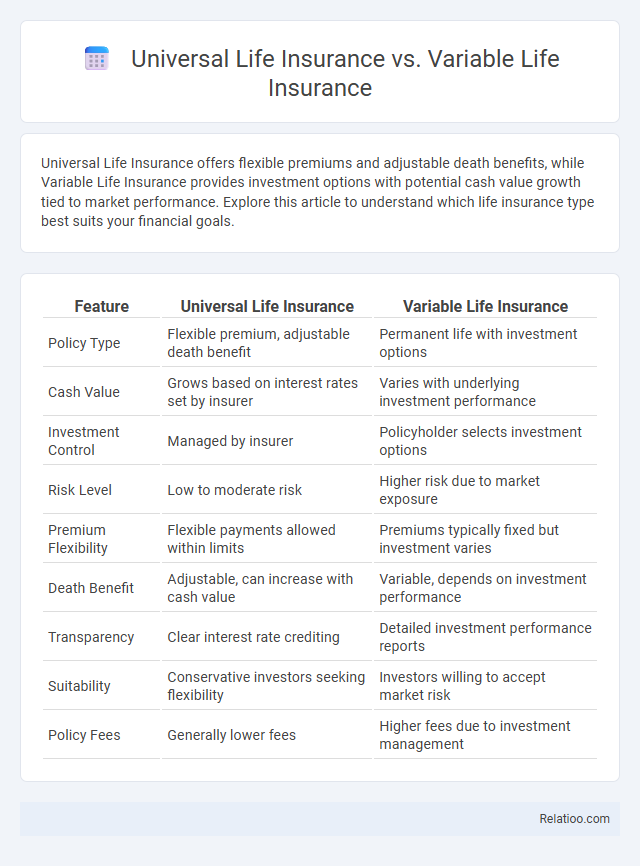

Universal Life Insurance offers flexible premiums and adjustable death benefits, while Variable Life Insurance provides investment options with potential cash value growth tied to market performance. Explore this article to understand which life insurance type best suits your financial goals.

Table of Comparison

| Feature | Universal Life Insurance | Variable Life Insurance |

|---|---|---|

| Policy Type | Flexible premium, adjustable death benefit | Permanent life with investment options |

| Cash Value | Grows based on interest rates set by insurer | Varies with underlying investment performance |

| Investment Control | Managed by insurer | Policyholder selects investment options |

| Risk Level | Low to moderate risk | Higher risk due to market exposure |

| Premium Flexibility | Flexible payments allowed within limits | Premiums typically fixed but investment varies |

| Death Benefit | Adjustable, can increase with cash value | Variable, depends on investment performance |

| Transparency | Clear interest rate crediting | Detailed investment performance reports |

| Suitability | Conservative investors seeking flexibility | Investors willing to accept market risk |

| Policy Fees | Generally lower fees | Higher fees due to investment management |

Introduction to Universal and Variable Life Insurance

Universal Life Insurance offers flexible premiums and adjustable death benefits, allowing policyholders to modify coverage and accumulate cash value based on interest rates. Variable Life Insurance combines permanent coverage with investment options, enabling policyholders to allocate cash value into various securities for potential growth. Both types differ from traditional whole life insurance by providing greater control over policy features and investment performance.

Key Differences Between Universal and Variable Life Insurance

Universal life insurance offers flexible premiums and a guaranteed minimum interest rate on the cash value, while variable life insurance allows you to invest the cash value in various sub-accounts with potential for higher returns but greater risk. Universal life focuses on stability and adaptability for your changing financial needs, whereas variable life emphasizes investment growth tied to market performance. Choosing between them depends on your risk tolerance and financial goals in managing your life insurance policy.

How Universal Life Insurance Works

Universal Life Insurance offers flexible premiums and adjustable death benefits, allowing Your policy to grow based on interest rates set by the insurer. Unlike Variable Life Insurance, which invests cash value in separate accounts with market risks, Universal Life builds cash value in a general account with more stability. This flexibility makes Universal Life a versatile choice for long-term financial planning and estate protection.

How Variable Life Insurance Works

Variable life insurance combines a death benefit with an investment component, allowing Your cash value to be allocated among various separate accounts like stocks and bonds, directly affecting the policy's growth potential and risk. Unlike universal life insurance, which offers flexible premiums and adjustable death benefits with a cash value tied to interest rates, variable life insurance's cash value fluctuates based on market performance. Understanding how variable life insurance works helps You decide if the potential for higher returns aligns with Your risk tolerance compared to the more stable but less flexible universal life insurance.

Flexibility in Premiums and Coverage

Universal Life Insurance offers flexible premiums and adjustable death benefits, allowing policyholders to tailor coverage based on changing financial needs. Variable Life Insurance includes investment options with premiums generally fixed, enabling potential cash value growth tied to market performance but less premium flexibility. Traditional life insurance typically has fixed premiums and coverage, providing stability but limited adaptability compared to universal and variable policies.

Investment Options and Cash Value Growth

Universal Life Insurance offers flexible premiums and a cash value component that grows based on interest rates set by the insurer, providing moderate investment risk and steady cash value accumulation. Variable Life Insurance allows policyholders to allocate cash value into diverse investment options such as stocks and bonds, resulting in potentially higher returns but increased market risk and fluctuating cash value. Traditional Life Insurance typically does not include cash value or investment options, focusing solely on providing a fixed death benefit without cash accumulation.

Risk Factors: Guarantees vs Market Performance

Universal Life Insurance offers flexible premiums and death benefits with a minimum interest rate guarantee, reducing risk exposure by protecting against market downturns. Variable Life Insurance involves investment subaccounts tied to market performance, increasing potential returns but exposing policyholders to higher risk due to lack of guaranteed minimum returns. Traditional Life Insurance provides fixed premiums and guaranteed death benefits, minimizing risk by avoiding market fluctuations entirely.

Costs and Fees Comparison

Universal life insurance typically features flexible premiums and interest-sensitive cash value growth but may include higher administrative fees and cost of insurance charges. Variable life insurance involves investment options with potential for higher returns, yet it carries greater risk and often higher fees due to fund management and mortality expenses. Comparing costs, universal life offers more predictable fees, whereas variable life can have variable charges tied to market performance, making cost-effectiveness dependent on investment success and policy structure.

Suitability: Who Should Choose Which Policy?

Universal Life Insurance suits individuals seeking flexible premiums and adjustable death benefits to accommodate changing financial needs, often favored by those with fluctuating income. Variable Life Insurance appeals to policyholders comfortable with investment risk, as it offers the potential for higher cash value growth through equity market exposure, making it ideal for financially savvy investors. Traditional Life Insurance provides stable premiums and guaranteed death benefits, fitting those prioritizing predictability and long-term security without market risk.

Final Considerations: Making the Right Choice

Universal life insurance offers flexible premiums and adjustable death benefits tailored to changing financial needs, while variable life insurance provides investment options with potential growth but higher risk. When making the right choice, consider your risk tolerance, investment knowledge, and the need for financial flexibility versus guaranteed elements. Evaluating factors like policy fees, cash value growth potential, and long-term financial goals helps determine which life insurance type best supports your family's future security.

Infographic: Universal Life Insurance vs Variable Life Insurance

relatioo.com

relatioo.com