---|---|

| Plan Type | Employer promises a fixed pension payout | Employee and/or employer contribute to individual accounts |

| Contribution Responsibility | Primarily employer-funded | Employee and employer contributions vary |

| Investment Risk | Bear by the employer | Bear by the employee |

| Payout | Guaranteed lifetime benefit based on salary and years of service | Depends on contributions and investment returns |

| Portability | Limited; tied to employer | High; account follows employee |

| Financial Management Complexity | Higher due to actuarial calculations | Lower, self-managed or outsourced |

| Benefit Predictability | High, predictable retirement income | Variable, depends on market performance |

| Typical Users | Large organizations and government | Private sector and newer retirement plans |

Introduction to Defined Benefit and Defined Contribution Plans

Defined Benefit plans guarantee a specified monthly benefit at retirement, often calculated through a formula based on salary and years of service, providing predictable income for retirees. Defined Contribution plans, such as 401(k)s, depend on employee and employer contributions invested, with retirement income varying according to investment performance. Pension schemes typically refer to Defined Benefit plans managed by employers or governments to ensure steady post-retirement income.

Key Differences Between Defined Benefit and Defined Contribution

Defined Benefit plans guarantee a fixed retirement income based on salary and years of service, while Defined Contribution plans depend on employee and employer contributions invested over time, with retirement income varying by investment performance. Pension plans often refer to Defined Benefit schemes providing predictable payouts, whereas Defined Contribution plans shift investment risk to employees. Key differences include income certainty for retirees under Defined Benefit versus investment risk borne by employees in Defined Contribution plans.

How Defined Benefit Plans Work

Defined Benefit Plans guarantee a specific retirement benefit amount based on factors such as salary history and years of service, providing predictable income for Your retirement. Employers typically fund these plans, managing the investment risks and ensuring promised payouts regardless of market performance. Unlike Defined Contribution plans, where Your benefits depend on individual contributions and investment returns, Defined Benefit Plans offer a stable and secure pension income stream.

Mechanics of Defined Contribution Plans

Defined Contribution Plans operate by allowing employees and employers to contribute a fixed amount or percentage of salary into individual accounts, which are then invested to grow over time. The account balance depends on contribution amounts, investment performance, and fees, with retirement benefits determined by the accumulated funds rather than a guaranteed payout. Unlike Defined Benefit Plans that promise a specific monthly pension, Defined Contribution Plans place investment risk and reward on the participant.

Employer and Employee Responsibilities

Defined Benefit plans place the primary responsibility on employers to guarantee a specific retirement benefit based on salary and years of service, requiring them to manage investment risks and fund shortfalls. In Defined Contribution plans, employees contribute a portion of their salary into individual accounts, making them responsible for investment decisions and bearing the risk of market fluctuations. Pension schemes typically involve employer-funded promises of future payouts, with employees often having limited control but reliant on the employer's ability to maintain funding and manage long-term liabilities.

Risk Factors: Who Bears the Investment Risk?

Defined Benefit plans place the investment risk on the employer, guaranteeing a fixed payout regardless of market performance. In Defined Contribution plans, Your investment risk is borne by You, as benefits depend on contributions and asset returns, which can fluctuate. Pension schemes vary by type but generally shift risk depending on whether they are defined benefit or defined contribution plans.

Retirement Income Predictability and Stability

Defined Benefit plans guarantee a predetermined retirement income based on salary and years of service, providing you with predictable and stable income throughout retirement. Defined Contribution plans, such as 401(k)s, rely on employee and employer contributions invested over time, leading to variable and less predictable income depending on market performance. Traditional pensions, often synonymous with Defined Benefit plans, focus on ensuring consistent retirement payments, emphasizing income security and financial stability for retirees.

Portability and Flexibility of Each Plan

Defined Benefit plans offer limited portability as benefits are tied to tenure and employer sponsorship, often requiring employees to stay with one company for maximum value. Defined Contribution plans provide greater portability since funds are individually owned and can be rolled over into other retirement accounts, enabling flexibility in changing jobs. Pension plans typically have lower flexibility, as payouts and eligibility are predetermined, restricting modifications or early withdrawals without penalties.

Tax Implications for Each Plan Type

Defined Benefit plans provide a guaranteed retirement income based on salary and years of service, with contributions typically made pre-tax, reducing your taxable income, but withdrawals during retirement are taxed as ordinary income. Defined Contribution plans, such as 401(k)s, involve pre-tax contributions that grow tax-deferred until withdrawal, where distributions are taxed as income, but you bear the investment risk. Pension plans function as traditional Defined Benefit arrangements with employer-funded benefits and similarly taxable withdrawals, often offering tax advantages contingent on plan rules and qualifying status.

Choosing the Right Retirement Plan for You

Choosing the right retirement plan involves understanding the differences between Defined Benefit, Defined Contribution, and Pension plans. A Defined Benefit plan guarantees a fixed payout at retirement based on salary and years of service, while Defined Contribution plans, such as 401(k)s, depend on your contributions and investment performance. Your decision should consider your financial goals, risk tolerance, and the stability of the employer offering the plan to ensure a secure retirement.

Infographic: Defined Benefit vs Defined Contribution

relatioo.com

relatioo.com