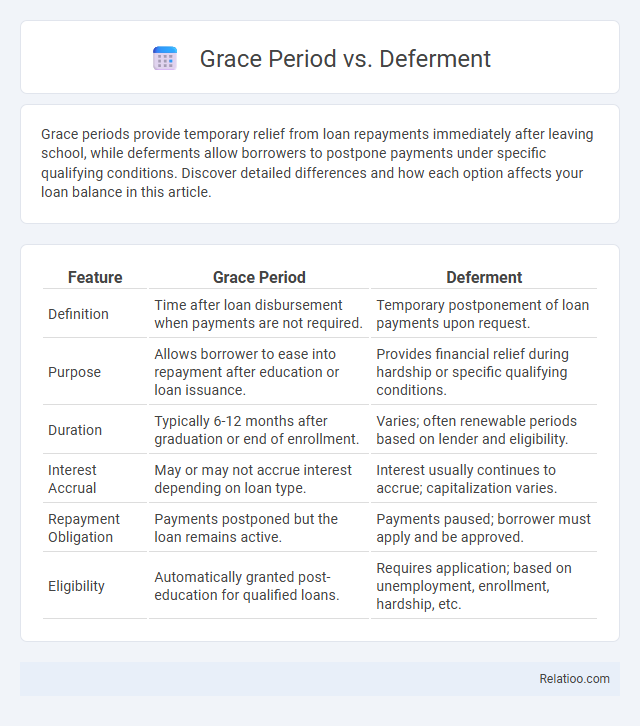

Grace periods provide temporary relief from loan repayments immediately after leaving school, while deferments allow borrowers to postpone payments under specific qualifying conditions. Discover detailed differences and how each option affects your loan balance in this article.

Table of Comparison

| Feature | Grace Period | Deferment |

|---|---|---|

| Definition | Time after loan disbursement when payments are not required. | Temporary postponement of loan payments upon request. |

| Purpose | Allows borrower to ease into repayment after education or loan issuance. | Provides financial relief during hardship or specific qualifying conditions. |

| Duration | Typically 6-12 months after graduation or end of enrollment. | Varies; often renewable periods based on lender and eligibility. |

| Interest Accrual | May or may not accrue interest depending on loan type. | Interest usually continues to accrue; capitalization varies. |

| Repayment Obligation | Payments postponed but the loan remains active. | Payments paused; borrower must apply and be approved. |

| Eligibility | Automatically granted post-education for qualified loans. | Requires application; based on unemployment, enrollment, hardship, etc. |

Introduction to Grace Period and Deferment

The grace period and deferment are essential options for managing student loan repayments, offering temporary relief under different conditions. A grace period is the time after graduation during which you are not required to make loan payments, typically lasting six months, allowing you to prepare financially. Deferment, on the other hand, is a formal postponement of payments granted for specific reasons such as enrollment in school, unemployment, or economic hardship, which helps you avoid default during financial challenges.

Understanding Grace Period: Definition and Purpose

Understanding the grace period is essential to managing your loans effectively, as it refers to the fixed time after a loan disbursement or graduation when you are not required to make payments. This period allows borrowers to transition financially without immediate repayment obligations, reducing stress and providing time to secure income. Unlike deferment, which postpones payments due to specific hardships, the grace period universally offers temporary payment relief immediately following loan completion or disbursement.

What is Deferment? Key Features Explained

Deferment is a temporary postponement of loan payments allowed under specific conditions, such as enrollment in school, unemployment, or economic hardship. Key features include the suspension of principal and sometimes interest payments, eligibility criteria based on borrower status, and the requirement to apply for deferment through the loan servicer. Unlike a grace period, which typically occurs immediately after leaving school and offers limited span without payments, deferment can be granted at various times during the life of the loan.

Eligibility Criteria: Who Qualifies for Each Option?

Eligibility criteria for grace periods typically require borrowers to have completed their education or left school, allowing a temporary pause before loan repayment begins. Deferment eligibility is generally based on specific circumstances such as enrollment in further education, unemployment, or economic hardship, requiring documentation to qualify. Your qualification for these options depends on your current status and ability to meet the lender's specific requirements for grace period or deferment.

Financial Impact: Interest Accrual Differences

Grace periods typically allow your loan payments to be paused without interest accruing, preserving your loan balance. Deferment may also suspend payments, but depending on the loan type, interest can continue to accumulate, increasing your total repayment amount. Understanding these differences helps you manage your financial impact and minimize long-term interest costs effectively.

Duration and Limitations of Grace Period and Deferment

Grace periods typically last six to twelve months after loan repayment begins, offering limited relief specifically for federal student loans, with no interest accruing on subsidized loans during this time. Deferment can extend relief for longer periods, such as while enrolled in school or facing economic hardship, but interest may continue to accumulate on unsubsidized loans. Both grace periods and deferments pause repayment, but deferments have stricter qualification criteria and can last several months to years depending on the situation.

Benefits and Drawbacks of Grace Period

Grace period offers you a temporary pause on loan payments after graduation, allowing finances to stabilize before repayment begins. Its benefits include immediate relief from financial pressure and time to secure a steady income, but drawbacks involve accruing interest during the period, potentially increasing the total loan cost. Unlike deferment, which may require meeting specific eligibility criteria and can sometimes postpone interest accrual, the grace period is a standard feature with fixed terms but limited extension options.

Pros and Cons of Deferment

Deferment allows borrowers to temporarily postpone loan payments, providing financial relief during periods of unemployment or economic hardship. The primary advantage of deferment is that interest on subsidized federal loans does not accrue, reducing overall loan costs; however, the downside includes potential increased debt if borrowers extend their repayment term or if unsubsidized loan interest accrues during deferment. Unlike grace periods, which are automatic post-graduation, deferment requires an application and qualifying conditions, and it generally offers more flexibility than forbearance but stricter eligibility compared to other repayment options.

Choosing the Right Option: Factors to Consider

Choosing the right option between grace period, deferment, and forbearance depends on your financial situation, repayment ability, and loan type. Grace periods typically provide immediate relief after graduation, while deferment allows temporary suspension of payments for qualifying hardships without accruing interest on subsidized loans. Your best choice balances minimizing interest costs and maintaining loan status, ensuring manageable payments aligned with your current budget and long-term financial goals.

Conclusion: Navigating Grace Period and Deferment Choices

Choosing between grace period and deferment hinges on your financial situation and loan terms, as grace periods offer temporary relief after graduation without interest accrual, while deferments postpone payments under qualifying circumstances but may accrue interest depending on the loan type. Understanding the eligibility criteria and impact on your loan balance is crucial for optimizing repayment strategies. Prioritize clear communication with your loan servicer to make informed decisions that protect your financial health.

Infographic: Grace Period vs Deferment

relatioo.com

relatioo.com