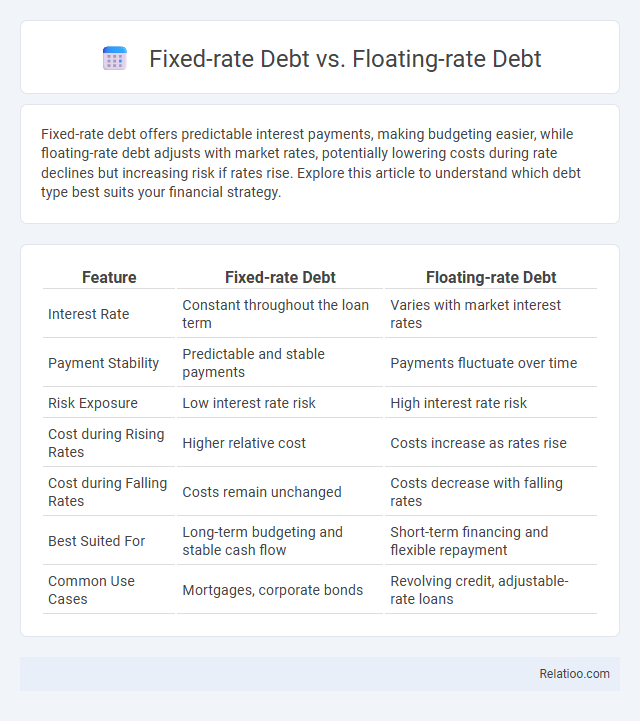

Fixed-rate debt offers predictable interest payments, making budgeting easier, while floating-rate debt adjusts with market rates, potentially lowering costs during rate declines but increasing risk if rates rise. Explore this article to understand which debt type best suits your financial strategy.

Table of Comparison

| Feature | Fixed-rate Debt | Floating-rate Debt |

|---|---|---|

| Interest Rate | Constant throughout the loan term | Varies with market interest rates |

| Payment Stability | Predictable and stable payments | Payments fluctuate over time |

| Risk Exposure | Low interest rate risk | High interest rate risk |

| Cost during Rising Rates | Higher relative cost | Costs increase as rates rise |

| Cost during Falling Rates | Costs remain unchanged | Costs decrease with falling rates |

| Best Suited For | Long-term budgeting and stable cash flow | Short-term financing and flexible repayment |

| Common Use Cases | Mortgages, corporate bonds | Revolving credit, adjustable-rate loans |

Introduction to Fixed-rate and Floating-rate Debt

Fixed-rate debt maintains a constant interest rate throughout the loan term, providing predictable repayment amounts and shielding borrowers from interest rate fluctuations. Floating-rate debt, also known as variable-rate debt, has interest rates that adjust periodically based on benchmark rates, exposing borrowers to potential rate increases or decreases over time. Understanding the differences between fixed-rate and floating-rate debt helps borrowers assess risk tolerance and manage cash flow effectively when choosing financing options.

Key Definitions and Concepts

Fixed-rate debt features an interest rate that remains constant throughout the loan term, providing predictable monthly payments and shielding your finances from interest rate fluctuations. Floating-rate debt, also known as variable-rate debt, has an interest rate that adjusts periodically based on benchmark rates like LIBOR or SOFR, potentially lowering initial costs but increasing payment uncertainty. Understanding these key concepts is essential for managing your debt strategy effectively and balancing risk with financial stability.

How Fixed-rate Debt Works

Fixed-rate debt involves borrowing money at a predetermined interest rate that remains constant throughout the loan term, providing predictability in interest payments and protecting borrowers from market rate fluctuations. This type of debt is commonly used in mortgages, bonds, and corporate loans, offering stability in budgeting and financial planning. Unlike floating-rate debt, which varies with benchmark interest rates such as LIBOR or SOFR, fixed-rate debt ensures consistent expenses regardless of economic changes.

How Floating-rate Debt Works

Floating-rate debt features an interest rate that adjusts periodically based on a benchmark index such as the LIBOR or SOFR, which helps borrowers manage interest rate risk in fluctuating market conditions. Unlike fixed-rate debt, where the interest rate remains constant throughout the loan term, floating-rate loans can lead to variable payment amounts depending on market interest rate changes. This type of debt is often favored by companies expecting interest rates to decline or seeking to capitalize on lower initial rates while accepting potential increases.

Major Differences Between Fixed-rate and Floating-rate Debt

Fixed-rate debt features an interest rate that remains constant throughout the loan term, providing predictable monthly payments and shielding you from rate fluctuations. Floating-rate debt, also known as variable-rate debt, has interest rates that change periodically, often tied to benchmark rates like LIBOR or the federal funds rate, which can lead to lower initial rates but increased payment uncertainty. The major differences between fixed-rate and floating-rate debt lie in payment predictability, risk exposure to interest rate changes, and long-term cost implications for borrowers.

Advantages of Fixed-rate Debt

Fixed-rate debt offers the advantage of predictable monthly payments and protection against rising interest rates, ensuring consistent budgeting for your financial planning. Unlike floating-rate debt, fixed-rate loans shield you from market volatility and potential payment increases, providing stability over the loan term. This reliability helps you maintain control over your expenses and reduces the risk associated with fluctuating interest costs.

Advantages of Floating-rate Debt

Floating-rate debt offers the advantage of interest payments that adjust with market rates, providing you potential savings when rates decline. This debt structure reduces the risk of locking into high fixed rates, enhancing cash flow flexibility. Borrowers benefit from aligning interest costs more closely with prevailing economic conditions, making it ideal for managing interest rate volatility.

Risks and Drawbacks of Each Option

Fixed-rate debt carries the risk of higher interest payments if market rates decline, limiting Your ability to benefit from falling rates and causing potential overpayment. Floating-rate debt exposes You to interest rate volatility, leading to uncertain monthly payments and increased risk during periods of rising rates, which can strain cash flow. General debt risks include credit default, reduced financial flexibility, and potential damage to credit scores, emphasizing the importance of matching debt type with Your financial stability and market conditions.

Choosing Between Fixed-rate and Floating-rate Debt

Choosing between fixed-rate and floating-rate debt depends on interest rate risk tolerance and market expectations. Fixed-rate debt offers predictability and protection against rising rates by locking in a set interest rate, benefiting borrowers in a high-rate environment. Floating-rate debt, with variable interest tied to benchmarks like LIBOR or SOFR, can reduce borrowing costs when interest rates are stable or falling but exposes borrowers to fluctuations and potential rate increases.

Current Market Trends and Future Outlook

Fixed-rate debt offers stability with predictable interest payments, making it attractive amid rising interest rates in current markets. Floating-rate debt benefits borrowers when interest rates decline, but poses risks during periods of rate hikes, as seen with recent central bank tightening globally. Debt strategies increasingly favor hybrid approaches combining fixed and floating rates to balance risk and cost efficiency in uncertain economic conditions.

Infographic: Fixed-rate Debt vs Floating-rate Debt

relatioo.com

relatioo.com