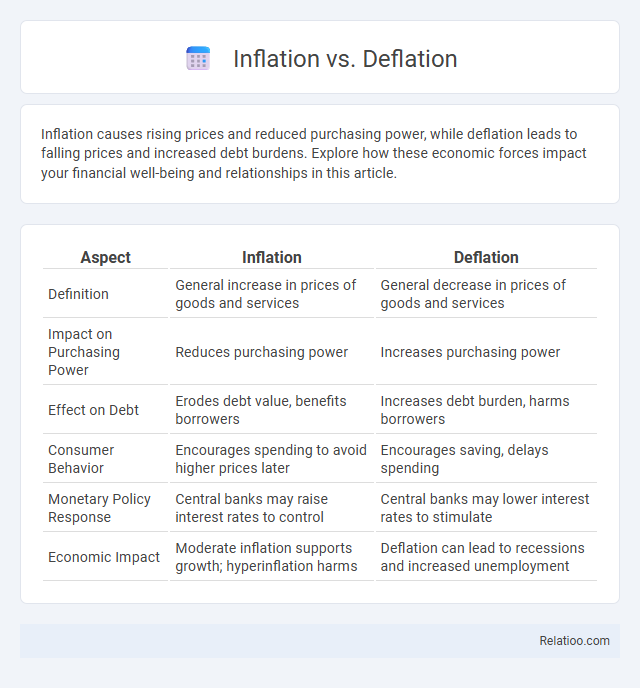

Inflation causes rising prices and reduced purchasing power, while deflation leads to falling prices and increased debt burdens. Explore how these economic forces impact your financial well-being and relationships in this article.

Table of Comparison

| Aspect | Inflation | Deflation |

|---|---|---|

| Definition | General increase in prices of goods and services | General decrease in prices of goods and services |

| Impact on Purchasing Power | Reduces purchasing power | Increases purchasing power |

| Effect on Debt | Erodes debt value, benefits borrowers | Increases debt burden, harms borrowers |

| Consumer Behavior | Encourages spending to avoid higher prices later | Encourages saving, delays spending |

| Monetary Policy Response | Central banks may raise interest rates to control | Central banks may lower interest rates to stimulate |

| Economic Impact | Moderate inflation supports growth; hyperinflation harms | Deflation can lead to recessions and increased unemployment |

Understanding Inflation: Definition and Causes

Inflation occurs when the general price level of goods and services rises, reducing your purchasing power over time. It is primarily caused by demand-pull factors, where demand exceeds supply, cost-push factors like increased production costs, and built-in inflation driven by adaptive expectations. Understanding inflation helps you anticipate economic shifts and manage your finances effectively.

What is Deflation? Key Concepts Explained

Deflation is a decrease in the general price level of goods and services, leading to increased purchasing power of money. It often results from reduced consumer demand, oversupply, or tighter monetary policy, which can slow economic growth and increase unemployment. Understanding deflation helps you anticipate its impact on investments, spending habits, and economic stability.

The Main Differences Between Inflation and Deflation

Inflation involves a general increase in prices and a decrease in the purchasing power of money, while deflation is characterized by a general decrease in prices and an increase in the value of money. Inflation often results from demand outpacing supply, leading to higher costs, whereas deflation usually occurs due to reduced consumer spending and excess supply, causing prices to fall. Central banks monitor inflation rates, commonly targeting around 2%, to maintain economic stability and avoid the adverse effects associated with prolonged inflation or deflation.

Economic Indicators: How to Measure Inflation and Deflation

Economic indicators such as the Consumer Price Index (CPI) and Producer Price Index (PPI) are critical for measuring inflation, reflecting changes in the average prices consumers and producers pay over time. Deflation is tracked through decreases in these indices, signaling a drop in overall price levels, which can indicate weakened demand or economic contraction. Monitoring these metrics helps you understand real purchasing power trends and make informed financial decisions.

Impacts of Inflation on Consumer Purchasing Power

Inflation erodes your consumer purchasing power by increasing the prices of goods and services, meaning you need more money to buy the same items. Deflation, on the other hand, increases your purchasing power as prices decline, allowing you to get more value for your money. Understanding these dynamics helps you manage your finances effectively in fluctuating economic conditions.

Deflationary Effects on Businesses and Employment

Deflation causes declining prices, which reduces business revenues and profit margins, leading to cost-cutting measures and lower investment. This decrease in corporate earnings often results in layoffs and higher unemployment rates as companies struggle to maintain financial stability. Prolonged deflation can create a cycle of reduced consumer spending and economic contraction, severely impacting employment levels and business growth.

Historical Examples: Inflation and Deflation Trends

Historical examples show inflation during the 1970s oil crisis, where soaring energy prices led to widespread price increases and reduced purchasing power globally. Deflation prevailed during the Great Depression of the 1930s, marked by falling prices, decreased consumer spending, and high unemployment rates. Hyperinflation in Weimar Germany during the 1920s exemplifies extreme inflation, while Japan's Lost Decade in the 1990s illustrates prolonged deflation and sluggish economic growth.

Central Bank Strategies for Managing Inflation and Deflation

Central banks deploy monetary policy tools such as adjusting interest rates, open market operations, and reserve requirements to manage inflation and deflation effectively. To combat inflation, central banks typically raise interest rates to reduce money supply and curb spending, while in deflationary environments, they lower rates and implement quantitative easing to stimulate demand and increase liquidity. Inflation targeting frameworks guide central banks in maintaining price stability, balancing economic growth with low and predictable inflation rates.

Inflation vs Deflation: Risks and Opportunities for Investors

Inflation erodes the purchasing power of your investments by causing prices to rise, leading to potential increases in interest rates and reduced real returns on fixed-income assets. Deflation, characterized by falling prices, can increase the real value of debt but may lead to economic stagnation and declining corporate profits, posing challenges for equity investors. Understanding the risks and opportunities of both inflation and deflation helps you strategically allocate assets to preserve capital and capitalize on market shifts.

Future Outlook: Balancing Inflation and Deflation in the Global Economy

The future outlook for the global economy hinges on effectively balancing inflation and deflation to ensure stable growth. Central banks and policymakers aim to maintain moderate inflation rates around 2% while preventing deflationary pressures that could hinder consumer spending and investment. Technological advancements, supply chain resilience, and fiscal strategies will play critical roles in managing price stability and avoiding the extremes of runaway inflation or persistent deflation.

Infographic: Inflation vs Deflation

relatioo.com

relatioo.com