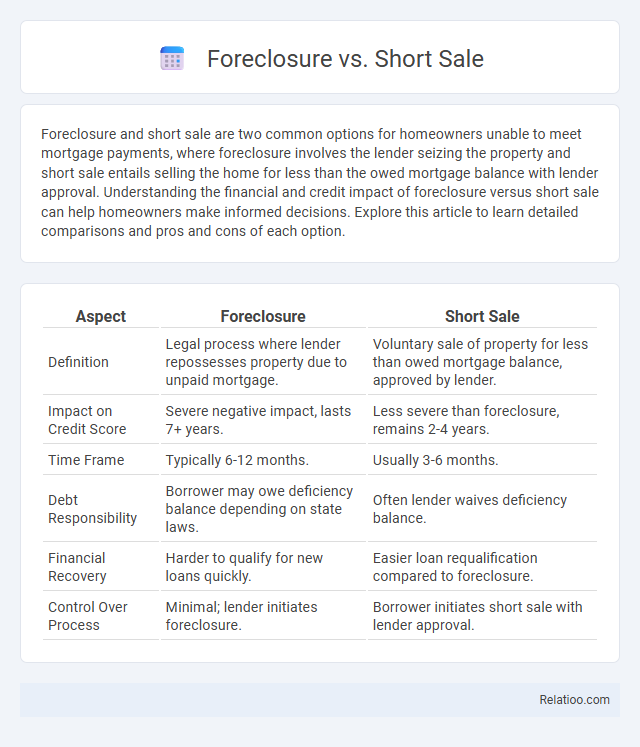

Foreclosure and short sale are two common options for homeowners unable to meet mortgage payments, where foreclosure involves the lender seizing the property and short sale entails selling the home for less than the owed mortgage balance with lender approval. Understanding the financial and credit impact of foreclosure versus short sale can help homeowners make informed decisions. Explore this article to learn detailed comparisons and pros and cons of each option.

Table of Comparison

| Aspect | Foreclosure | Short Sale |

|---|---|---|

| Definition | Legal process where lender repossesses property due to unpaid mortgage. | Voluntary sale of property for less than owed mortgage balance, approved by lender. |

| Impact on Credit Score | Severe negative impact, lasts 7+ years. | Less severe than foreclosure, remains 2-4 years. |

| Time Frame | Typically 6-12 months. | Usually 3-6 months. |

| Debt Responsibility | Borrower may owe deficiency balance depending on state laws. | Often lender waives deficiency balance. |

| Financial Recovery | Harder to qualify for new loans quickly. | Easier loan requalification compared to foreclosure. |

| Control Over Process | Minimal; lender initiates foreclosure. | Borrower initiates short sale with lender approval. |

Understanding Foreclosure: Definition and Process

Foreclosure is a legal process initiated when a homeowner fails to make mortgage payments, allowing the lender to seize and sell the property to recover the loan balance. During foreclosure, the lender files a public notice, often starting with a notice of default, followed by a sheriff's sale or auction to transfer ownership. Understanding this process helps you make informed decisions when facing financial difficulties, contrasting with options like short sales that may mitigate credit impact.

What is a Short Sale? Key Features Explained

A short sale occurs when a homeowner sells their property for less than the outstanding mortgage balance, requiring lender approval to accept the reduced payoff amount. Key features include avoiding foreclosure on the homeowner's credit report and potentially minimizing financial losses for both the borrower and lender. Unlike foreclosure, short sales involve a cooperative process to sell the home voluntarily, often resulting in less damage to the homeowner's credit score and allowing a faster resolution.

Foreclosure vs Short Sale: Main Differences

Foreclosure occurs when a lender repossesses your property due to missed mortgage payments, leading to a public auction and significant credit impact. A short sale involves selling your home for less than the owed mortgage balance with lender approval, allowing a less damaging effect on your credit and potentially avoiding bankruptcy. Understanding the differences between foreclosure and short sale helps you make informed decisions to protect your financial future while navigating distressed property sales.

Financial Impact on Homeowners

Foreclosure typically results in a severe negative impact on homeowners' credit scores, often dropping by 200 to 300 points, and remains on credit reports for up to seven years, making future borrowing difficult and costly. Short sales, while still damaging, generally cause less credit impairment than foreclosure, as lenders agree to accept less than the owed mortgage balance, often resulting in a credit score drop of 85 to 160 points and a shorter impact duration of two to four years. Both options significantly affect homeowners' financial health, but short sales usually offer a less detrimental path by mitigating debt obligations and providing a faster route to credit recovery compared to the long-term consequences of a foreclosure.

Credit Score Consequences

Foreclosure significantly impacts your credit score, often causing a drop of 200 to 300 points and remaining on your report for seven years. Short sales have a less severe effect, typically lowering your credit score by 50 to 150 points and staying on your credit report for up to seven years but with a potential faster recovery. Understanding these differences helps you make informed decisions to minimize long-term damage to your financial health.

Eligibility Requirements for Foreclosure and Short Sale

Eligibility requirements for foreclosure typically hinge on the borrower's failure to make mortgage payments over a specified period, leading the lender to initiate legal proceedings to repossess the property. In contrast, short sale eligibility requires the borrower to demonstrate financial hardship and obtain lender approval to sell the property for less than the outstanding mortgage balance. Both processes involve strict documentation, but short sales often demand proof of income, hardship letters, and current mortgage statements, while foreclosures focus primarily on delinquencies and default status.

The Role of Lenders in Foreclosure vs Short Sale

Lenders play a critical role in both foreclosure and short sale processes by evaluating the borrower's financial situation and deciding whether to approve a short sale or proceed with foreclosure. In a short sale, lenders must agree to accept less than the outstanding mortgage balance, which can reduce their losses compared to foreclosure. Your ability to negotiate with lenders effectively can influence the outcome, potentially avoiding the lengthy and costly foreclosure process.

Timeline Comparison: How Long Each Process Takes

Foreclosure typically takes 6 to 12 months, depending on state laws and lender actions, making it the longest process among the three. Short sales generally take 3 to 6 months, contingent on lender approval and buyer financing, offering a faster resolution compared to foreclosure. Pre-foreclosure, the initial phase before formal foreclosure proceedings, can last several months as homeowners attempt to sell or negotiate with lenders.

Pros and Cons for Homeowners

Foreclosure offers homeowners the chance to avoid a lengthy legal process but severely damages credit scores for up to seven years, impacting future borrowing ability. Short sales allow sale of the property for less than the owed mortgage balance, reducing credit damage compared to foreclosure but requiring lender approval and often a lengthy negotiation process. Foreclosure, while a last-resort option for unpaid mortgage debt, usually results in property loss and significant financial and credit repercussions, yet it releases homeowners from further mortgage liabilities faster than short sales.

Making the Right Choice: Foreclosure or Short Sale

Choosing between foreclosure and short sale significantly impacts credit scores, with foreclosure typically causing a more severe and long-lasting negative effect than short sales. Short sales often allow homeowners to negotiate with lenders to accept less than the owed mortgage balance, minimizing financial damage and facilitating quicker recovery. Understanding lender policies, market conditions, and personal financial situations is crucial in making the right decision and mitigating long-term credit and financial consequences.

Infographic: Foreclosure vs Short Sale

relatioo.com

relatioo.com